Question: I have attached the answer and guidelines to question 4. Could you explain qn 4 (e)? Thanks! Question 4 In 2018, the following information is

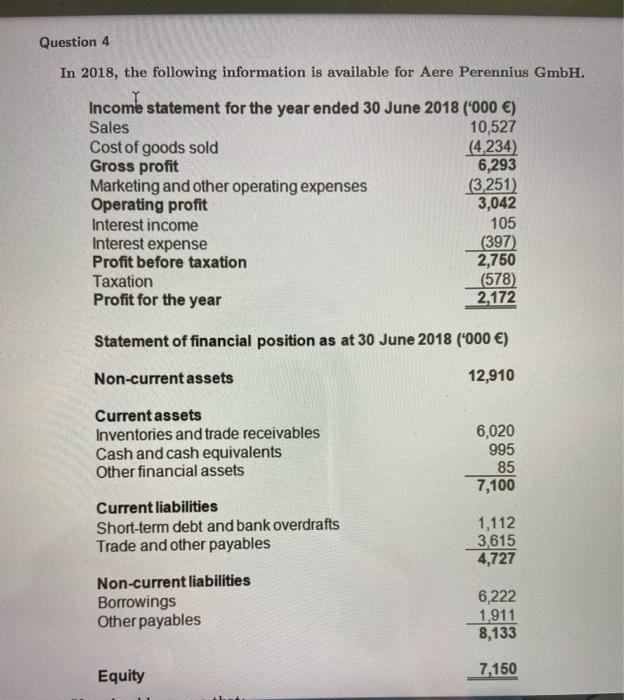

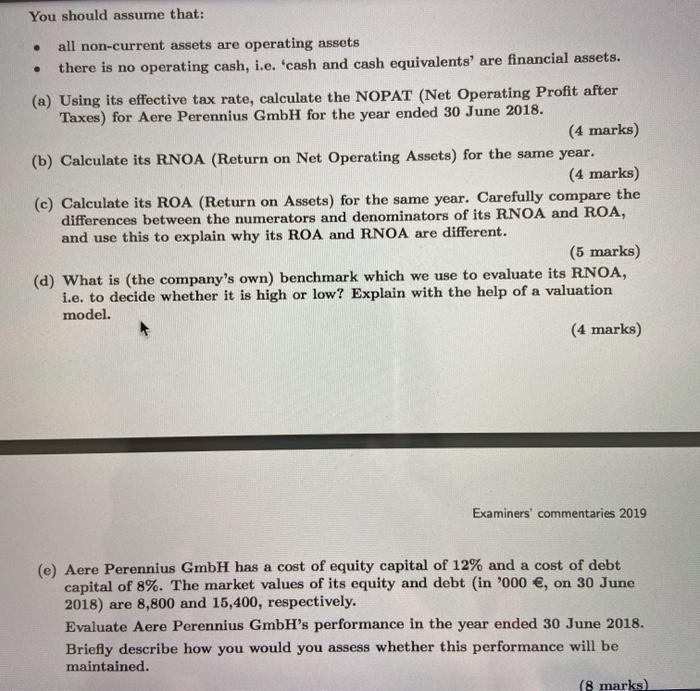

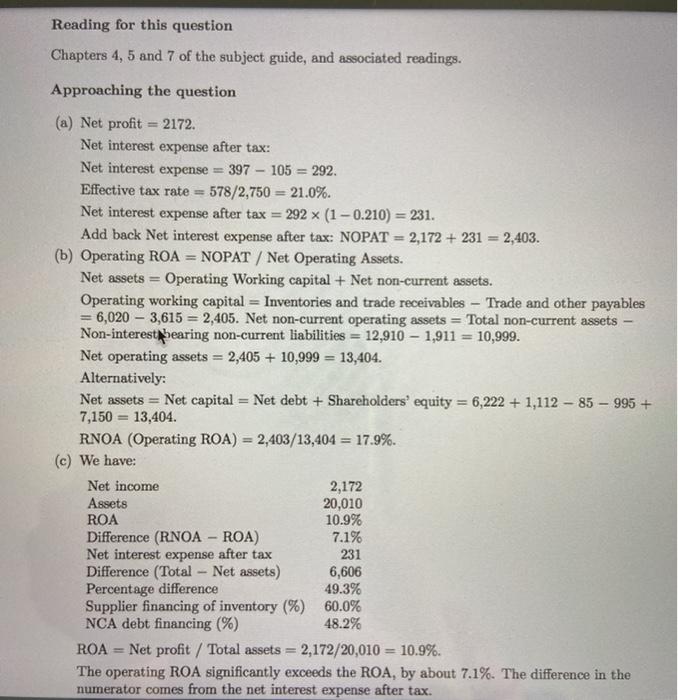

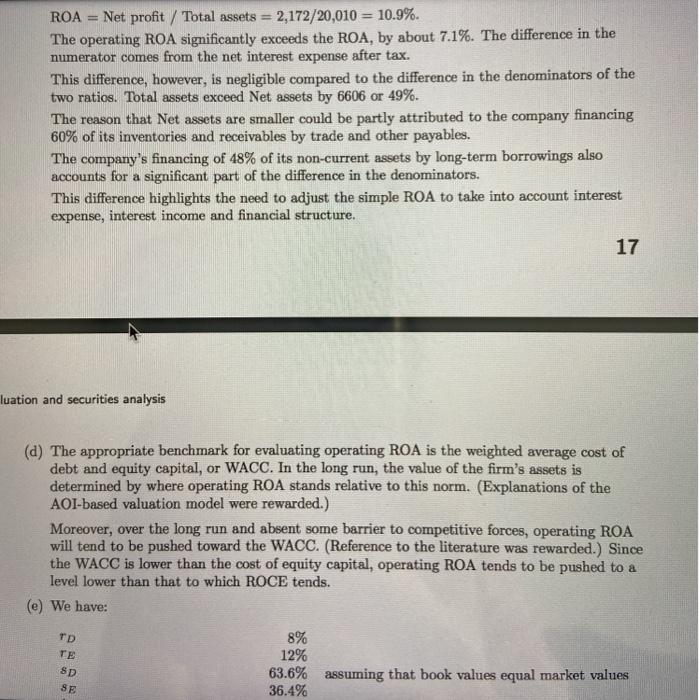

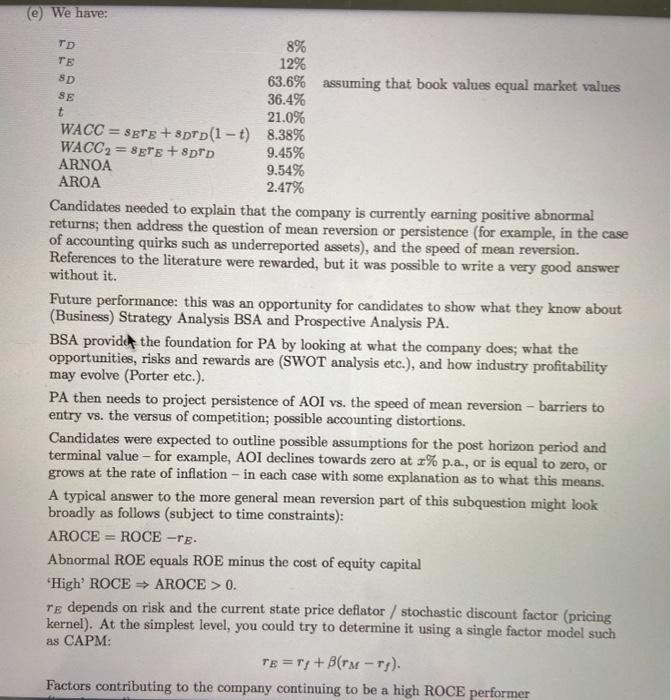

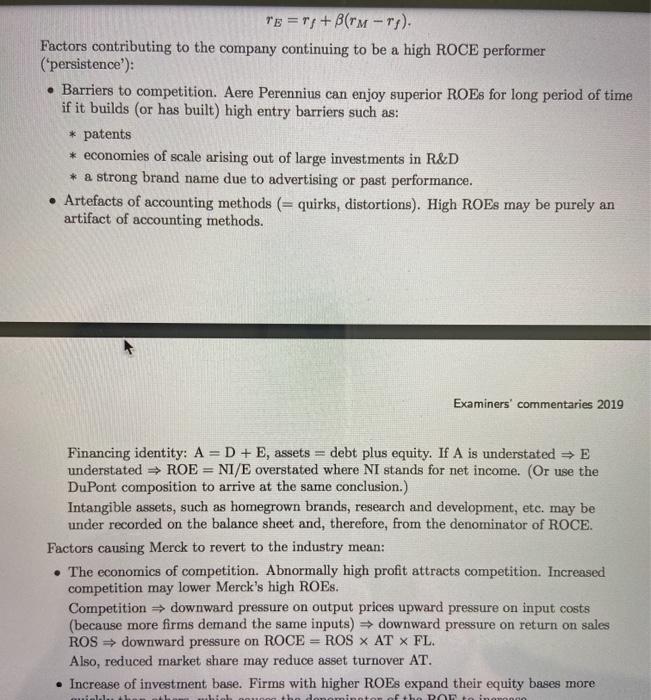

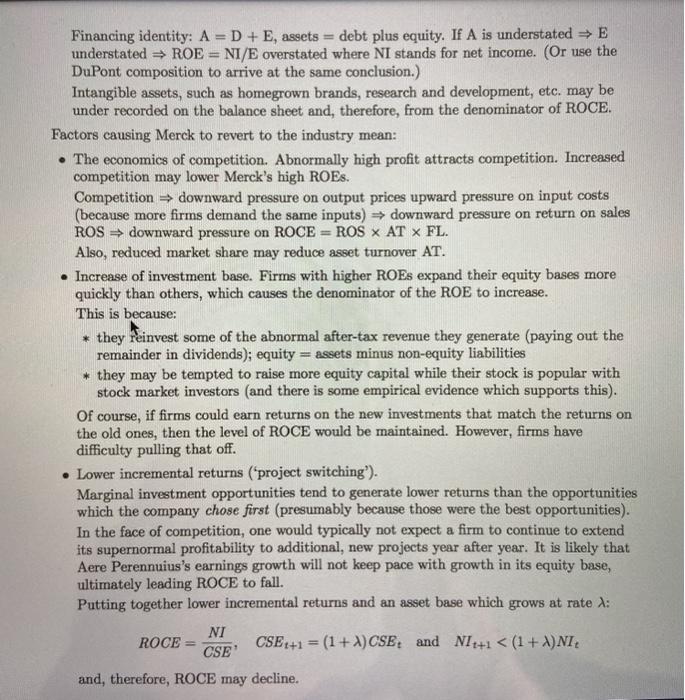

Question 4 In 2018, the following information is available for Aere Perennius GmbH. Income statement for the year ended 30 June 2018 (-000 ) Sales 10,527 Cost of goods sold (4,234) Gross profit 6,293 Marketing and other operating expenses (3.251) Operating profit 3,042 Interest income 105 Interest expense (397) Profit before taxation 2,750 Taxation (578) Profit for the year 2,172 Statement of financial position as at 30 June 2018 ('000 ) Non-current assets 12,910 Current assets Inventories and trade receivables Cash and cash equivalents Other financial assets 6,020 995 85 7,100 Current liabilities Short-term debt and bank overdrafts Trade and other payables 1,112 3,615 4,727 Non-current liabilities Borrowings Other payables 6,222 1,911 8,133 Equity 7,150 You should assume that: all non-current assets are operating assets there is no operating cash, i.e. 'cash and cash equivalents' are financial assets. (a) Using its effective tax rate, calculate the NOPAT (Net Operating Profit after Taxes) for Aere Perennius GmbH for the year ended 30 June 2018. (4 marks) (b) Calculate its RNOA (Return on Net Operating Assets) for the same year. (4 marks) (c) Calculate its ROA (Return on Assets) for the same year. Carefully compare the differences between the numerators and denominators of its RNOA and ROA, and use this to explain why its ROA and RNOA are different. (5 marks) (d) What is the company's own) benchmark which we use to evaluate its RNOA, i.e. to decide whether it is high or low? Explain with the help of a valuation model. (4 marks) Examiners' commentaries 2019 (e) Aere Perennius GmbH has a cost of equity capital of 12% and a cost of debt capital of 8%. The market values of its equity and debt (in '000 , on 30 June 2018) are 8,800 and 15,400, respectively. Evaluate Aere Perennius GmbH's performance in the year ended 30 June 2018. Briefly describe how you would you assess whether this performance will be maintained. (8 marks) Reading for this question Chapters 4, 5 and 7 of the subject guide, and associated readings. Approaching the question (a) Net profit = 2172. Net interest expense after tax: Net interest expense = 397 - 105 = 292. Effective tax rate = 578/2,750 = 21.0%. Net interest expense after tax = 292 x (1 -0.210) = 231. Add back Net interest expense after tax: NOPAT = 2,172 +231 = 2,403. (b) Operating ROA = NOPAT / Net Operating Assets. Net assets Operating Working capital + Net non-current assets. Operating working capital = Inventories and trade receivables - Trade and other payables 6,020 - 3,615 = 2,405. Net non-current operating assets = Total non-current assets - Non-interest bearing non-current liabilities = 12,910 - 1,911 = 10,999. Net operating assets = 2,405 + 10,999 = 13,404. Alternatively: Net assets = Net capital = Net debt + Shareholders' equity = 6,222 + 1,112 - 85 - 995 + 7,150 = 13,404. RNOA (Operating ROA) = 2,403/13,404 = 17.9%. (c) We have: Net income 2,172 Assets 20,010 ROA 10.9% Difference (RNOA - ROA) 7.1% Net interest expense after tax 231 Difference (Total - Net assets) 6,606 Percentage difference 49.3% Supplier financing of inventory (%) 60.0% NCA debt financing (%) 48.2% ROA Net profit / Total assets = 2,172/20,010 = 10.9%. The operating ROA significantly exceeds the ROA, by about 7.1%. The difference in the numerator comes from the net interest expense after tax. ROA = Net profit / Total assets = 2,172/20,010 = 10.9%. The operating ROA significantly exceeds the ROA, by about 7.1%. The difference in the numerator comes from the net interest expense after tax. This difference, however, is negligible compared to the difference in the denominators of the two ratios. Total assets exceed Net assets by 6606 or 49%. The reason that Net assets are smaller could be partly attributed to the company financing 60% of its inventories and receivables by trade and other payables. The company's financing of 48% of its non-current assets by long-term borrowings also accounts for a significant part of the difference in the denominators. This difference highlights the need to adjust the simple ROA to take into account interest expense, interest income and financial structure. 17 luation and securities analysis (d) The appropriate benchmark for evaluating operating ROA is the weighted average cost of debt and equity capital, or WACC. In the long run, the value of the firm's assets is determined by where operating ROA stands relative to this norm. (Explanations of the AOI-based valuation model were rewarded.) Moreover, over the long run and absent some barrier to competitive forces, operating ROA will tend to be pushed toward the WACC. (Reference to the literature was rewarded.) Since the WACC is lower than the cost of equity capital, operating ROA tends to be pushed to a level lower than that to which ROCE tends. (e) We have: 8% 12% 63.6% assuming that book values equal market values 36.4% TD TE SD BE (@) We have: TD TE SD SE t 8% 12% 63.6% assuming that book values equal market values 36.4% 21.0% WACC = sgrg +8prd (1 t) 8.38% WACC2 = 8gle +8pro 9.45% ARNOA 9.54% AROA 2.47% Candidates needed to explain that the company is currently earning positive abnormal returns; then address the question of mean reversion or persistence (for example, in the case of accounting quirks such as underreported assets), and the speed of mean reversion. References to the literature were rewarded, but it was possible to write a very good answer without it. Future performance: this was an opportunity for candidates to show what they know about (Business Strategy Analysis BSA and Prospective Analysis PA. BSA provide the foundation for PA by looking at what the company does; what the opportunities, risks and rewards are (SWOT analysis etc.), and how industry profitability may evolve (Porter etc.). PA then needs to project persistence of AOI vs. the speed of mean reversion - barriers to entry vs. the versus of competition; possible accounting distortions. Candidates were expected to outline possible assumptions for the post horizon period and terminal value - for example, AOI declines towards zero at x% p.a., or is equal to zero, or grows at the rate of inflation - in each case with some explanation as to what this means. A typical answer to the more general mean reversion part of this subquestion might look broadly as follows (subject to time constraints): AROCE ROCE -re. Abnormal ROE equals ROE minus the cost of equity capital "High' ROCE AROCE > 0. Te depends on risk and the current state price deflator / stochastic discount factor (pricing kernel). At the simplest level, you could try to determine it using a single factor model such as CAPM: Terry + B(rm-T). Factors contributing to the company continuing to be a high ROCE performer TE=r/+ (rm-T). Factors contributing to the company continuing to be a high ROCE performer (persistence': Barriers to competition. Aere Perennius can enjoy superior ROEs for long period of time if it builds (or has built) high entry barriers such as: * patents * economies of scale arising out of large investments in R&D * a strong brand name due to advertising or past performance. Artefacts of accounting methods (= quirks, distortions). High ROEs may be purely an artifact of accounting methods. Examiners' commentaries 2019 Financing identity: A =D + E, assets = debt plus equity. If A is understated E understated ROE = NI/E overstated where NI stands for net income. (Or use the DuPont composition to arrive at the same conclusion.) Intangible assets, such as homegrown brands, research and development, etc. may be under recorded on the balance sheet and, therefore, from the denominator of ROCE. Factors causing Merck to revert to the industry mean: The economics of competition. Abnormally high profit attracts competition. Increased competition may lower Merck's high ROEs. Competition downward pressure on output prices upward pressure on input costs (because more firms demand the same inputs) downward pressure on return on sales ROS downward pressure on ROCE = ROS X AT X FL. Also, reduced market share may reduce asset turnover AT. Increase of investment base. Firms with higher ROEs expand their equity bases more ulala to DO namang Financing identity: A =D + E, assets debt plus equity. If A is understated E understated ROE = NI/E overstated where NI stands for net income. (Or use the DuPont composition to arrive at the same conclusion.) Intangible assets, such as homegrown brands, research and development, etc. may be under recorded on the balance sheet and, therefore, from the denominator of ROCE. Factors causing Merck to revert to the industry mean: The economics of competition. Abnormally high profit attracts competition. Increased competition may lower Merck's high ROEs. Competition = downward pressure on output prices upward pressure on input costs (because more firms demand the same inputs) downward pressure on return on sales ROS downward pressure on ROCE = ROS AT FL. Also, reduced market share may reduce asset turnover AT. Increase of investment base. Firms with higher ROEs expand their equity bases more quickly than others, which causes the denominator of the ROE to increase. This is because: * they reinvest some of the abnormal after-tax revenue they generate (paying out the remainder in dividends); equity = assets minus non-equity liabilities * they may be tempted to raise more equity capital while their stock is popular with stock market investors and there is some empirical evidence which supports this). Of course, if firms could earn returns on the new investments that match the returns on the old ones, then the level of ROCE would be maintained. However, firms have difficulty pulling that off. . Lower incremental returns ("project switching'). Marginal investment opportunities tend to generate lower returns than the opportunities which the company chose first (presumably because those were the best opportunities). In the face of competition, one would typically not expect a firm to continue to extend its supernormal profitability to additional, new projects year after year. It is likely that Aere Perennuius's earnings growth will not keep pace with growth in its equity base, ultimately leading ROCE to fall. Putting together lower incremental returns and an asset base which grows at rate :: NI ROCE = CSE' CSE +1 = (1 +A) CSE and NIT+1 0. Te depends on risk and the current state price deflator / stochastic discount factor (pricing kernel). At the simplest level, you could try to determine it using a single factor model such as CAPM: Terry + B(rm-T). Factors contributing to the company continuing to be a high ROCE performer TE=r/+ (rm-T). Factors contributing to the company continuing to be a high ROCE performer (persistence': Barriers to competition. Aere Perennius can enjoy superior ROEs for long period of time if it builds (or has built) high entry barriers such as: * patents * economies of scale arising out of large investments in R&D * a strong brand name due to advertising or past performance. Artefacts of accounting methods (= quirks, distortions). High ROEs may be purely an artifact of accounting methods. Examiners' commentaries 2019 Financing identity: A =D + E, assets = debt plus equity. If A is understated E understated ROE = NI/E overstated where NI stands for net income. (Or use the DuPont composition to arrive at the same conclusion.) Intangible assets, such as homegrown brands, research and development, etc. may be under recorded on the balance sheet and, therefore, from the denominator of ROCE. Factors causing Merck to revert to the industry mean: The economics of competition. Abnormally high profit attracts competition. Increased competition may lower Merck's high ROEs. Competition downward pressure on output prices upward pressure on input costs (because more firms demand the same inputs) downward pressure on return on sales ROS downward pressure on ROCE = ROS X AT X FL. Also, reduced market share may reduce asset turnover AT. Increase of investment base. Firms with higher ROEs expand their equity bases more ulala to DO namang Financing identity: A =D + E, assets debt plus equity. If A is understated E understated ROE = NI/E overstated where NI stands for net income. (Or use the DuPont composition to arrive at the same conclusion.) Intangible assets, such as homegrown brands, research and development, etc. may be under recorded on the balance sheet and, therefore, from the denominator of ROCE. Factors causing Merck to revert to the industry mean: The economics of competition. Abnormally high profit attracts competition. Increased competition may lower Merck's high ROEs. Competition = downward pressure on output prices upward pressure on input costs (because more firms demand the same inputs) downward pressure on return on sales ROS downward pressure on ROCE = ROS AT FL. Also, reduced market share may reduce asset turnover AT. Increase of investment base. Firms with higher ROEs expand their equity bases more quickly than others, which causes the denominator of the ROE to increase. This is because: * they reinvest some of the abnormal after-tax revenue they generate (paying out the remainder in dividends); equity = assets minus non-equity liabilities * they may be tempted to raise more equity capital while their stock is popular with stock market investors and there is some empirical evidence which supports this). Of course, if firms could earn returns on the new investments that match the returns on the old ones, then the level of ROCE would be maintained. However, firms have difficulty pulling that off. . Lower incremental returns ("project switching'). Marginal investment opportunities tend to generate lower returns than the opportunities which the company chose first (presumably because those were the best opportunities). In the face of competition, one would typically not expect a firm to continue to extend its supernormal profitability to additional, new projects year after year. It is likely that Aere Perennuius's earnings growth will not keep pace with growth in its equity base, ultimately leading ROCE to fall. Putting together lower incremental returns and an asset base which grows at rate :: NI ROCE = CSE' CSE +1 = (1 +A) CSE and NIT+1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts