Question: i got this part wrong. 3. If two years' preferred dividends are in arrears at the current date, what is the book value per share

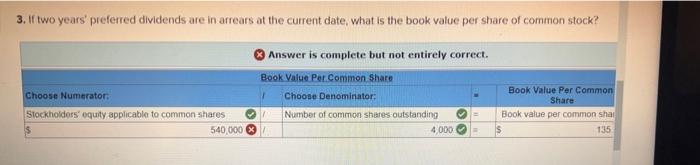

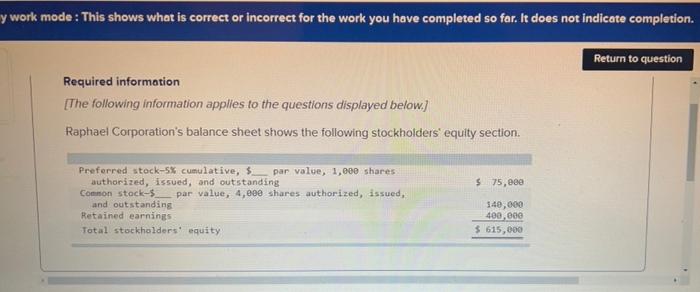

3. If two years' preferred dividends are in arrears at the current date, what is the book value per share of common stock? Answer is complete but not entirely correct. Book Value Per Common Share Choose Numerator: 1 Choose Denominator: Book Value Per Common Share Stockholders' equity applicable to common shares Number of common shares outstanding = Book value per common shar 135 540,000/ 4,000 = $ y work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question Required information [The following information applies to the questions displayed below.] Raphael Corporation's balance sheet shows the following stockholders' equity section. Preferred stock-5% cumulative, $ par value, 1,000 shares authorized, issued, and outstanding $ 75,000 Common stock-$ par value, 4,000 shares authorized, issued, and outstanding 140,000 400,000 Retained earnings Total stockholders' equity $ 615,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts