Question: I have the solver for this problem, just not sure how to use it or solve it. 11. In the Markowitz portfolio optimization model defined

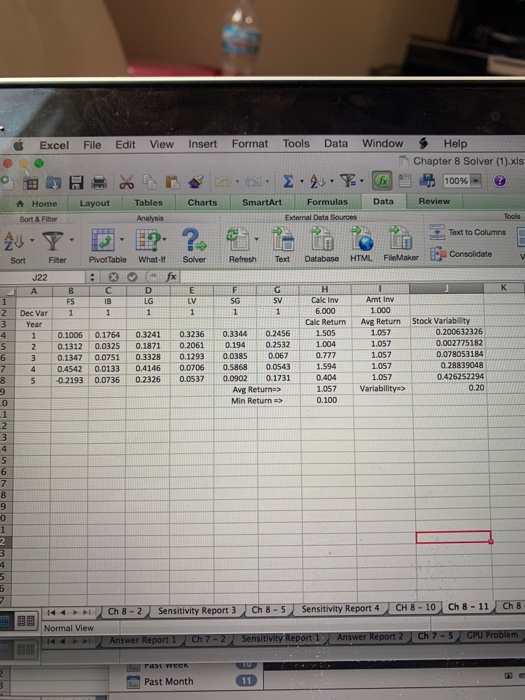

11. In the Markowitz portfolio optimization model defined in equations (8.10) through (8.19), the decision variables represent the percentage of the portfolio invested in each of the mutual funds. For example, FS 0.25 in the solution means that 25% of the money in the portfolio is invested in the foreign stock mutual fund. It is possible to define the deci- sion variables to represent the actual dollar amount invested in each mutual fund or stock. Redefine the decision variables so that now each variable represents the dollar amourt invested in the mutual fund. Assume an investor has $50,000 to invest and wants to mini- mize the variance of his or her portfolio subject to a constraint that the portfolio returns a minimum of 1 0%. definition of the decision variables. Solve the revised model with LINGO or Reformulate the model given by (8.10) through (8.19) based on the new Excel Solver Excel File Edit View Insert Format Tools Data Window Help Chapter 8 Solver (1).xls r .2-.T2. gm 110096@ ).tx Formulas n Home Layout Tables Analysis Charts SmartArt Sort & Fiter Extemal Data Sources Text to Columns Sort Fiter PivotTable What-f Solver Refresh Text Database HTML FileMaker Calc Inv 6.000 Cale Return Amt Inv 1.000 Avg Return 1.057 1.057 1.057 1057 FS LV 2 Dec Var 1 1 Stock Variability Year 10.1006 0.1764 0.3241 0.3236 0.3344 0.2456 2 0.1312 0.0325 0.1871 0.2061 0.1940.2532 0.200632326 0.002775182 0.078053184 6 3 0.1347 0.0751 0.3328 0,1293 0.0385 0670.777 74 0.4542 0.0133 0.41460.0706 0.5868 00543 1594 8 5 0.2193 0.0736 0.2326 0.0537 0.0902 0.1731 0.404 1.057 0.28839048 0.426252294 0.20 Avg Return-> Min Return> 1.057 Variability> 0.100 Ch 8-2 Senstivity Report 3 Ch 8-5 Sensitivity Report4 CH 8-10 Ch 8-11 Ch 8 Normal View Past Month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts