Question: * I have to explain the steps in class. Could you please provide a little detail on how and why you used certain steps a)

* I have to explain the steps in class. Could you please provide a little detail on how and why you used certain steps

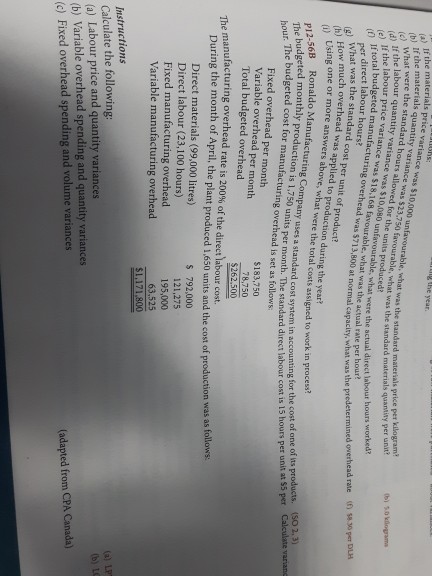

a) If the pric (4) nf the materials quantity v D What were the standard hours aterials price variance was $10,000 was t terials quantity variance was $23,750 favourable, what e the standard hours allowed for the units produce avourable, what was the standard materials price per kilogram? tavourable, what was the standard materials quantity per unit If the labour quantity variance ) the labour price varian If What was the standard cost per unit of product? Using one or more answers above, what were the total costs assigned to work in process was $10,080 unfavour ce was $18,168 favourable, what was the actual rate per hou (t) ner direct labour hours? g) ow much overhead was applied to production during the year? Whatour hoursing overhead wourable,what whst aere the actual direct labour hours worked: at normal capacity, what was the predetermined overhead rate ( s830 per DLH -56B Ronaldo Manufacturing Company uses a standard cost system in accoumtans hudgeted monthly production is 1,750 units per month. The standard direct labour The The budgeted cost for manufacturing overhead is set as follows m in accounting for the cost of one of its products. (S0 2.3) cost is 15 hours per unit at $5 per Calculate variand Fixed overhead per month Variable overhead per month Total budgeted overhead $183,750 manufacturing overhead rate is 200% of the direct!abour cost. During the month of April, the plant produced 1,650 units and the cost of production was as foll Direct materials (99,000 litres) Direct labour (23,100 hours) Fixed manufacturing overhead Variable manufacturing overhead $ 792,000 121,275 195,000 63,525 $1,171,800 Instructions Calculate the following: (a) Labour price and quantity variances b) Variable overhead spending and quantity variances (c) Fixed overhead spending and volume variances (adapted from CPA Canada)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts