Question: I got 12, but that is incorrect. Please help Question 19 10 points Save Answer Canyon Buff Corp. has $200 million in cash and 100

I got 12, but that is incorrect. Please help

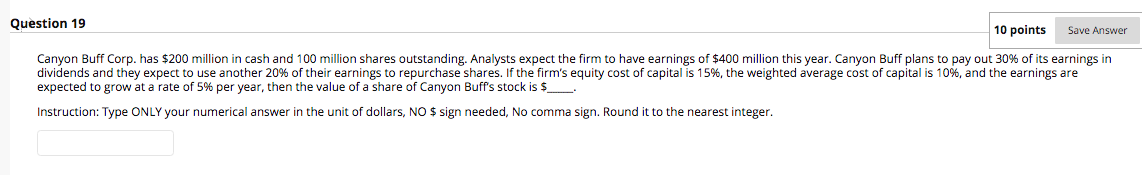

Question 19 10 points Save Answer Canyon Buff Corp. has $200 million in cash and 100 million shares outstanding. Analysts expect the firm to have earnings of $400 million this year. Canyon Buff plans to pay out 30% of its earnings in dividends and they expect to use another 20% of their earnings to repurchase shares. If the firm's equity cost of capital is 15%, the weighted average cost of capital is 10%, and the earnings are expected to grow at a rate of 5% per year, then the value of a share of Canyon Buff's stock is $_ Instruction: Type ONLY your numerical answer in the unit of dollars, NO $ sign needed, No comma sign. Round it to the nearest integer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts