Question: I have been trying to answer number 1 for about 6 hours and I keep getting a random number every time could someone how mee

I have been trying to answer number 1 for about 6 hours and I keep getting a random number every time could someone how mee how to correctly do it.

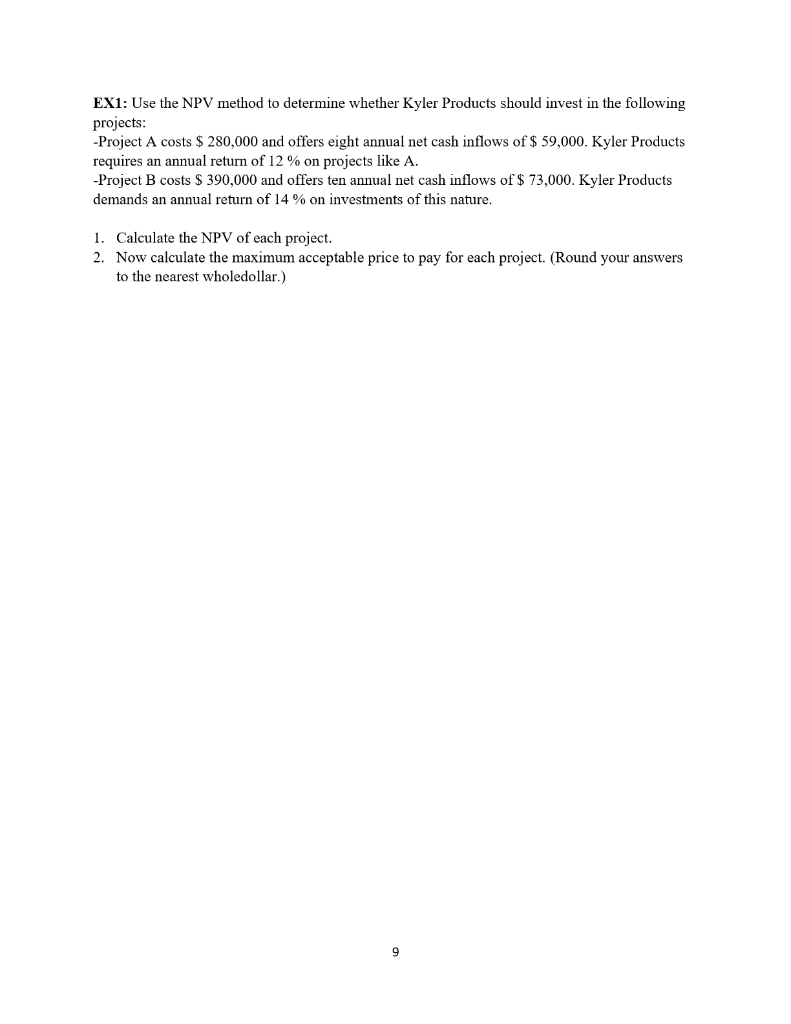

EX1: Use the NPV method to determine whether Kyler Products should invest in the following projects: -Project A costs $ 280,000 and offers eight annual net cash inflows of $ 59,000. Kyler Products requires an annual return of 12 % on projects like A. - Project B costs $ 390,000 and offers ten annual net cash inflows of $ 73,000. Kyler Products demands an annual return of 14% on investments of this nature. 1. Calculate the NPV of each project. 2. Now calculate the maximum acceptable price to pay for each project. (Round your answers to the nearest wholedollar.) 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts