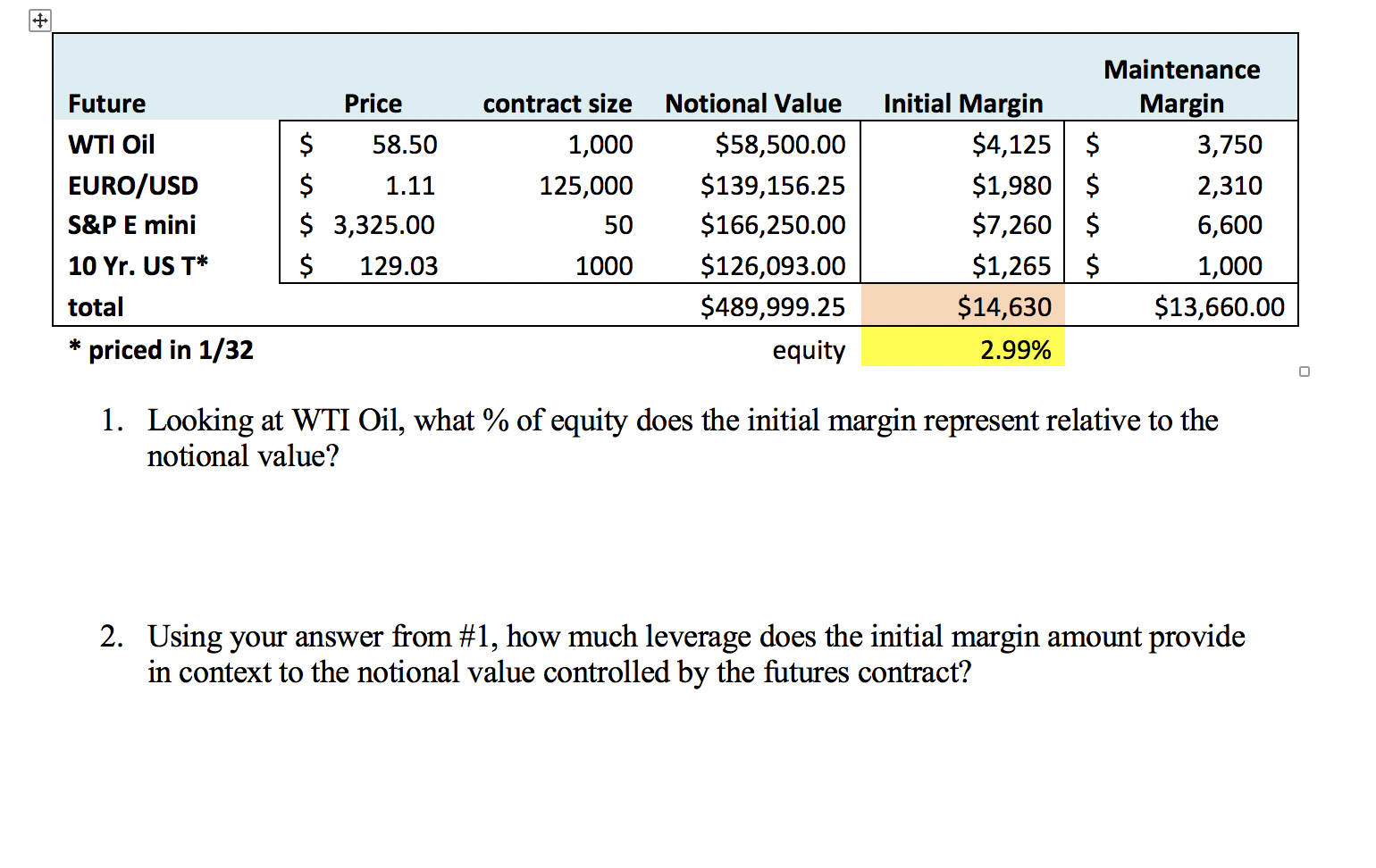

Question: i got 7.05 for the first one or .07051. please help with the second + contract size Future WTI Oil EURO/USD S&P E mini 10

i got 7.05 for the first one or .07051. please help with the second

+ contract size Future WTI Oil EURO/USD S&P E mini 10 Yr. US T* total priced in 1/32 Price $ 58.50 $ 1.11 $ 3,325.00 $ 129.03 1,000 125,000 50 Notional Value $58,500.00 $139,156.25 $166,250.00 $126,093.00 $489,999.25 equity Maintenance Initial Margin Margin $4,125 $ 3,750 $1,980 $ 2,310 $7,260 $ 6,600 $1,265 $ 1,000 $14,630 $13,660.00 2.99% 1000 1. Looking at WTI Oil, what % of equity does the initial margin represent relative to the notional value? 2. Using your answer from #1, how much leverage does the initial margin amount provide in context to the notional value controlled by the futures contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts