Question: I have also gotten 54 that is wrong but I can't seem to figure out what I am doing wrong. Quantitative Problem: Winston Inc. is

I have also gotten 54 that is wrong but I can't seem to figure out what I am doing wrong.

I have also gotten 54 that is wrong but I can't seem to figure out what I am doing wrong.

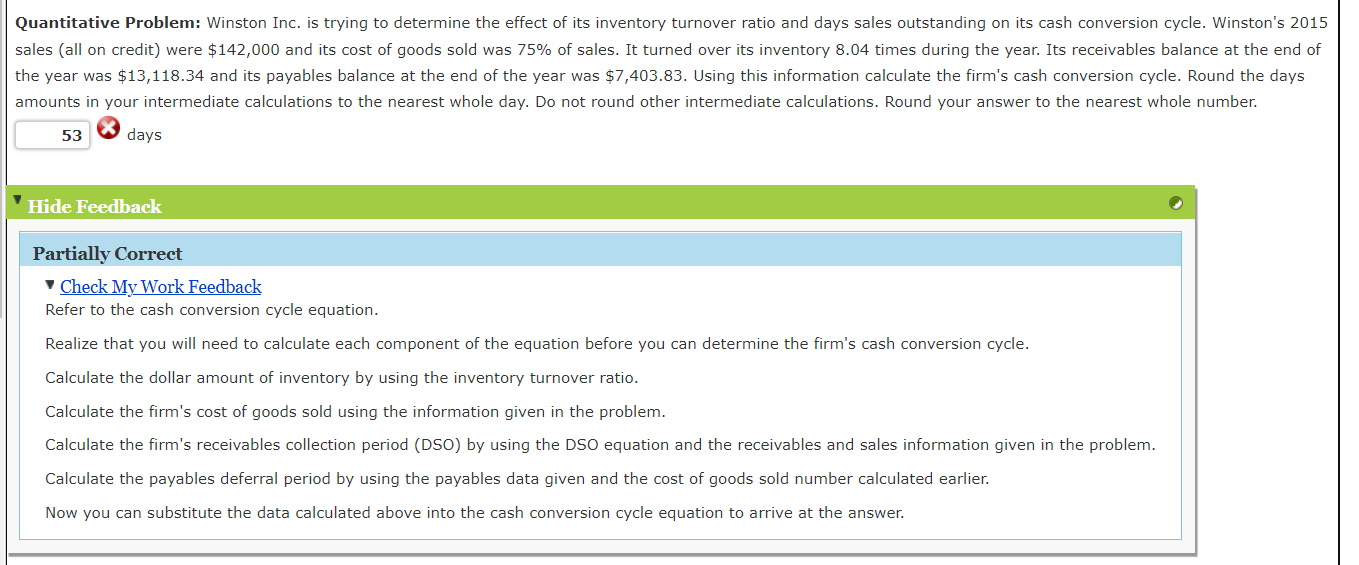

Quantitative Problem: Winston Inc. is trying to determine the effect of its inventory turnover ratio and days sales outstanding on its cash conversion cycle. Winston's 2015 sales (all on credit) were $142,000 and its cost of goods sold was 75% of sales. It turned over its inventory 8.04 times during the year. Its receivables balance at the end of the year was $13,118.34 and its payables balance at the end of the year was $7,403.83. Using this information calculate the firm's cash conversion cycle. Round the days amounts in your intermediate calculations to the nearest whole day. Do not round other intermediate calculations. Round your answer to the nearest whole number. 53 days Hide Feedback Partially Correct Check My Work Feedback Refer to the cash conversion cycle equation. Realize that you will need to calculate each component of the equation before you can determine the firm's cash conversion cycle. Calculate the dollar amount of inventory by using the inventory turnover ratio. Calculate the firm's cost of goods sold using the information given in the problem. Calculate the firm's receivables collection period (DSO) by using the DSO equation and the receivables and sales information given in the problem. Calculate the payables deferral period by using the payables data given and the cost of goods sold number calculated earlier. Now you can substitute the data calculated above into the cash conversion cycle equation to arrive at the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts