Question: I have gone wrong somewhere throughout this project. I have spent hours trying to figure out where I went wrong. Anyone who is skilled at

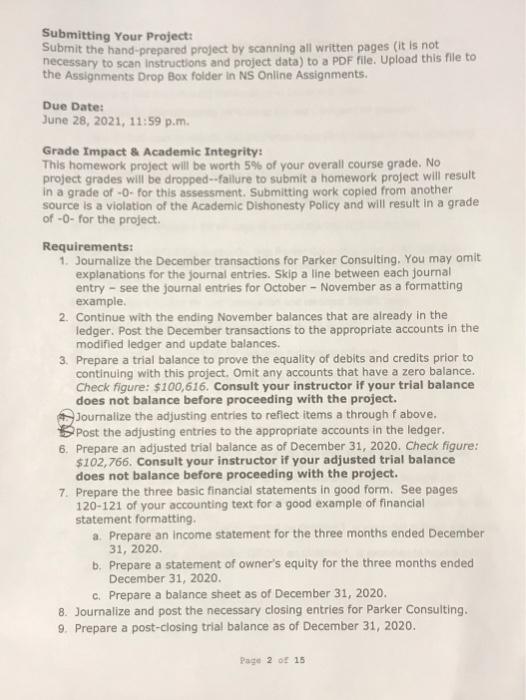

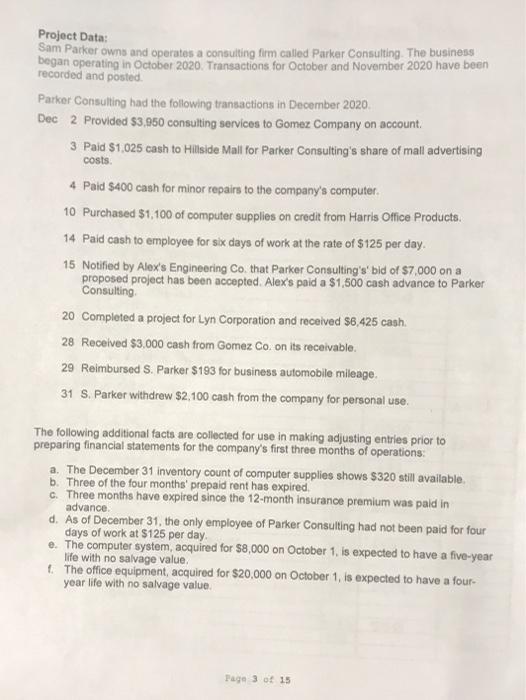

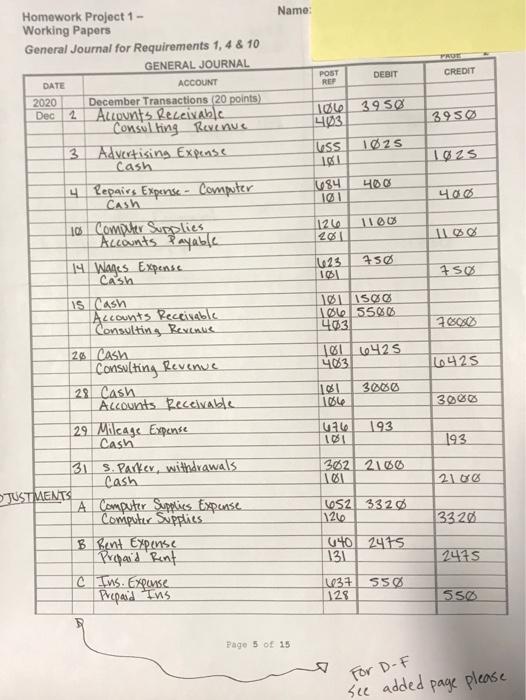

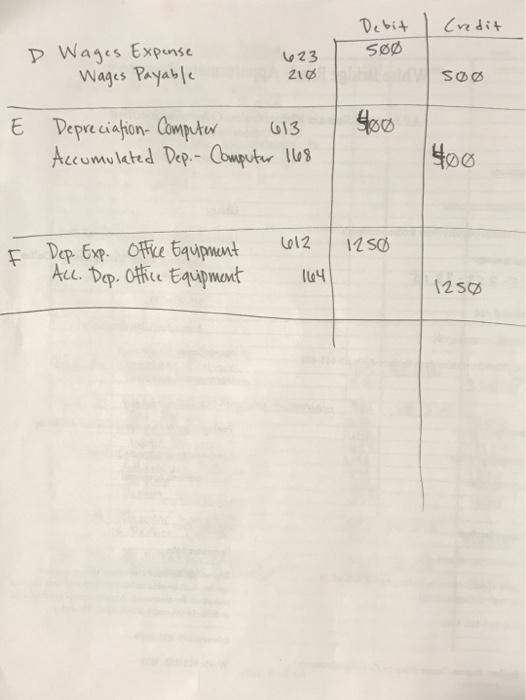

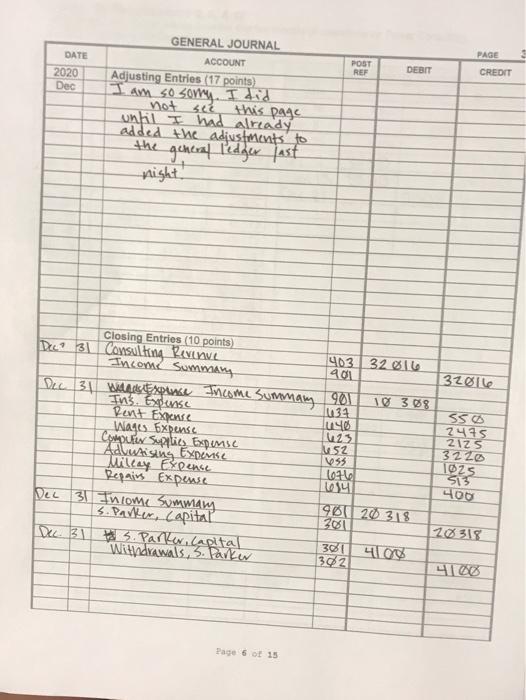

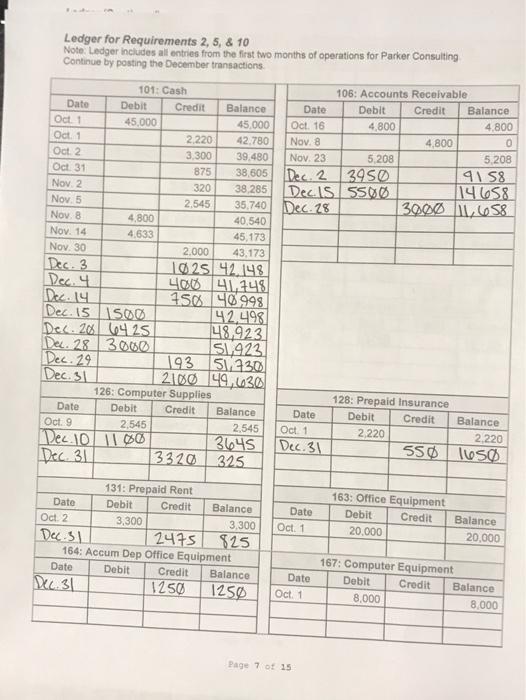

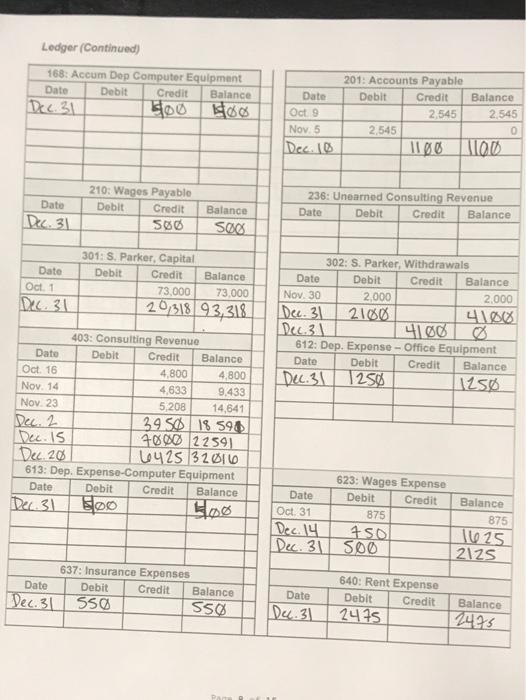

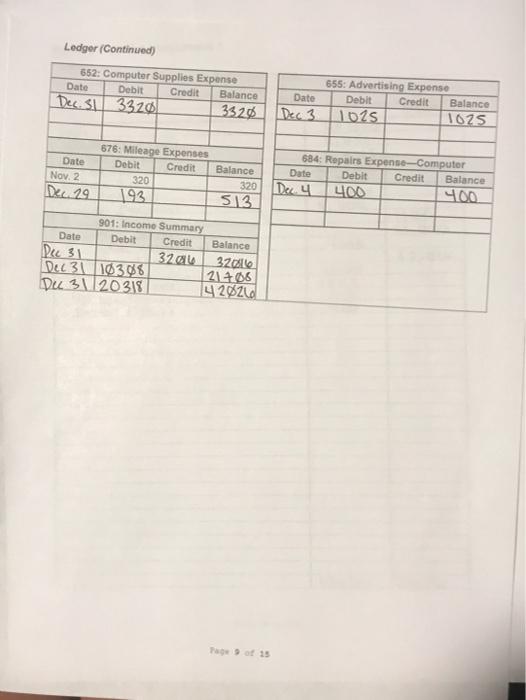

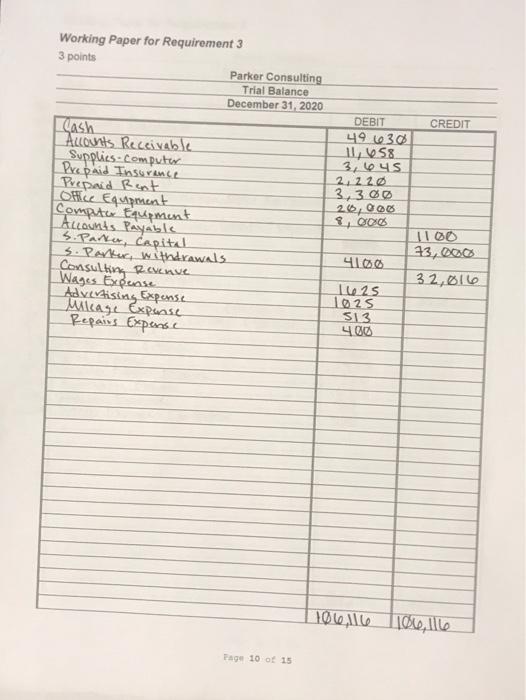

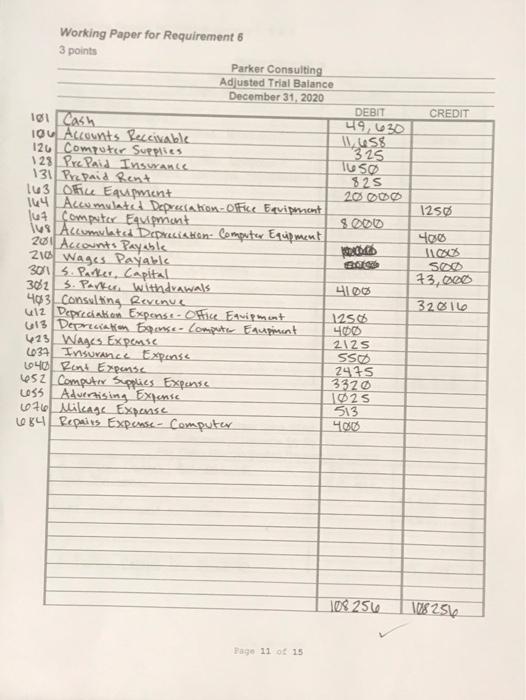

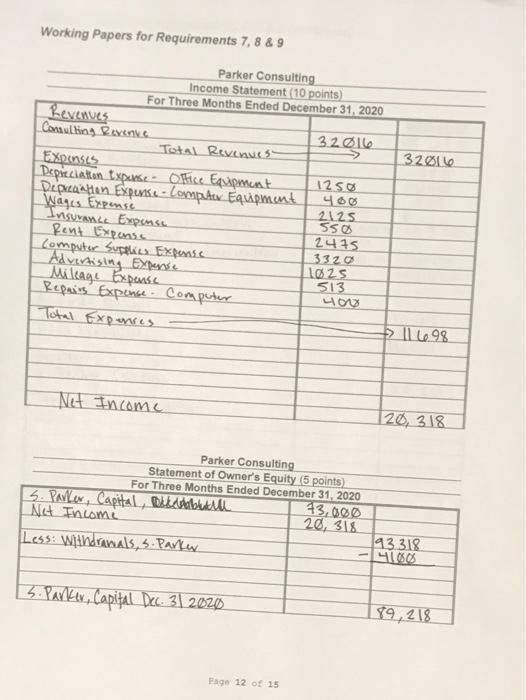

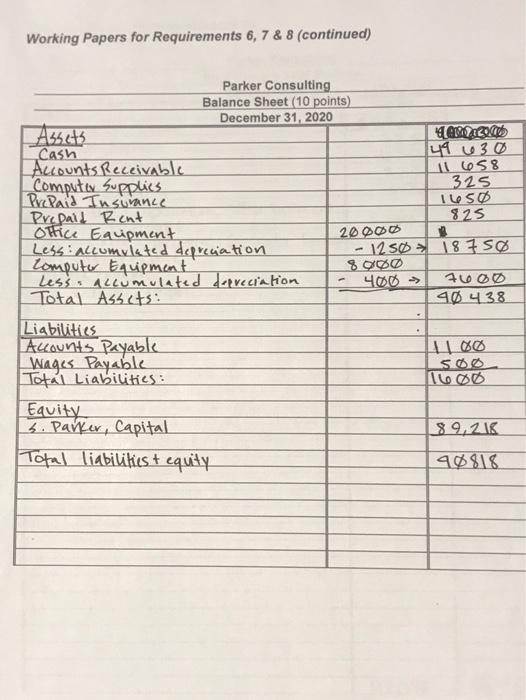

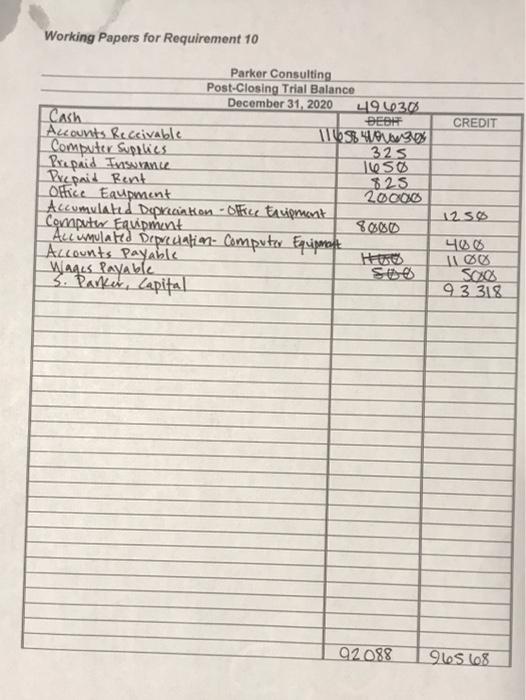

Submitting Your Project: Submit the hand prepared project by scanning all written pages (it is not necessary to scan instructions and project data) to a PDF file. Upload this file to the Assignments Drop Box folder in NS Online Assignments. Due Date: June 28, 2021, 11:59 p.m. Grade Impact & Academic Integrity: This homework project will be worth 5% of your overall course grade. No project grades will be dropped--failure to submit a homework project will result in a grade of -- for this assessment. Submitting work copied from another source is a violation of the Academic Dishonesty Policy and will result in a grade of - O- for the project Requirements: 1. Journalize the December transactions for Parker Consulting. You may omit explanations for the journal entries. Skip a line between each journal entry - see the journal entries for October - November as a formatting example, 2. Continue with the ending November balances that are already in the ledger. Post the December transactions to the appropriate accounts in the modified ledger and update balances. 3. Prepare a trial balance to prove the equality of debits and credits prior to continuing with this project. Omit any accounts that have a zero balance. Check figure: $100,616. Consult your instructor if your trial balance does not balance before proceeding with the project. Journalize the adjusting entries to reflect items a through fabove. Post the adjusting entries to the appropriate accounts in the ledger. 6. Prepare an adjusted trial balance as of December 31, 2020. Check figure: $102,766. Consult your instructor if your adjusted trial balance does not balance before proceeding with the project. 7. Prepare the three basic financial statements in good form. See pages 120-121 of your accounting text for a good example of financial statement formatting a. Prepare an income statement for the three months ended December 31, 2020 b. Prepare a statement of owner's equity for the three months ended December 31, 2020. c. Prepare a balance sheet as of December 31, 2020, 8. Journalize and post the necessary closing entries for Parker Consulting. 9. Prepare a post-closing trial balance as of December 31, 2020. Page 2 of 15 Project Data: Sam Parker owns and operates a consulting firm called Parker Consulting. The business began operating in October 2020. Transactions for October and November 2020 have been recorded and posted Parker Consulting had the following transactions in December 2020 Dec 2 Provided $3,960 consulting services to Gomez Company on account. 3 Paid $1,025 cash to Hillside Mall for Parker Consulting's share of maill advertising costs 4 Paid $400 cash for minor repairs to the company's computer. 10 Purchased $1,100 of computer supplies on credit from Harris Office Products. 14 Paid cash to employee for six days of work at the rate of $125 per day. 15 Notified by Alex's Engineering Co that Parker Consulting's bid of $7,000 on a proposed project has been accepted. Alex's paid a $1,500 cash advance to Parker Consulting 20 Completed a project for Lyn Corporation and received $8,425 cash. 28 Received $3,000 cash from Gomez Co on its receivable. 29 Reimbursed S. Parker $193 for business automobile mileage. 31 S. Parker withdrew $2,100 cash from the company for personal use. The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months of operations: a. The December 31 Inventory count of computer supplies shows $320 still available. b. Three of the four months' prepaid rent has expired. c. Three months have expired since the 12-month insurance premium was paid in advance d. As of December 31, the only employee of Parker Consulting had not been paid for four e. The computer system, acquired for $8,000 on October 1, is expected to have a five-year life with no salvage value The office equipment, acquired for $20,000 on October 1, is expected to have a four- year life with no salvage value Page 3 of 15 Name: POST REP DEBIT CREDIT 3956 ole 3950 p3 USS 1025 131 1025 400 Us 101 40 1103 1126 201 11 1223 756 101 750 Homework Project 1 - Working Papers General Journal for Requirements 1,4 & 10 GENERAL JOURNAL DATE ACCOUNT 2020 December Transactions 20 points) Dec2 Accounts Receivable Consulting Revenue 13 Advertising Expense Cash 4 Repairs Expense - Computer Cash 10. Comer Supplies Accounts Payable 19 Wages Expanse Cash 15 cash Accounts Receivable Consulting Revenue 28 Cash Consulting Revenue 28 cash Accounts Receivable 29 Mileage Expense Cash 31 S. Parker, withdrawals Cash JUSTMENTS A computer Supplies Expense Computer Supplies B Rent Expense Prepaid Rent c Ius. Expanse Prepaid Ins 760 1811500 ble S56S 403 1% 6425 4063 6425 101 3000 106 3000 3 193 101 193 362 2160 10 2100 652 3320 126 3320 640 2415 131 2445 1037 128 SSO 550 Page 5 of 15 For D-F see added page please Credit Debit Sg D Wages Expense Wages Payable 623 210 so soos E Depreciation Computer 613 Accumulated Dep.- Computer 168 400 612 2 12 so . F Dep. Exp. Office Equipment Acc. Dep. Office Equipment 114 1250 PAGE DATE 2020 Dec POST REF DEBIT DEBIT CREDIT GENERAL JOURNAL ACCOUNT Adjusting Entries (17 points) I am so sorry. I did this page until I had already added the adjustments to the general ledger last se night 040 Closing Entries (10 points) Dec? 31 Consulting Revive 403 32 1 Income Summary 401 32lle Dec 31 Widgest Expense Income Summary 901 10 308 1632 55 Rent Expense 2475 Wages Expense 123 212S Computer Split Expense 3220 Aalutising Experise 53 1025 Miley Expans 513 Repairs Expense 34 400 Dec 31 Income Summary ) 90 20 318 s. Parker, Capital 2001 20318 Dec. 31 # S. Parker, capital 361 4100 Withdrawals, 3. Parker 302 410 SZ 6076 Page 6 of 15 Ledger for Requirements 2, 5, & 10 Note: Ledger includes alt entries from the first two months of operations for Parker Consulting Continue by posting the December transactions 106: Accounts Receivable Date Debit Credit Balance Oct. 16 4.800 4.800 Nov. 8 4.800 Nov. 23 5 208 5,208 Dec. 2 3950 91 58 Dec IS S500 14658 Dec. 28 3000 1.658 101: Cash Date Debit Credit Balance Oct 45.000 45.000 Oct 1 2.220 42.780 Oct 2 3.300 39.480 Oct 31 875 38.605 Nov. 2 320 38.285 Nov. 5 2.545 35.740 Nov. 8 4.800 40.540 Nov. 14 4.633 45.173 Nov. 30 2.000 43.173 Dec. 3 1025 42.148 Dec. 4 400 41,748 Dec. 14 7505 40998 Dec. 15 1500 42.498 Dec. 2064 25 48,923 Dec 28 3000 $1,923 Dec. 29 193 51,730 Dec.31 2100 49.630 126: Computer Supplies Date Debit Credit Balance Oct 9 2,545 2.545 Dec 10 1100 3645 Dec. 31 3320 325 128: Prepaid Insurance Date Debit Credit Balance Oct 1 2,220 2.220 Dec.31 550 lose Date Oct. 1 163: Office Equipment Debit Credit 20.000 131: Prepaid Rent Date Debit Credit Balance Oct 2 3,300 3.300 Dec.31 2475 $25 164: Accum Dep Office Equipment Date Debit Credit Balance Dec.31 1250 1250 Balance 20.000 Date Oct 1 167: Computer Equipment Debit Credit Balance 8.000 8.000 Page 7 of 15 Ledger (Continued) 168: Accum Dep Computer Equipment Date Debit Credit Balance Dec.31 100 50 Date Oct 9 Nov. 5 Dec 10 201: Accounts Payable Debit Credit Balance 2.545 2.545 2,545 0 11 00 @ Date Dec. 31. 210: Wages Payable Debit Credit Soos 236: Unearned Consulting Revenue Date Debit Credit Balance Balance 500 Date Oct 1 Dec. 31 301: S. Parker, Capital Debit Credit 73,000 Balance 73,000 20/318 93,318 302: S. Parker, Withdrawals Date Debit Credit Balance Nov. 30 2.000 2,000 Dec. 31 2100 4180 Dec.31 4100 612: Dep. Expense - Office Equipment Date Debit Credit Balance Dec.31 1250 1256 403: Consulting Revenue Date Debit Credit Balance Oct. 16 4.800 4.800 Nov. 14 4,633 9.433 Nov. 23 5.208 14,841 Dec. 2 34 518 590 Dec. is 4000 2259) Dec. 20 6042532016 613: Dep. Expense-Computer Equipment Date Debit Credit Balance Dec 31 Hoo 500 Date Oct. 31 Dec. 14 Dec. 31 623: Wages Expense Debit Credit Balance 875 875 7sol 1625 Soo 2125 637: Insurance Expenses Date Debit Credit Balance Dec.31 550 550 Date 640: Rent Expense Debit Credit 2475 Balance Dec. 31 2475 Ledger (Continued) 652: Computer Supplies Expense Date Debit Credit Balance Dec.31 3320 3320 Date 655: Advertising Expense Debit Credit Balance 1025 1025 Date Nov. 2 876: Mileage Expenses Debit Credit Balance 320 320 193 513 684: Repairs Expense-Computer Date Debit Credit Balance 400 400 Dec 29 Dec 4 901: Income Summary Date Debit Credit Balance 320 320ll Dec 31 10308 2106 Du 3120 318 1420821 Dec 31 915 Working Paper for Requirement 3 3 points Parker Consulting Trial Balance December 31, 2020 Sash Alounts Receivable Supplies-computer Prepaid Insurance Prepaid Rent Office Equpment Computer Equipment Allounts Payable S. Parker, capital S. Parker, withdrawals. Consulting Revenue Wages Expense Advertising Expanse Mikage Expanse Repairs Expanse DEBIT CREDIT 49 130 14658 3,645 2.22% 3,30 20,000 8,000 1100 13,000 4100 32,016 1625 1025 S13 40 106,116 1106, 116 Page 10 of 15 Working Paper for Requirement 6 3 points Parker Consulting Adjusted Trial Balance December 31, 2020 DEBIT CREDIT 181 cash 49,630 Ou Accounts Receivable 11 458 126 Computer Supplies 325 123 Pre Paid Insurance Teso 131 Prepaid Rent 825 lu3 Office Equipment 2000 144 Accumulate Depressabon-fice Equipment 1250 147 Computer Equipment 8000 148 Accumulate Depecishen Computer Equipment 400 201 Accounts Payable sos 21 Wages Payable BAS so 301 5. Parker, Capital 73,000 302 3. Parke withdrawals 4100% 403. Consulting Revenue 328160 U12 Depreciation Expanse - Office Equipment 1250 613 Depreciation Espanse - Computer Eaupinant 400 425 Wages Expense 2125 634 Insurance Expanse S508 1640 Rent Expense 2475 452 Computer supplies Expense 3320 Less Advertising Expense 1025 6076 Mileage Expanse 513 6064 Repairs ExRm5e - Computer 400 aces 108254 128 256 Fage-11 15 Working Papers for Requirements 7, 8 & 9 32016 Parker Consulting Income Statement 10 points) For Three Months Ended December 31, 2020 Revenues Consulting Revents 3.2016 Total Revenues Expansis Depitcialen Expanse Otrice Equipment 1250 Depreaahton Expuse - Company Equipment 400 Wages Expense 2125 Insurance Expense 550 Rent Expense 2475 Computer Supplies Expanse 3320 Advertising Expense 1025 Mileage Expose 513 Repairs Expense. Computer 00 Total Expenses - 11698 Net Income 20, 318 Parker Consulting Statement of Owner's Equity 5 points) For Three Months Ended December 31, 2020 3. Parler, Capital, Dikdabadell 73,000 Net Income 20,318 43318 Less: Windrana, s. Parke 41050 3. Parker, Capital Dec. 31 2020 189,218 Page 12 of 15 Working Papers for Requirements 6, 7 & 8 (continued) - Parker Consulting Balance Sheet (10 points) December 31, 2020 Assets Cash 49 630 Accounts Receivable 1658 Computer supplies 325 Prepaid Insurance les Prepaid Rent 825 Office Equipment, 20 000 Less Accumulated depreciation 1250 18750 Computer Equipment 800 Less, accumulated depreciation 400 7000 Total Assets: 40438 Liabilities Accounts Payable 100 Wages Payable 500 Total Liabilities: 11600 Equity 5. Parker, Capital 89.216 Total liabilities t equity 40818 Working Papers for Requirement 10 CREDIT Parker Consulting Post-Closing Trial Balance December 31, 2020 419.03.08 Cash DEH Accounts Receivable 116658 Hourse Computer Suprlies 325 Prepaid TISA YALE 16 SO Prepaid Rent $25 Ofice Equipment 20000 Accumulated Deprezin konce tavignant Computer Equipment SO Accumulated Depreciation Computer Equipment Accounts Payable HUS Wagus Payable S. Parker, Capital 12.5% 400 11 00 SCO 93318 92088 965 108

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts