Question: (i) Explain what is meant by: (a) risk-neutral models (b) equilibrium models [6] (ii) Outline the advantages and disadvantages of the two different approaches for

(i) Explain what is meant by:

(a) risk-neutral models

(b) equilibrium models [6]

(ii) Outline the advantages and disadvantages of the two different approaches for

modelling asset prices and returns..

Outline](https://s3.amazonaws.com/si.experts.images/answers/2024/06/667ca2aad6d71_138667ca2aac5518.jpg)

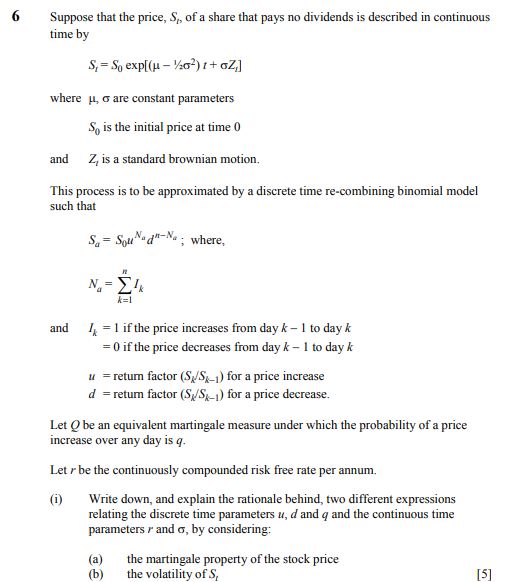

(i) State expressions for the following measures of investment risk: variance of return ( b ) downside semi-variance (c) expected shortfall conditional upon a shortfall occurring [3] (ii) Returns, R, for an investment are distributed R ~ exp(2.). Find expressions for: (a) the variance (b) the downside semi-variance (c) the expected shortfall below a return of & conditional on a shortfall occurring and evaluate for ) = 12, for values of k = 2. [11]6 Suppose that the price, S,, of a share that pays no dividends is described in continuous time by S, = So exp[(H - 127) 1 + 2,] where u, o are constant parameters So is the initial price at time 0 and Z, is a standard brownian motion. This process is to be approximated by a discrete time re-combining binomial model such that Sa = Squad"-No ; where, N = and 1 = 1 if the price increases from day k - 1 to day k = 0 if the price decreases from day k - 1 to day k = return factor (S/S,_) for a price increase / = return factor (S /S_) for a price decrease. Let O be an equivalent martingale measure under which the probability of a price increase over any day is q. Let / be the continuously compounded risk free rate per annum. (i) Write down, and explain the rationale behind, two different expressions relating the discrete time parameters u, a and q and the continuous time parameters / and o, by considering: (a) the martingale property of the stock price (b) the volatility of S, [5](ii) Assume / = 6% p.a. 6 = 15% p.a. So = 100 " = exp(a.200-05) and that there are 200 trading days in a year. Using the binomial approximation: (a) Find the price of a call option that expires in 2 days with a strike price of 101. (b) Calculate the percentage error that the binomial model produces compared with the continuous time model of Black-Scholes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts