Question: please make sure the whole answer is visible after posting, thank you in advance [The following information applies to the questions displayed below] The equity

![in advance [The following information applies to the questions displayed below] The](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66faf678df663_12866faf6787a930.jpg)

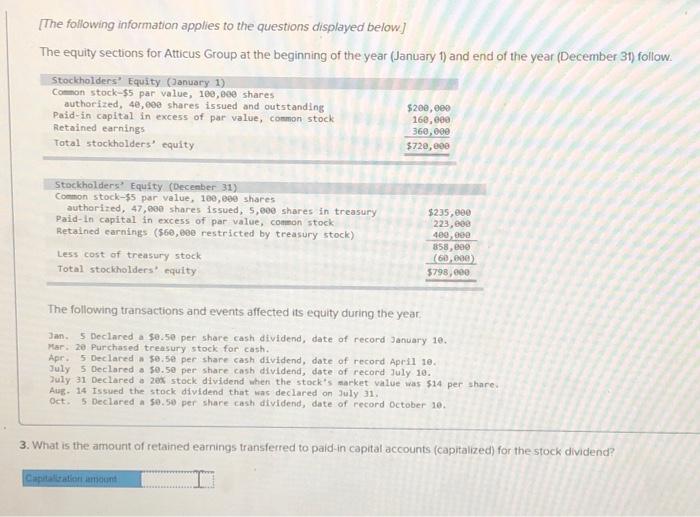

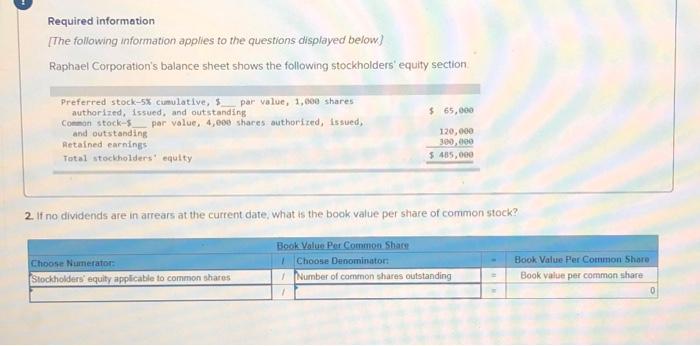

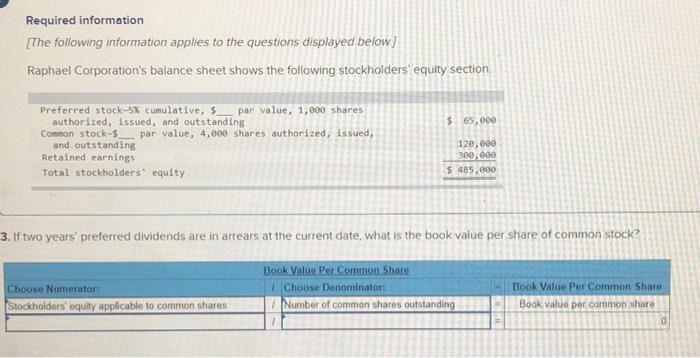

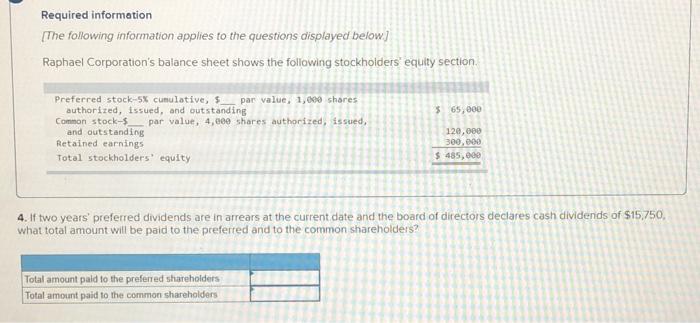

[The following information applies to the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. Stockholders' Equity (January 1) Common stock-$5 par value, 100,000 shares authorized, 48,000 shares issued and outstanding $200, eee Paid in capital in excess of par value, common stock 168,000 Retained earnings 360,000 Total stockholders' equity $720,000 Stockholders' Equity (December 31) Common stock-$5 par value, 100,000 shares authorized, 47,000 shares issued, 5,000 shares in treasury Paid in capital in excess of par value, common stock Retained earnings ($60,000 restricted by treasury stock) $235,000 223,600 409, ese 858,800 (60.000) $798,000 Less cost of treasury stock Total stockholdersequity The following transactions and events affected its equity during the year Jan. 5 Declared a $0.50 per share cash dividend, date of record January 10. Mar. 20 Purchased treasury stock for cash Apr. 5 Declared $0.50 per share cash dividend, date of record April 10. July 5 Declared a $0.50 per share cash dividend, date of record July 10. July 31 Declared 20% stock dividend when the stock's market value was $14 per share. Aug. 14 Issued the stock dividend that was declared on July 31. Oct. 5 Declared a 50.50 per share cash dividend, date of record October 10. 3. What is the amount of retained earnings transferred to paid in capital accounts (capitalized) for the stock dividend? Capitallation amount Required information [The following information applies to the questions displayed below) The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. Stockholders Equity (January 1) Common stock-55 par value, 180,000 shares authorized, 40,eee shares issued and outstanding $200,000 Paid in capital in excess of par value, common stock 160,000 Retained earnings 360,000 Total stockholders' equity $720,000 Stockholders' Equity (December 31) Common stock-55 par value, 100,000 shares authorized, 47,000 shares Issued, 5,000 shares in treasury Paid in capital in excess of par value, cumon stock Retained earnings (560,000 restricted by treasury stock) 5235,000 223,000 400.000 850,000 60.000 5790,000 Less cost of treasury stock Total stockholders' equity The following transactions and events affected its equity during the year Jan. S Declared a 50.50 per share cash dividend, date of record January 10 Mar. 20 Purchased treasury stock for cash Apres Declared a $9.50 per share cash dividend, date of record April 10 July 5 Declared 50.50 per share cash dividend, date of record ly 10. July 31 Declared a 200 stock dividend when the stock's market value was 514 per share Aug 14 Issued the stock dividend that was declared on July 31 Oct. 5 Declared 50.50 per share cash dividend, date of record October 10, 5. How much net income did the company ear this year? Net income 7 Required information [The following information applies to the questions displayed below) Raphael Corporation's balance sheet shows the following stockholders' equity section $ 65,000 Preferred stock-5% cumulative, par value, 1,000 shares authorized, issued, and outstanding Common stock-$__ par value. 4,000 shares authorized, issued and outstanding Retained earnings Total stockholders' equity 120,000 300,000 5485,000 2. If no dividends are in arrears at the current date, what is the book value per share of common stock? Choose Numerator: Stockholders' equity applicable to common shares Book Value Per Common Share | Choose Denominator Number of common shares outstanding 1 Book Value Per Common Share Book Value per common share 0 Required information [The following information applies to the questions displayed below) Raphael Corporation's balance sheet shows the following stockholders' equity section $ 65,000 Preferred stock-5% cumulative, s par value, 1,000 shares authorized, issued, and outstanding Common stocks par value, 4,000 shares authorized, issued, and outstanding Retained earnings Total stockholders' equity 120,000 300,000 $ 485.000 3. If two years preferred dividends are in arrears at the current date, what is the book value per share of common stock? Choose Numerator Stockholders equity applicable to common shares Book Value Per Commen Share Choose Denominator Number of common shares outstanding Book Value Per Common Share Book value per common share 0 Required information The following information applies to the questions displayed below) Raphael Corporation's balance sheet shows the following stockholders eqully section $ 65,000 Preferred stock-5% cumulative, s par value, 1,000 shares authorized, issued, and outstanding Common stock- par value, 4,000 shares authorized, issued, and outstanding Retained earnings Total stockholders' equity 120,000 300,000 $ 485,000 4. If two years' preferred dividends are in arrears at the current date and the board of directors declares cash dividends of $15.750. what total amount will be paid to the preferred and to the common shareholders? Total amount paid to the preferred shareholders Total amount paid to the common shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts