Question: i have to send the case study in pcitures due to the ref not workinh snd having to pay to read it Task Using a

i have to send the case study in pcitures due to the ref not workinh snd having to pay to read it

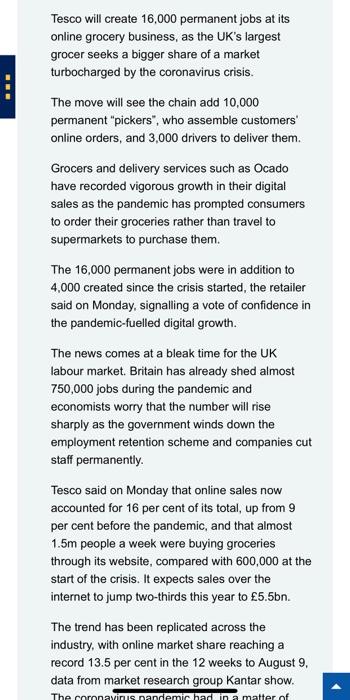

Task Using a SWOT analysis, critically examine the internal and external environment of Tesco, a multinational groceries and general merchandise supermarket chain based in the UK, as described in the case study. Finish your analysis by providing recommendations to Tesco about the important issues it needs to address and the actions it needs to take for business success. This part of the TMA is intended to assess your ability to analyse a business case study by applying the SWOT framework. You are also required to demonstrate how you have applied your tutor's feedback on TMA 01 to this second assignment. Part 1 of your assignment should be 900 words in length and you should keep to within 10 per cent above or below this limit. Any figures or diagrams should be included in the body of the main text and will form part of the total word count. However, the reference list does not contribute to the word limit. Case study: Tesco Article 1 Tesco to create 16,000 permanent jobs to bolster online business UK supermarket chain expects internet sales to rise two-thirds this year to 5.5bn. Tesco says online sales now account for 16 per cent of its total, up from 9 per cent before the pandemic. Plea! follow one- systen Tesco will create 16,000 permanent jobs at its online grocery business, as the UK's largest grocer seeks a bigger share of a market turbocharged by the coronavirus crisis. The move will see the chain add 10,000 permanent "pickers", who assemble customers online orders, and 3,000 drivers to deliver them. Grocers and delivery services such as Ocado have recorded vigorous growth in their digital sales as the pandemic has prompted consumers to order their groceries rather than travel to supermarkets to purchase them. The 16,000 permanent jobs were in addition to 4,000 created since the crisis started, the retailer said on Monday, signalling a vote of confidence in the nondomin fillod dicitalarth Tesco will create 16,000 permanent jobs at its online grocery business, as the UK's largest grocer seeks a bigger share of a market turbocharged by the coronavirus crisis. The move will see the chain add 10,000 permanent "pickers", who assemble customers' online orders, and 3,000 drivers to deliver them. Grocers and delivery services such as Ocado have recorded vigorous growth in their digital sales as the pandemic has prompted consumers to order their groceries rather than travel to supermarkets to purchase them. The 16,000 permanent jobs were in addition to 4,000 created since the crisis started, the retailer said on Monday, signalling a vote of confidence in the pandemic-fuelled digital growth. The news comes at a bleak time for the UK labour market. Britain has already shed almost 750,000 jobs during the pandemic and economists worry that the number will rise sharply as the government winds down the employment retention scheme and companies cut staff permanently. Tesco said on Monday that online sales now accounted for 16 per cent of its total, up from 9 per cent before the pandemic, and that almost 1.5m people a week were buying groceries through its website, compared with 600,000 at the start of the crisis. It expects sales over the internet to jump two-thirds this year to 5.5bn. The trend has been replicated across the industry, with online market share reaching a record 13.5 per cent in the 12 weeks to August 9, data from market research group Kantar show. The coronavirus pandemir had in a matter of The trend has been replicated across the industry, with online market share reaching a record 13.5 per cent in the 12 weeks to August 9, data from market research group Kantar show. The coronavirus pandemic had, in a matter of months, propelled online market share gains that previously would have taken years to achieve, said Clive Black, analyst at Shore Capital. "It feels pretty permanent this change; a lot of people such as the elderly who had shunned digitisation have now become internet shoppers and won't go back to stores," he added. But online shopping is not without its challenges. Supermarkets have struggled to profit from the boom in demand for home deliveries, with both Tesco and rival J Sainsbury having said they expect to make the same profits this year despite a huge transfer of food consumption from restaurants and bars. The cost of picking orders for customers, coupled with offers of free delivery to lure new shoppers, has long dragged down profit margins for online deliveries. But with supermarkets now operating online channels at full capacity there is no longer any need for aggressive promotions. Mr Black said the larger number of home deliveries also meant vans did not have to travel as far to empty their loads. "A marginally lossmaking business is becoming marginally profitable," he added. Dave Lewis, the outgoing chief executive of Tesco, has previously said that the chain's large number of stores means it is close to many customers, allowing it to scale up deliveries without heavy capital expenditure. During a call with analysts in June, Mr Lewis said the online business "might be margin dilutive, but it is not akthe company decaying ow has long dragged down profit margins for online deliveries. But with supermarkets now operating online channels at full capacity there is no longer any need for aggressive promotions. Mr Black said the larger number of home deliveries also meant vans did not have to travel as far to empty their loads. "A marginally lossmaking business is becoming marginally profitable," he added. Dave Lewis, the outgoing chief executive of Tesco, has previously said that the chain's large number of stores means it is close to many customers, allowing it to scale up deliveries without heavy capital expenditure. During a call with analysts in June, Mr Lewis said the online business "might be margin dilutive, but it is not decaying overall profit", adding that the company had worked very hard over the last five years to make it a positive contribution". Tesco, the biggest UK supermarket by market share, on Monday said it expected the majority" of the new permanent positions to be filled by temporary employees who had joined since the Covid-19 crisis began. In order to meet high demand and cover the absence of vulnerable employees, the company had by June hired 47,000 temporary workers. "These new roles will help us continue to meet online demand for the long term," said Jason Tarry, chief executive of Tesco's UK business. Tesco, which employs 320,000 people in the UK and Ireland, said in June that it faced rising costs to adapt its business to endure the Covid-19 crisis, including spending to increase its online capacity. Its shares, little changed on Monday, have fallen 10.5 per cent this year, less than the almost 19 per cent fall for the benchmark FTSE 100 index

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock