Question: i have 30 mins plz i will upvote you Task 1: Thomas's sales since the commencement of trading have been as follows: April 2020 10,500

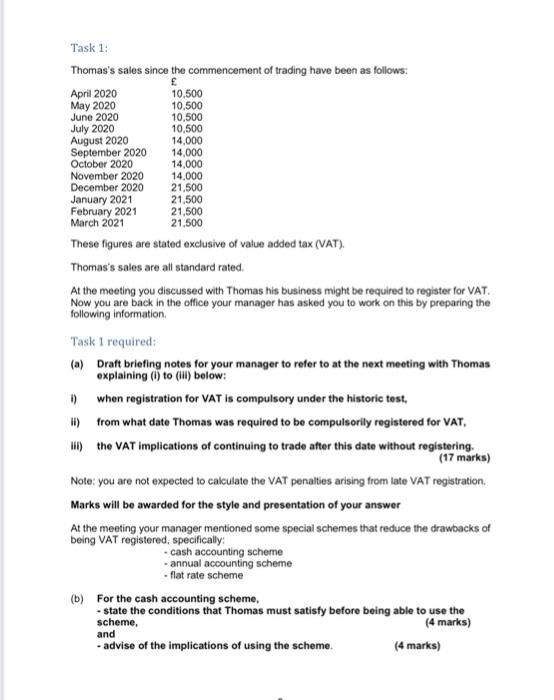

Task 1: Thomas's sales since the commencement of trading have been as follows: April 2020 10,500 May 2020 10,500 June 2020 10.500 July 2020 10,500 August 2020 14,000 September 2020 14,000 October 2020 14,000 November 2020 14,000 December 2020 21.500 January 2021 21,500 February 2021 21,500 March 2021 21,500 These figures are stated exclusive of value added tax (VAT) Thomas's sales are all standard rated At the meeting you discussed with Thomas his business might be required to register for VAT. Now you are back in the office your manager has asked you to work on this by preparing the following information Task 1 required: (a) Draft briefing notes for your manager to refer to at the next meeting with Thomas explaining to (i) below: 1) when registration for VAT is compulsory under the historic test, 11) from what date Thomas was required to be compulsorily registered for VAT, 1) the VAT implications of continuing to trade after this date without registering. (17 marks) Note: you are not expected to calculate the VAT penalties arising from late VAT registration Marks will be awarded for the style and presentation of your answer At the meeting your manager mentioned some special schemes that reduce the drawbacks of being VAT registered, specifically: cash accounting scheme annual accounting scheme - flat rate scheme (b) For the cash accounting scheme, state the conditions that Thomas must satisfy before being able to use the scheme, (4 marks) advise of the implications of using the scheme. (4 marks) and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts