Question: I feel like i keep getting the wrong answers, can some one help me? thank you 6% Before you begin, print out all the pages

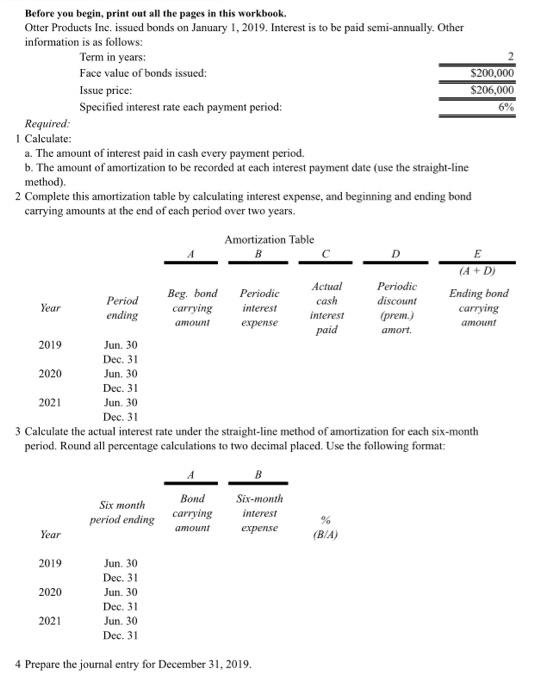

6% Before you begin, print out all the pages in this workbook. Otter Products Inc. issued bonds on January 1, 2019. Interest is to be paid semi-annually. Other information is as follows: Term in years: Face value of bonds issued: $200,000 Issue price: $206,000 Specified interest rate each payment period: Required: 1 Calculate: a. The amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use the straight-line method). 2 Complete this amortization table by calculating interest expense, and beginning and ending bond carrying amounts at the end of each period over two years. Amortization Table B D E (A + D) Actual Periodic Periodic Beg, bond Period cash Ending bond Year discount interesi carrying ending interest carrying (prem.) amount expense amount paid amort. 2019 Jun 30 Dec. 31 2020 Jun 30 Dec. 31 2021 Jun 30 Dec. 31 3 Calculate the actual interest rate under the straight-line method of amortization for each six-month period, Round all percentage calculations to two decimal placed. Use the following format: Six month period ending Bond carrying amount Six-month interest expense Year (BA) 2019 2020 Jun 30 Dec. 31 Jun. 30 Dec. 31 Jun. 30 Dec. 31 2021 4 Prepare the journal entry for December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts