Question: I have hit a roadblock on this problem. Please provide explanations for the missing fields. Thanks! Wood Corporation owns 1 percent of Carter Company's voting

I have hit a roadblock on this problem. Please provide explanations for the missing fields. Thanks!

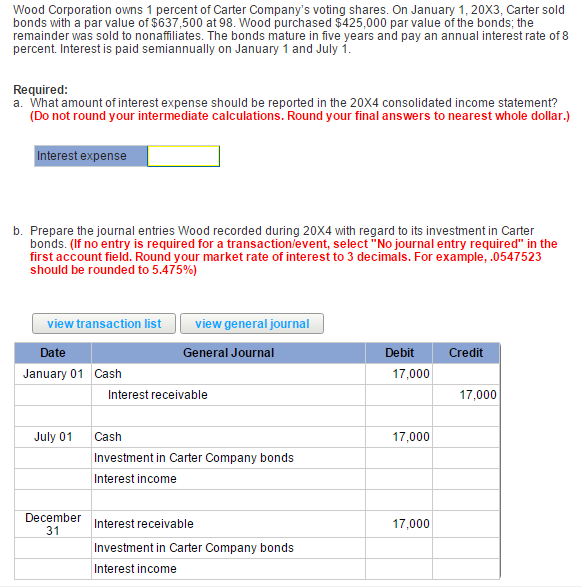

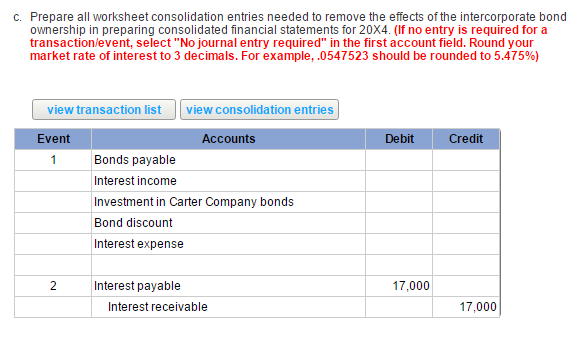

Wood Corporation owns 1 percent of Carter Company's voting shares. On January 1 20X3, Carter sold bonds with a par value of $637,500 at 98. Wood purchased $425,000 par value of the bonds; the remainder was sold to nonaffiliates. The bonds mature in five years and pay an annual interest rate of 8 percent. Interest is paid semiannually on January 1 and July 1 Required: a. What amount of interest expense should be reported in the 20X4 consolidated income statement? (Do not round your intermediate calculations. Round your final answers to nearest whole dollar.) Interest expense b. Prepare the journal entries Wood recorded during 20X4 with regard to its investment in Carter bonds. (If no entry is required for a transaction/event, select"No journal entry required" in the first account field. Round your market rate of interest to 3 decimals. For example, .0547523 should be rounded to 5.475%) view transaction list view general journal Credit Date General Journal Debit January 01 Cash 17,000 17 Interest receivable 17,000 July 01 Cash 17,000 Investment in Carter Company bonds Interest income December Interest receivable 17,000 Investment in Carter Company bonds Interest income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts