Question: I have looked at other posts that have the same questions. I see some people are saying it is (15.79) while another is saying 10.78.

I have looked at other posts that have the same questions. I see some people are saying it is (15.79) while another is saying 10.78. Or maybe both are wrong. Please help thank you.

I have looked at other posts that have the same questions. I see some people are saying it is (15.79) while another is saying 10.78. Or maybe both are wrong. Please help thank you.

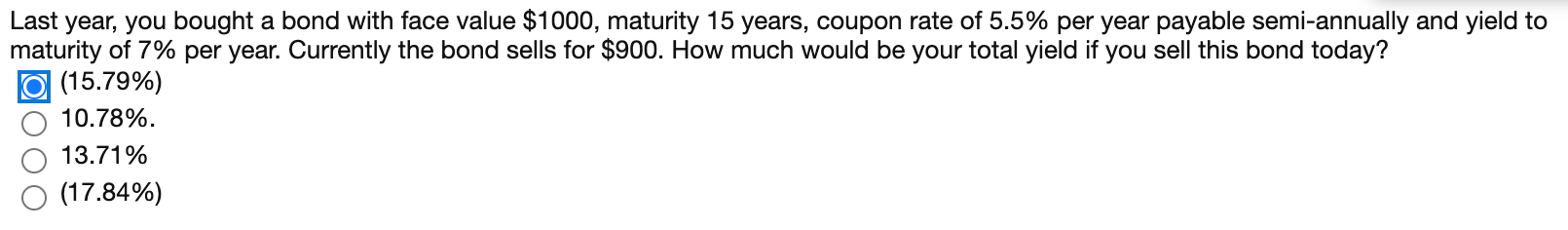

Last year, you bought a bond with face value $1000, maturity 15 years, coupon rate of 5.5% per year payable semi-annually and yield to maturity of 7% per year. Currently the bond sells for $900. How much would be your total yield if you sell this bond today? (15.79%) 10.78%. 13.71% (17.84%)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock