Question: I don't understand, what other information do you need? All the information that they've provided have been included in this question. Question 1 P.W Sheppard

I don't understand, what other information do you need? All the information that they've provided have been included in this question.

I don't understand, what other information do you need? All the information that they've provided have been included in this question.

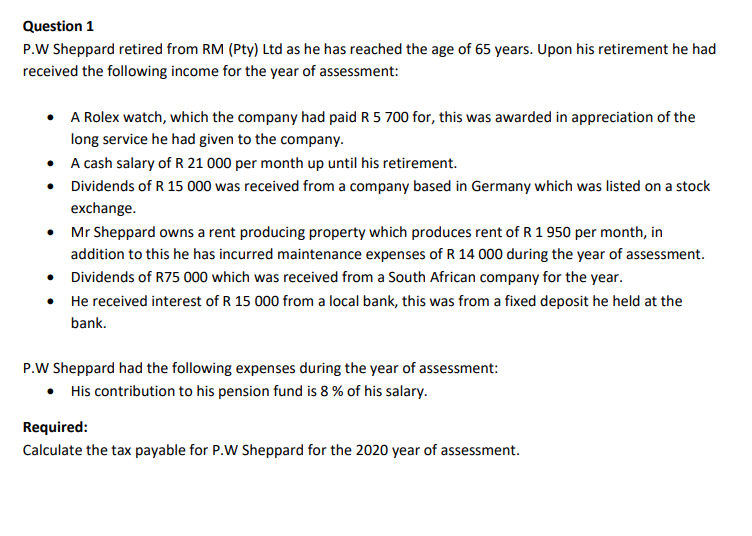

Question 1 P.W Sheppard retired from RM (Pty) Ltd as he has reached the age of 65 years. Upon his retirement he had received the following income for the year of assessment: A Rolex watch, which the company had paid R 5 700 for, this was awarded in appreciation of the long service he had given to the company. A cash salary of R 21 000 per month up until his retirement. Dividends of R 15 000 was received from a company based in Germany which was listed on a stock exchange. Mr Sheppard owns a rent producing property which produces rent of R1 950 per month, in addition to this he has incurred maintenance expenses of R 14 000 during the year of assessment. Dividends of R75 000 which was received from a South African company for the year. He received interest of R 15 000 from a local bank, this was from a fixed deposit he held at the bank. P.W Sheppard had the following expenses during the year of assessment: His contribution to his pension fund is 8 % of his salary. Required: Calculate the tax payable for P.W Sheppard for the 2020 year of assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts