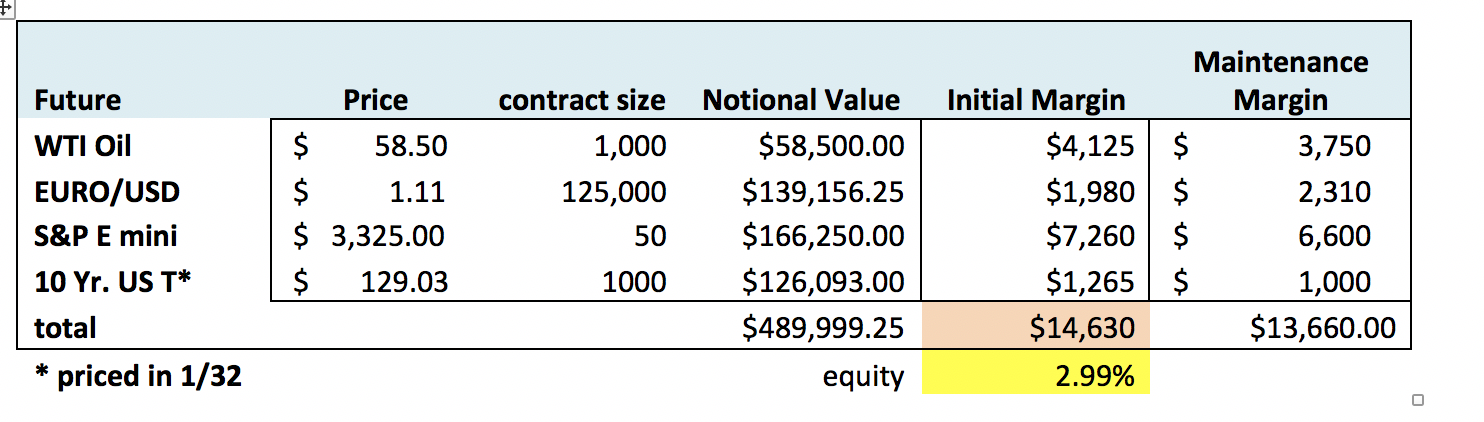

Question: what more information do i need? i provided the mini contract i was given. + Future Price contract size WTI Oil EURO/USD S&P E mini

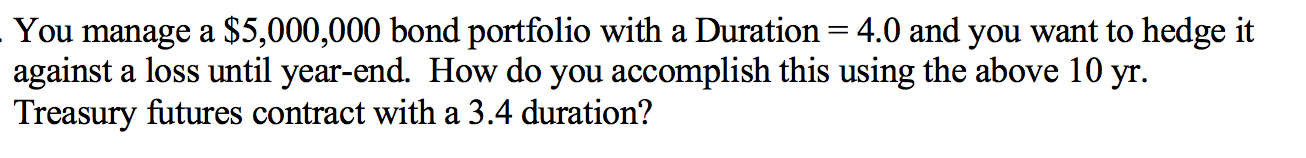

+ Future Price contract size WTI Oil EURO/USD S&P E mini 10 Yr. US T* total $ 58.50 $ 1.11 $ 3,325.00 $ 129.03 1,000 125,000 50 Notional Value $58,500.00 $139,156.25 $166,250.00 $126,093.00 $489,999.25 equity Maintenance Initial Margin Margin $4,125 $ 3,750 $1,980 $ 2,310 $7,260 $ 6,600 $1,265 $ 1,000 $14,630 $13,660.00 2.99% 1000 priced in 1/32 You manage a $5,000,000 bond portfolio with a Duration = 4.0 and you want to hedge it against a loss until year-end. How do you accomplish this using the above 10 yr. Treasury futures contract with a 3.4 duration? + Future Price contract size WTI Oil EURO/USD S&P E mini 10 Yr. US T* total $ 58.50 $ 1.11 $ 3,325.00 $ 129.03 1,000 125,000 50 Notional Value $58,500.00 $139,156.25 $166,250.00 $126,093.00 $489,999.25 equity Maintenance Initial Margin Margin $4,125 $ 3,750 $1,980 $ 2,310 $7,260 $ 6,600 $1,265 $ 1,000 $14,630 $13,660.00 2.99% 1000 priced in 1/32 You manage a $5,000,000 bond portfolio with a Duration = 4.0 and you want to hedge it against a loss until year-end. How do you accomplish this using the above 10 yr. Treasury futures contract with a 3.4 duration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts