Question: i got part ( a ) but can you help me with parts ( b ) - ( d ) ? step by step please!!

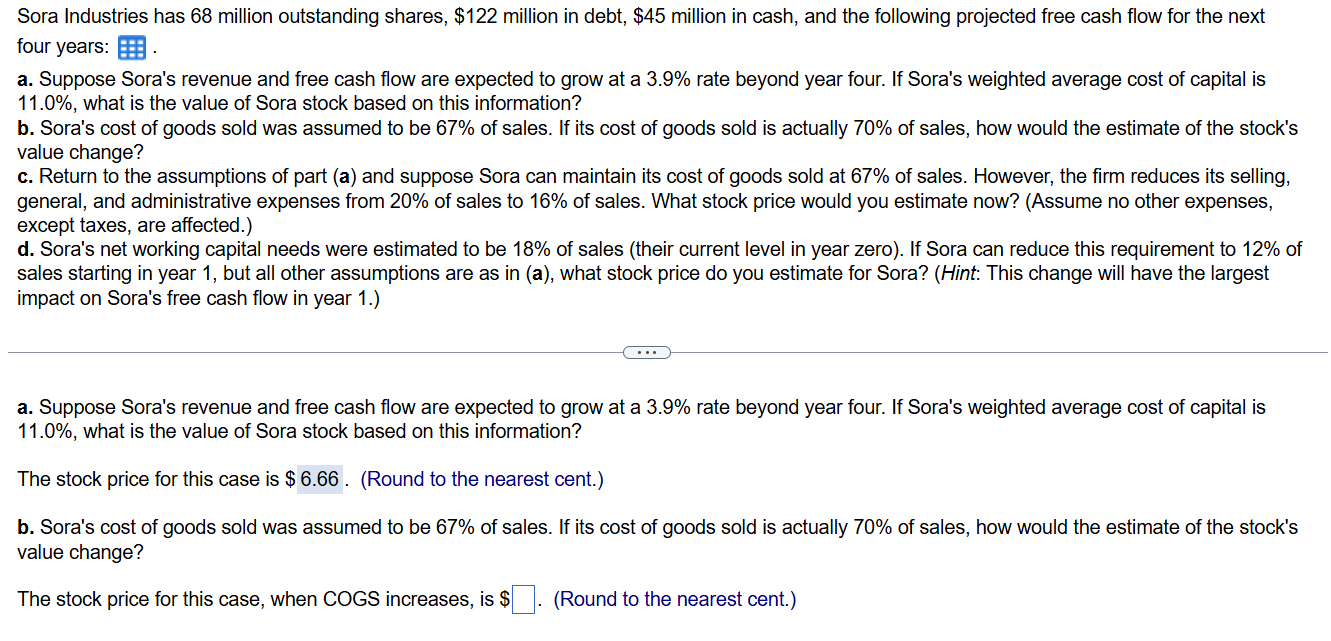

i got part a but can you help me with parts bd step by step please!! Sora Industries has million outstanding shares, $ million in debt, $ million in cash, and the following projected free cash flow for the next four years: a Suppose Sora's revenue and free cash flow are expected to grow at a rate beyond year four. If Sora's weighted average cost of capital is what is the value of Sora stock based on this information? b Sora's cost of goods sold was assumed to be of sales. If its cost of goods sold is actually of sales, how would the estimate of the stock's value change? c Return to the assumptions of part a and suppose Sora can maintain its cost of goods sold at of sales. However, the firm reduces its selling, general, and administrative expenses from of sales to of sales. What stock price would you estimate now? Assume no other expenses, except taxes, are affected. d Sora's net working capital needs were estimated to be of sales their current level in year zero If Sora can reduce this requirement to of sales starting in year but all other assumptions are as in a what stock price do you estimate for Sora? Hint: This change will have the largest impact on Sora's free cash flow in year a Suppose Sora's revenue and free cash flow are expected to grow at a rate beyond year four. If Sora's weighted average cost of capital is what is the value of Sora stock based on this information? The stock price for this case is $ Round to the nearest cent. b Sora's cost of goods sold was assumed to be of sales. If its cost of goods sold is actually of sales, how would the estimate of the stock's value change? The stock price for this case, when COGS increases, is $ Round to the nearest cent.Click on the following icon in order to copy its contents into a spreadsheet.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock