Question: I have no idea if i am doing this right You opened a new brokerage account to begin trading. You invest $500,000. You decide to

I have no idea if i am doing this right

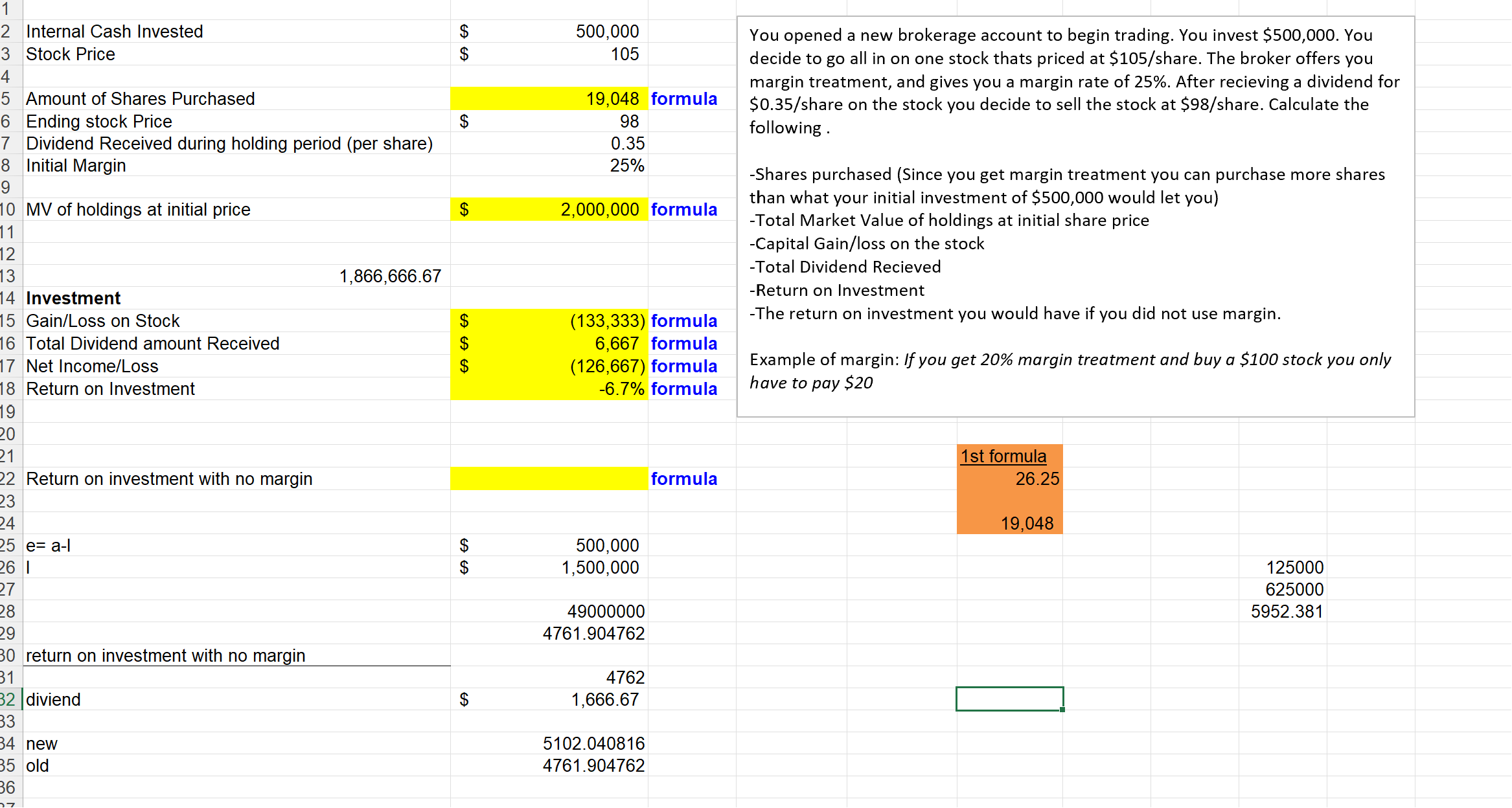

You opened a new brokerage account to begin trading. You invest $500,000. You decide to go all in on one stock thats priced at $105/ share. The broker offers you margin treatment, and gives you a margin rate of 25%. After recieving a dividend for $0.35/ share on the stock you decide to sell the stock at $98/ share. Calculate the following . -Shares purchased (Since you get margin treatment you can purchase more shares than what your initial investment of $500,000 would let you) -Total Market Value of holdings at initial share price - Capital Gain/loss on the stock -Total Dividend Recieved -Return on Investment -The return on investment you would have if you did not use margin. Example of margin: If you get 20% margin treatment and buy a $100 stock you only have to pay $20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts