Question: I got these wrong, please help and explain Question 15: Assume that the one-year interest rates for USD and CHF are: rUSD=5% and rCHF=2% and

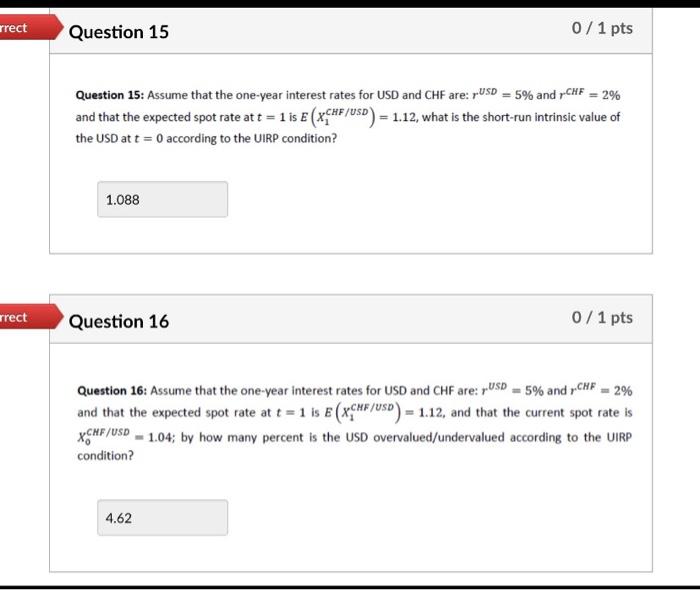

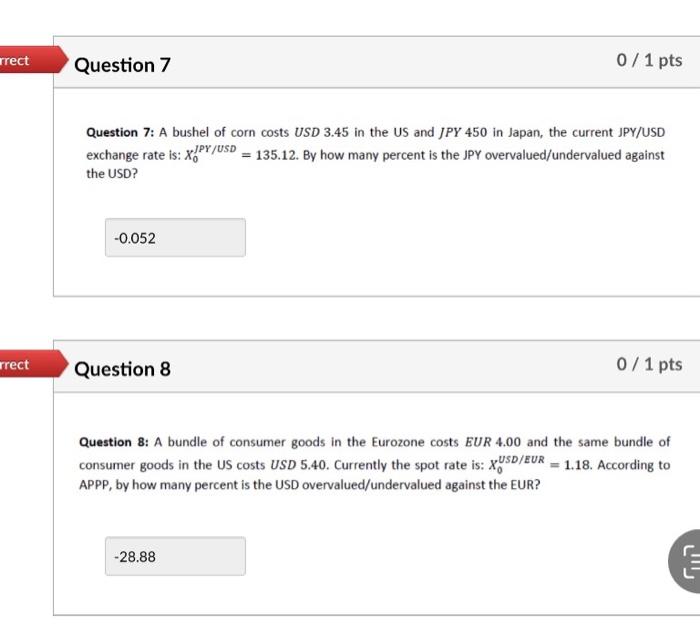

Question 15: Assume that the one-year interest rates for USD and CHF are: rUSD=5% and rCHF=2% and that the expected spot rate at t=1 is E(X1CHF/USD)=1.12, what is the short-run intrinsic value of the USD at t=0 according to the UIRP condition? Question 16 0/1 pts Question 16: Assume that the one-year interest rates for USD and CHF are: rUSD=5% and rCHF=2% and that the expected spot rate at t=1 is E(X1CHF/USD)=1.12, and that the current spot rate is X0CHF/USD=1.04; by how many percent is the USD overvalued/undervalued according to the UIRP condition? Question 7: A bushel of corn costS USD 3.45 in the US and JPY 450 in Japan, the current JPY/USD exchange rate is: X0JPY/USD=135.12. By how many percent is the JPY overvalued/undervalued against the USD? Question 8 0/1 pts Question 8: A bundle of consumer goods in the Eurozone costs EUR 4.00 and the same bundle of consumer goods in the US costs USD 5.40. Currently the spot rate is: X0USD/EVR=1.18. According to APPP, by how many percent is the USD overvalued/undervalued against the EUR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts