Question: I have already done question 1 I need help with question three but information from number 1 ia required to do them! PLEASE HELP WITH

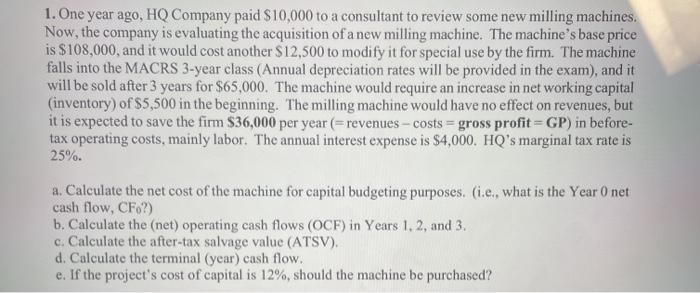

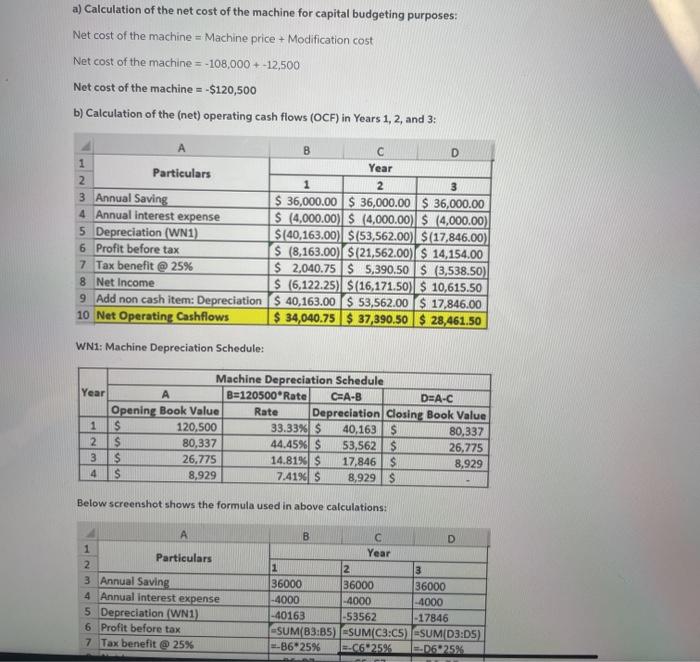

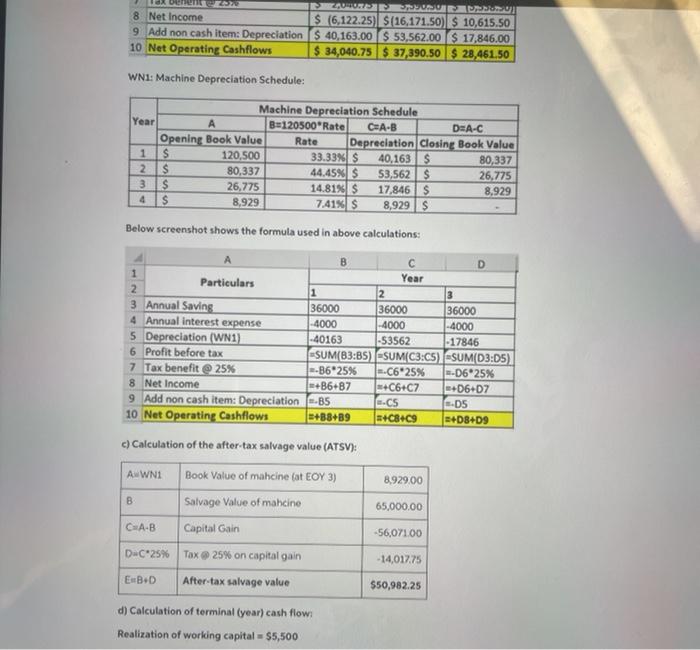

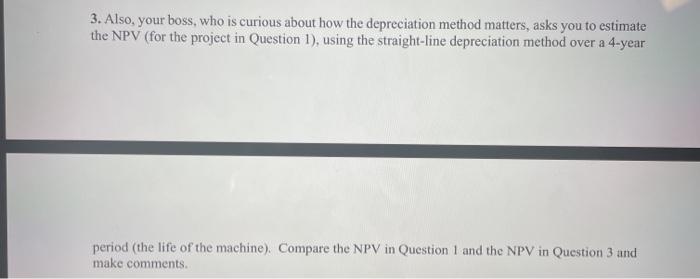

1. One year ago, HQ Company paid $10,000 to a consultant to review some new milling machines. Now, the company is evaluating the acquisition of a new milling machine. The machine's base price is $108,000, and it would cost another $12,500 to modify it for special use by the firm. The machine falls into the MACRS 3-year class (Annual depreciation rates will be provided in the exam), and it will be sold after 3 years for $65,000. The machine would require an increase in net working capital (inventory) of $5,500 in the beginning. The milling machine would have no effect on revenues, but it is expected to save the firm $36,000 per year (= revenues - costs = gross profit=GP) in before- tax operating costs, mainly labor. The annual interest expense is $4,000. HQ's marginal tax rate is 25%. a. Calculate the net cost of the machine for capital budgeting purposes. (ie, what is the Year 0 net cash flow, CF.?) b. Calculate the (net) operating cash flows (OCF) in Years 1, 2, and 3. c. Calculate the after-tax salvage value (ATSV). d. Calculate the terminal (year) cash flow. e. If the project's cost of capital is 12%, should the machine be purchased? a) Calculation of the net cost of the machine for capital budgeting purposes: Net cost of the machine = Machine price + Modification cost Net cost of the machine = -108,000 + -12,500 Net cost of the machine = -$120,500 b) Calculation of the (net) operating cash flows (OCF) in Years 1, 2 and 3: B D 1 Year Particulars 2 2 3 3 Annual Saving $ 36,000.00 $ 36,000.00 $ 36,000.00 4 Annual interest expense $ (4,000.00) S (4,000.00) $ (4,000.00) 5 Depreciation (WN1) $(40,163.00) $(53,562.00) $(17,846.00) 6 Profit before tax $ (8,163.00) $(21,562.00) S 14,154.00 7 Tax benefit @ 25% $ 2,040.75$ 5,390.50 S (3,538.50) 8 Net Income $ (6,122.25) $(16,171.50) S 10,615.50 9 Add non cash item: Depreciation $ 40,163.00 $ 53,562.00 $ 17,846.00 10 Net Operating Cashflows $ 34,040.75 $ 37,390.50 $ 28,461.50 WN1: Machine Depreciation Schedule: Machine Depreciation Schedule Year B=120500*Rate C=A-B DEA-C Opening Book Value Rate Depreciation Closing Book Value 1 120,500 33.33% $ 40,163 $ 80,337 2 $ 80,337 44.45% S 53,562 $ 26,775 3 $ 26.775 14.81% S 17.846 S 8,929 4 $ 8,929 7.419 S 8,929 $ Below screenshot shows the formula used in above calculations: 1 Particulars 2 3 Annual Saving 4 Annual Interest expense 5 Depreciation (WN1) 6 Profit before tax 7 Tax benefit @ 25% B D Year 1 2 3 36000 36000 36000 -4000 -4000 -4000 -40163 -53562 -17846 SUM(B3:35) SUM(C3:05) SUMID3:05) --B6.25% E-C62596 _D6M25% ZENIU 8 Net Income $ (6,122.25) $(16,171.50) $ 10,615.50 9 Add non cash item: Depreciation S 40,163.00 $ 53,562.00 $ 17,846.00 10 Net Operating Cashflows $ 34,040.75 $ 37,390.50 $ 28,461,50 WN1: Machine Depreciation Schedule: Machine Depreciation Schedule Year A B:120500"Rate CEA-B DEA-C Opening Book Value Rate Depreciation Closing Book Value 1 $ 120,500 33.33% $ 40,163 $ 80,337 2S 80,337 44.45% $ 53,562 $ 26,775 3 $ 26,775 14.81% $ 17,846 $ 8,929 4 $ 8,929 7.41% s 8,929 $ Below screenshot shows the formula used in above calculations: B D 1 Particulars Year 2 1 2 3 3 Annual Saving 36000 36000 36000 4 Annual interest expense 4000 -4000 -4000 5 Depreciation (WN1) -40163 1-53562 -17846 6 Profit before tax SUM(B3:35) SUM(C3:CS) SUM(D3:05) 7 Tax benefit @ 25% --B6.25% --C6'25% --D6.25% 8 Net Income +86-87 +C6+07 +06+07 9 Add non cash item: Depreciation --B5 -.CS --05 10 Net Operating Cashflows B+B8+89 *+C8+09 *+D8+D9 c) Calculation of the after tax salvage value (ATSV): AWNI 8.929.00 65,000.00 Book Value of mahcine (at EOY 3) B Salvage Value of mancino C=A.B Capital Gain D-C-25% Tax @ 25% on capital gain EB:D After-tax salvage value -56,071.00 -14,017.75 $50,982.25 d) Calculation of terminal (year) cash flow Realization of working capital = $5,500 3. Also, your boss, who is curious about how the depreciation method matters, asks you to estimate the NPV (for the project in Question 1), using the straight-line depreciation method over a 4-year period (the life of the machine). Compare the NPV in Question 1 and the NPV in Question 3 and make comments 1. One year ago, HQ Company paid $10,000 to a consultant to review some new milling machines. Now, the company is evaluating the acquisition of a new milling machine. The machine's base price is $108,000, and it would cost another $12,500 to modify it for special use by the firm. The machine falls into the MACRS 3-year class (Annual depreciation rates will be provided in the exam), and it will be sold after 3 years for $65,000. The machine would require an increase in net working capital (inventory) of $5,500 in the beginning. The milling machine would have no effect on revenues, but it is expected to save the firm $36,000 per year (= revenues - costs = gross profit=GP) in before- tax operating costs, mainly labor. The annual interest expense is $4,000. HQ's marginal tax rate is 25%. a. Calculate the net cost of the machine for capital budgeting purposes. (ie, what is the Year 0 net cash flow, CF.?) b. Calculate the (net) operating cash flows (OCF) in Years 1, 2, and 3. c. Calculate the after-tax salvage value (ATSV). d. Calculate the terminal (year) cash flow. e. If the project's cost of capital is 12%, should the machine be purchased? a) Calculation of the net cost of the machine for capital budgeting purposes: Net cost of the machine = Machine price + Modification cost Net cost of the machine = -108,000 + -12,500 Net cost of the machine = -$120,500 b) Calculation of the (net) operating cash flows (OCF) in Years 1, 2 and 3: B D 1 Year Particulars 2 2 3 3 Annual Saving $ 36,000.00 $ 36,000.00 $ 36,000.00 4 Annual interest expense $ (4,000.00) S (4,000.00) $ (4,000.00) 5 Depreciation (WN1) $(40,163.00) $(53,562.00) $(17,846.00) 6 Profit before tax $ (8,163.00) $(21,562.00) S 14,154.00 7 Tax benefit @ 25% $ 2,040.75$ 5,390.50 S (3,538.50) 8 Net Income $ (6,122.25) $(16,171.50) S 10,615.50 9 Add non cash item: Depreciation $ 40,163.00 $ 53,562.00 $ 17,846.00 10 Net Operating Cashflows $ 34,040.75 $ 37,390.50 $ 28,461.50 WN1: Machine Depreciation Schedule: Machine Depreciation Schedule Year B=120500*Rate C=A-B DEA-C Opening Book Value Rate Depreciation Closing Book Value 1 120,500 33.33% $ 40,163 $ 80,337 2 $ 80,337 44.45% S 53,562 $ 26,775 3 $ 26.775 14.81% S 17.846 S 8,929 4 $ 8,929 7.419 S 8,929 $ Below screenshot shows the formula used in above calculations: 1 Particulars 2 3 Annual Saving 4 Annual Interest expense 5 Depreciation (WN1) 6 Profit before tax 7 Tax benefit @ 25% B D Year 1 2 3 36000 36000 36000 -4000 -4000 -4000 -40163 -53562 -17846 SUM(B3:35) SUM(C3:05) SUMID3:05) --B6.25% E-C62596 _D6M25% ZENIU 8 Net Income $ (6,122.25) $(16,171.50) $ 10,615.50 9 Add non cash item: Depreciation S 40,163.00 $ 53,562.00 $ 17,846.00 10 Net Operating Cashflows $ 34,040.75 $ 37,390.50 $ 28,461,50 WN1: Machine Depreciation Schedule: Machine Depreciation Schedule Year A B:120500"Rate CEA-B DEA-C Opening Book Value Rate Depreciation Closing Book Value 1 $ 120,500 33.33% $ 40,163 $ 80,337 2S 80,337 44.45% $ 53,562 $ 26,775 3 $ 26,775 14.81% $ 17,846 $ 8,929 4 $ 8,929 7.41% s 8,929 $ Below screenshot shows the formula used in above calculations: B D 1 Particulars Year 2 1 2 3 3 Annual Saving 36000 36000 36000 4 Annual interest expense 4000 -4000 -4000 5 Depreciation (WN1) -40163 1-53562 -17846 6 Profit before tax SUM(B3:35) SUM(C3:CS) SUM(D3:05) 7 Tax benefit @ 25% --B6.25% --C6'25% --D6.25% 8 Net Income +86-87 +C6+07 +06+07 9 Add non cash item: Depreciation --B5 -.CS --05 10 Net Operating Cashflows B+B8+89 *+C8+09 *+D8+D9 c) Calculation of the after tax salvage value (ATSV): AWNI 8.929.00 65,000.00 Book Value of mahcine (at EOY 3) B Salvage Value of mancino C=A.B Capital Gain D-C-25% Tax @ 25% on capital gain EB:D After-tax salvage value -56,071.00 -14,017.75 $50,982.25 d) Calculation of terminal (year) cash flow Realization of working capital = $5,500 3. Also, your boss, who is curious about how the depreciation method matters, asks you to estimate the NPV (for the project in Question 1), using the straight-line depreciation method over a 4-year period (the life of the machine). Compare the NPV in Question 1 and the NPV in Question 3 and make comments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts