Question: I have to get full marks on this math. Requesting to do this math carefully. Thanks in Advance WACC-Book weights and market weights Webster Company

I have to get full marks on this math. Requesting to do this math carefully. Thanks in Advance

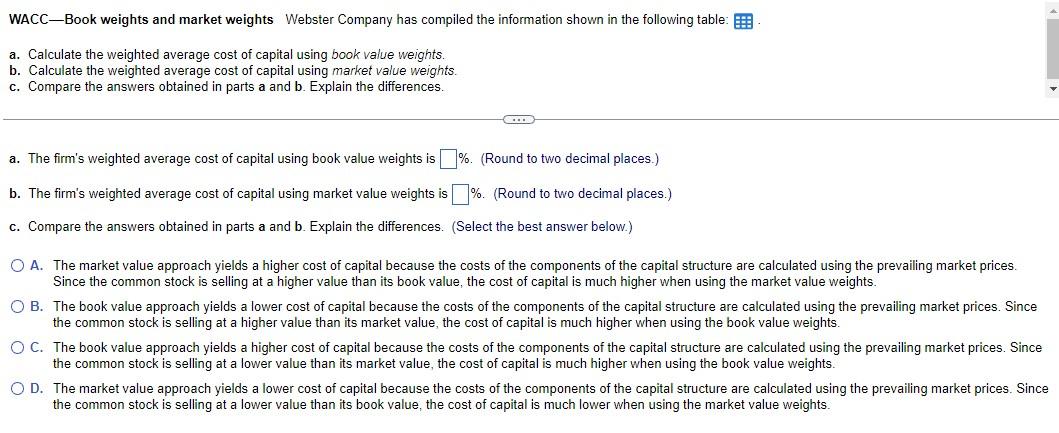

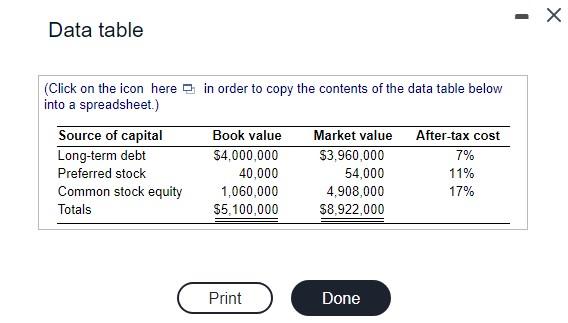

WACC-Book weights and market weights Webster Company has compiled the information shown in the following table: a. Calculate the weighted average cost of capital using book value weights. b. Calculate the weighted average cost of capital using market value weights. c. Compare the answers obtained in parts a and b. Explain the differences. a. The firm's weighted average cost of capital using book value weights is %. (Round to two decimal places.) b. The firm's weighted average cost of capital using market value weights is %. (Round to two decimal places.) c. Compare the answers obtained in parts a and b. Explain the differences. (Select the best answer below.) A. The market value approach yields a higher cost of capital because the costs of the components of the capital structure are calculated using the prevailing market prices. Since the common stock is selling at a higher value than its book value, the cost of capital is much higher when using the market value weights. B. The book value approach yields a lower cost of capital because the costs of the components of the capital structure are calculated using the prevailing market prices. Since the common stock is selling at a higher value than its market value, the cost of capital is much higher when using the book value weights. C. The book value approach yields a higher cost of capital because the costs of the components of the capital structure are calculated using the prevailing market prices. Since the common stock is selling at a lower value than its market value, the cost of capital is much higher when using the book value weights. D. The market value approach yields a lower cost of capital because the costs of the components of the capital structure are calculated using the prevailing market prices. Since the common stock is selling at a lower value than its book value, the cost of capital is much lower when using the market value weights. Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts