Question: i found solutions with incomplete answers only. please answer all 5 questions PARTS: HOUSE TAX PLAN FOR 2018 For 2017 the actual tax brackets for

i found solutions with incomplete answers only. please answer all 5 questions

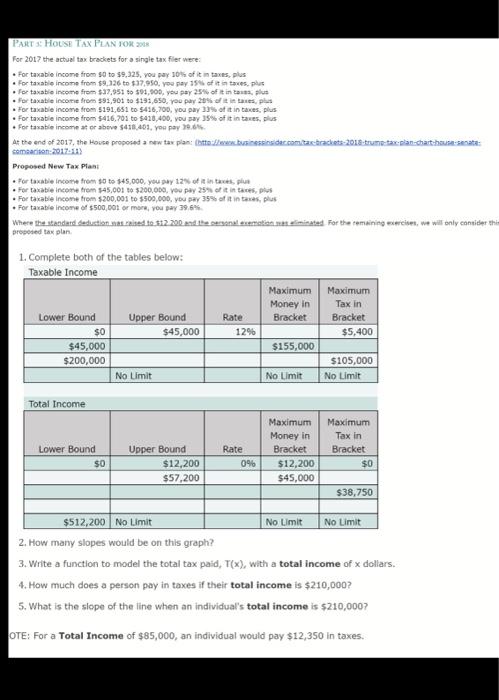

PARTS: HOUSE TAX PLAN FOR 2018 For 2017 the actual tax brackets for a single tax filer were . For taxable income from 50 to $9,325, you pay 10% of it taxes, plus . For taxable income from $9.926 to $37.950. you pay 15% of it in aces, plus for taxable income from $37,951 to $94,000. you pay 25% of tintas alus for taxable income from $93,901 to $133,650, you pay 20% tases, plus . For taxable income from 5191,651 to 5416,700, you pay 33% of it in aces, plus . For taxatie income from $416,701 to $420,400, you say 35% of it in taxes, plus . For taxable income or above $478.403, you pay 2006 At the end of 2017, the Houte proposed a new tax plan: (http://www.businessdeccomitacrackets-2018-trumentaxplan-thart:hunte: saman:2017-11) Proposed New Tax Plant . For taxable income from 0 to $45,000, you pay 12% of it in taxes, plus . For taxable income from $45,001 to $200.000. you pay 25% of it in the For taxable income from $200,001 to $500,000. you pay 35% of it in taxes, plus . For taxable income of $500,001 or more, you pay 39.6% Where the standard deduction trained to $12.200 and the canal emotion et diminated for the remaining wcies, we will only consider the proposed tax plan 1. Complete both of the tables below: Taxable income Maximum Money in Bracket Maximum Tax in Bracket $5,400 Rate 12% Lower Bound Upper Bound $0 $45,000 $45,000 $200,000 No Limit $155,000 $105,000 No Limit No Limit Total Income Maximum Tax in Bracket $0 Lower Bound $0 Upper Bound $12,200 $57,200 Maximum Money in Bracket $12,200 $45,000 Rate 096 $38,750 No Limit No Limit $512,200 No Limit 2. How many slopes would be on this graph? 3. Write a function to model the total tax paid, T(x), with a total income of dollars. 4. How much does a person pay in taxes if their total income is $210,000? 5. What is the slope of the line when an individual's total income is $210,000? OTE: For a Total Income of $85,000, an individual would pay $12,350 in taxes. PARTS: HOUSE TAX PLAN FOR 2018 For 2017 the actual tax brackets for a single tax filer were . For taxable income from 50 to $9,325, you pay 10% of it taxes, plus . For taxable income from $9.926 to $37.950. you pay 15% of it in aces, plus for taxable income from $37,951 to $94,000. you pay 25% of tintas alus for taxable income from $93,901 to $133,650, you pay 20% tases, plus . For taxable income from 5191,651 to 5416,700, you pay 33% of it in aces, plus . For taxatie income from $416,701 to $420,400, you say 35% of it in taxes, plus . For taxable income or above $478.403, you pay 2006 At the end of 2017, the Houte proposed a new tax plan: (http://www.businessdeccomitacrackets-2018-trumentaxplan-thart:hunte: saman:2017-11) Proposed New Tax Plant . For taxable income from 0 to $45,000, you pay 12% of it in taxes, plus . For taxable income from $45,001 to $200.000. you pay 25% of it in the For taxable income from $200,001 to $500,000. you pay 35% of it in taxes, plus . For taxable income of $500,001 or more, you pay 39.6% Where the standard deduction trained to $12.200 and the canal emotion et diminated for the remaining wcies, we will only consider the proposed tax plan 1. Complete both of the tables below: Taxable income Maximum Money in Bracket Maximum Tax in Bracket $5,400 Rate 12% Lower Bound Upper Bound $0 $45,000 $45,000 $200,000 No Limit $155,000 $105,000 No Limit No Limit Total Income Maximum Tax in Bracket $0 Lower Bound $0 Upper Bound $12,200 $57,200 Maximum Money in Bracket $12,200 $45,000 Rate 096 $38,750 No Limit No Limit $512,200 No Limit 2. How many slopes would be on this graph? 3. Write a function to model the total tax paid, T(x), with a total income of dollars. 4. How much does a person pay in taxes if their total income is $210,000? 5. What is the slope of the line when an individual's total income is $210,000? OTE: For a Total Income of $85,000, an individual would pay $12,350 in taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts