Question: i have the answers and everything needed to answer question #5 but cannot seem to understand it . can anyone answer # step by step

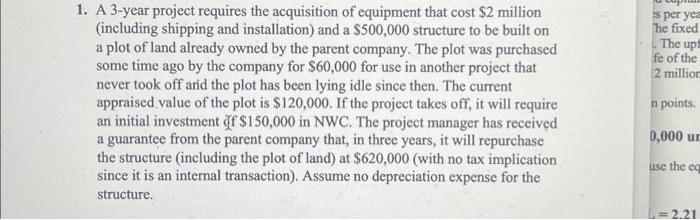

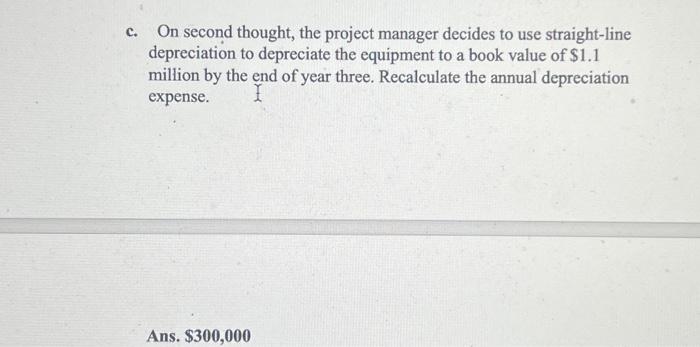

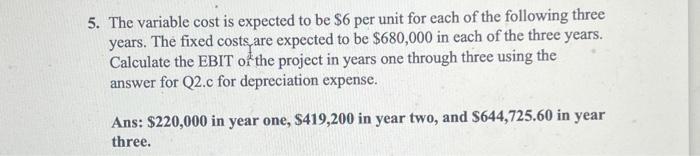

1. A 3-year project requires the acquisition of equipment that cost $2 million (including shipping and installation) and a $500,000 structure to be built on a plot of land already owned by the parent company. The plot was purchased some time ago by the company for $60,000 for use in another project that never took off arid the plot has been lying idle since then. The current appraised value of the plot is $120,000. If the project takes off, it will require an initial investment off $150,000 in NWC. The project manager has received a guarantee from the parent company that, in three years, it will repurchase the structure (including the plot of land) at $620,000 (with no tax implication since it is an internal transaction). Assume no depreciation expense for the structure. c. On second thought, the project manager decides to use straight-line depreciation to depreciate the equipment to a book value of $1.1 million by the end of year three. Recalculate the annual depreciation expense. The variable cost is expected to be $6 per unit for each of the following three years. The fixed costsare expected to be $680,000 in each of the three years. Calculate the EBIT or the project in years one through three using the answer for Q2.c for depreciation expense. Ans: $220,000 in year one, $419,200 in year two, and $644,725.60 in year three

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts