Question: I have come up with two different solutions. could you please walk me through the formulas used to solve for the ratios requested. also explain

I have come up with two different solutions. could you please walk me through the formulas used to solve for the ratios requested. also explain how these ratios compare with the ratios given. I appreciate it.

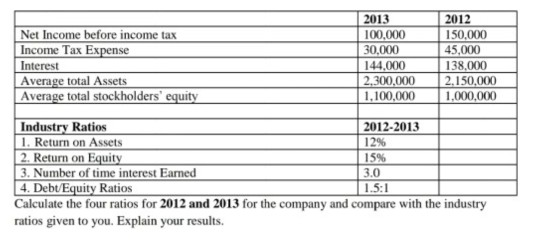

2013 2012 Net Income before income tax 100.000 150,000 Income Tax Expense 30,000 45,000 Interest 144,000 138,000 Average total Assets 2.300.000 2.150,000 Average total stockholders' equity 1,100,000 1,000,000 Industry Ratios 2012-2013 1. Return on Assets 12% 2. Return on Equity 15% 3. Number of time interest Earned 3.0 4. Debt Equity Ratios 1.5:1 Calculate the four ratios for 2012 and 2013 for the company and compare with the industry ratios given to you. Explain your resultsStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts