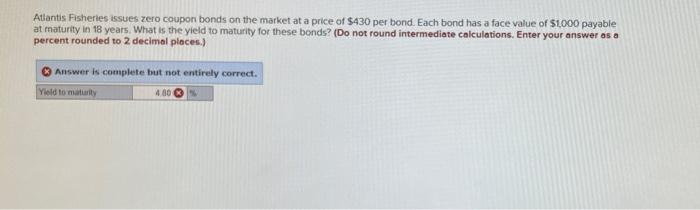

Question: i have worked this problem several times and keep getting this answer but its wrong. what am i doing that wrong? Atlantis Fisheries issues zero

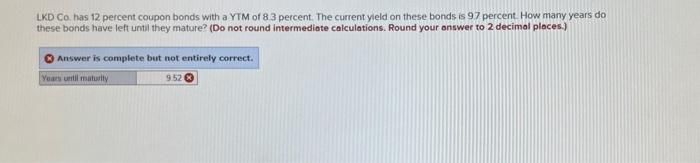

Atlantis Fisheries issues zero coupon bonds on the market at a price of $430 per bond. Each bond has a face value of $1,000 payable at maturity in 18 years. What is the yield to maturity for these bonds? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal ploces.) LKD Co. has 12 percent coupon bonds with a YTM of 83 percent. The current yield on these bonds is 97 percent. How many years do these bonds have left until they mature? (Do not round intermediote calculations. Round your answer to 2 decimal ploces.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts