I have YATES CONTROL SYSTEMS and I need 4 good assumption and 4 bad assumption

?

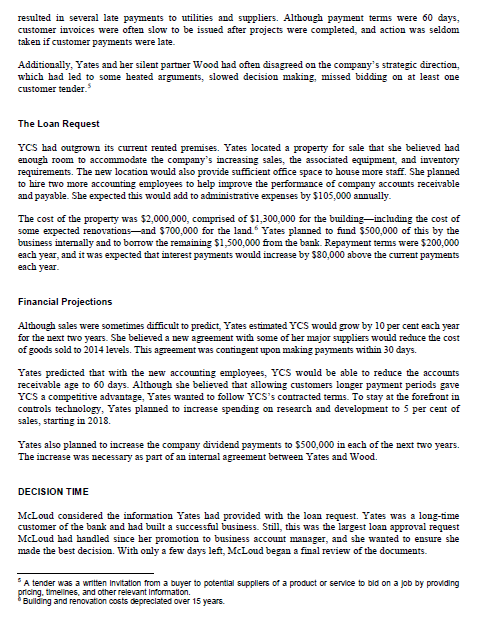

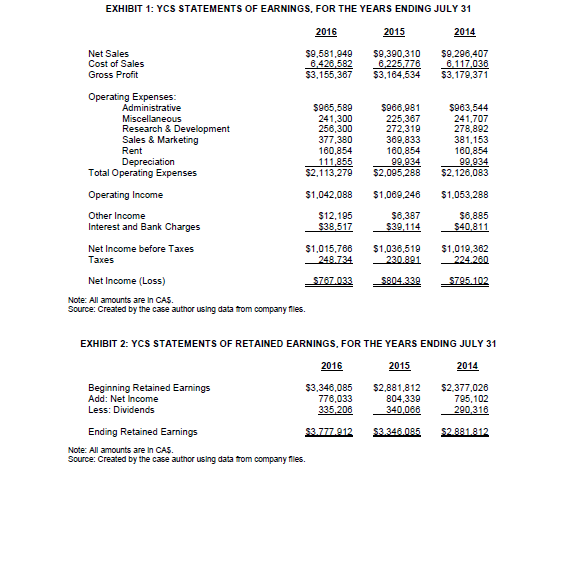

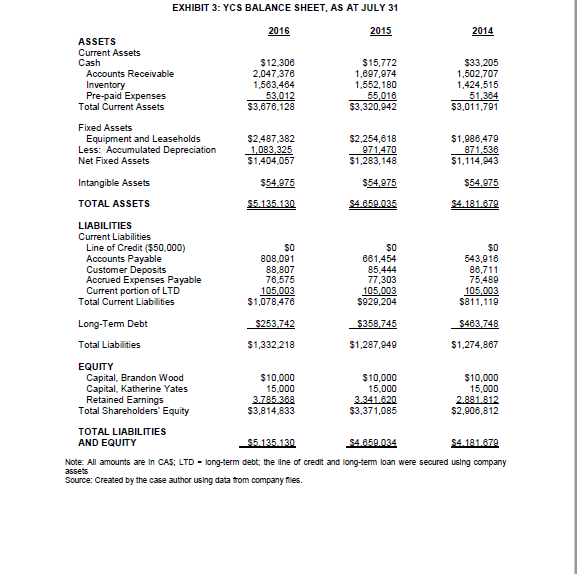

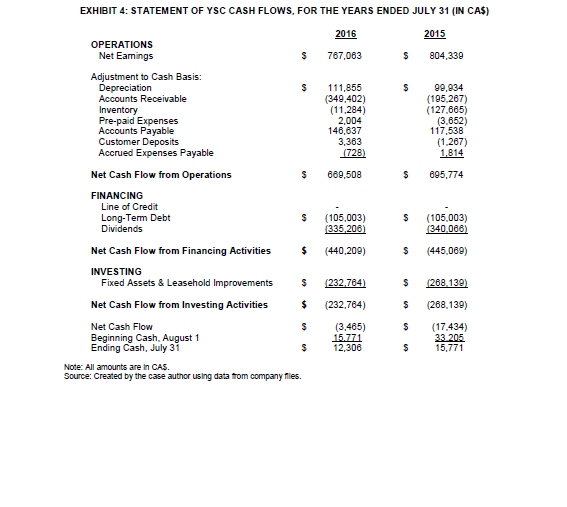

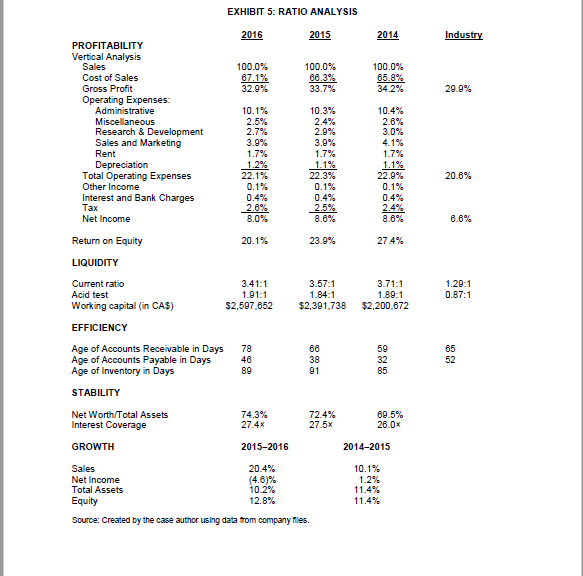

YATES CONTROL SYSTEMS: WILL THE BANK MAKE THE LOAN? David House wrote this case solely to provide material for class discussion. The author does not Intend to Mustrate ether effective or Ineffective handing of a managerial situation. The author may have disguised certain names and other Identifying Information to protect confidentiality This publication may not be transmitted, photocopiled, digitized or otherwise reproduced In any form or by any means without the permission of the copyright holder. Reproduction of this material Is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact ley Publishing, Ivey Business School, Westem University, London, Ontario, Canada, NOG ON1; (1) 510.601.3208; fe) casesgivey.ca; www.freycases.com. Copyright @ 2018, Ivey Business School Foundation Version: 2010-05-02 In early April 2017, Emily McLoud, the newly-appointed business account manager at the Confederation Bank of Canada's branch in London, Ontario, was reviewing her most recent loan request. Katherine Yates, president of Yates Control Systems (YCS), an engineering company focused on providing automation solutions for manufacturing companies, had requested a CA$1,500,000' loan to fund the purchase of a new facility as part of a strategic expansion plan. Yates had been a client of the bank for many years and was expecting a decision to be made about the loan within the next few days; otherwise, YCS's expansion could be delayed. However, granting the loan would have to be financially feasible for the bank. McLoud noted that YCS had a line of credit of $50,000 from the bank that had not been used in several years. She would need to ensure this credit limit would still be sufficient. THE INDUSTRY Control systems engineering was an area of technology typically studied in electrical engineering. It used various sensors to measure outputs and provided feedback by applying mathematical models to control a range of devices. Control systems were used virtually everywhere in the modern world, including in in- home heating and air conditioning, car engines, factory automation, and nuclear power plants. The worldwide control systems market had been growing at a rate of 3.9 per cent, with total revenues anticipated to be US$27 billion by 2019.'The industry consisted of many large and small players that often focused on a specific application where they had developed expertise. Some of the larger companies in the industry included ABB, Emerson Electric Co., Honeywell International Inc., and Siemens AG. The Canadian economy as a whole was expected to grow by less than 3 per cent in 2016 and 2017. Manufacturing was enjoying increased demand from the United States due to a relatively low Canadian dollar. There was some uncertainty in future growth due to low oil prices and a plan by Canada's largest trading partner, the United States, to renegotiate the North American Free Trade Agreement. The United States" plan to exit international environmental agreements also created future uncertainty for the Canadian economy- "All currency amounts are In CAS unless spectfled otherwise, CA$1 - US50.7515 on April 1, 2017. "Research and Markets: Global Control Systems Industry Gulde 2014," Investment Weekly News, December 20, 2014.COMPANY BACKGROUND Yates Control Systems Yates graduated in 1998 from McMaster University in Hamilton, Ontario with a degree in electrical engineering. After graduation, Yates began working for RWC Solutions, a small engineering company in St. Catharines, Ontario that designed, installed, and serviced automation for small and medium-sized manufacturing companies. She found the work hectic but enjoyed working with the various customers and being involved in a wide variety of projects. It was an excellent learning experience. After four years, Yates had gained enough experience to obtain a licence to practise professional engineering, which allowed her to do engineering work without supervision. Soon after receiving her licence, Yates began to think about starting her own business. With financial help from her family and an equity investment from Brandon Wood, a friend from university, she launched YCS in Mississauga, Ontario. The company focused on providing control systems and automation for manufacturing companies. The first few years of the business were tough. Yates had ethical concerns about pursuing the clients she had worked with at RWC Solutions and found that obtaining new clients was more difficult than she had anticipated. At the outset, Yates and one technician were the only employees of YCS. In 2012, the company received a loan of $750,000 from the Confederation Bank of Canada to purchase additional equipment." By 2016, the business had grown to 45 employees and had almost $10 million in annual sales. See Exhibits 1 to 5 for historical financial statements. As the business grew, Yates found it difficult to recruit experienced employees and decided it was more financially viable to hire recent university engineering graduates because of their lower salary expectations. As a result, many of the employees at YCS had been with the company their entire careers. They were young, energetic, and creative. The company worked only one shift, but overtime was often expected to ensure projects were completed on time. The company's marketing was based on direct sales, and during the early years of the company, Yates did all sales in addition to engineering work. As YCS's customer base grew and more engineers were hired, Yates found herself almost exclusively involved in the marketing portion of the business. Over the years, YCS had developed a reputation for excellent quality and outstanding service, which created positive word of mouth. As a result, sales had grown significantly. YOS's customers were typically located in the Greater Toronto Area and in the cities of Kitchener- Waterloo, Cambridge, and Guelph in Southwestern Ontario. Most were manufacturers looking to improve efficiency through automation and better control of their processes. Typically, several engineering controls companies bid on the work. To get their business, YCS needed to provide competitive pricing and above average, ongoing service. Current Situation With its focus on continuous improvement in engineered systems, YCS had been successful at providing clients with technical solutions. Yates reflected that things had not always gome as well administratively. A lack of focus in business systems had led to disorganized accounting systems, which in turn had In addition to an engineering licence, a Certificate of Authorization from Professional Engineers Ontario was required for a business to offer engineering services to the public. This loan was secured against company assets.resulted in several late payments to utilities and suppliers. Although payment terms were 60 days, customer invoices were often slow to be issued after projects were completed, and action was seldom taken if customer payments were late. Additionally, Yates and her silent partner Wood had often disagreed on the company's strategic direction, which had led to some heated arguments, slowed decision making, missed bidding on at least one customer tender." The Loan Request YCS had outgrown its current rented premises. Yates located a property for sale that she believed had enough room to accommodate the company's increasing sales, the associated equipment, and inventory requirements. The new location would also provide sufficient office space to house more staff. She planned to hire two more accounting employees to help improve the performance of company accounts receivable and payable. She expected this would add to administrative expenses by $105,000 annually. The cost of the property was $2,000,000, comprised of $1,300,000 for the building-including the cost of some expected renovations-and $700,000 for the land * Yates planned to fund $500,000 of this by the business internally and to borrow the remaining $1,500,000 from the bank. Repayment terms were $200,000 each year, and it was expected that interest payments would increase by $80,000 above the current payments each year. Financial Projections Although sales were sometimes difficult to predict, Yates estimated YCS would grow by 10 per cent each year for the next two years. She believed a new agreement with some of her major suppliers would reduce the cost of goods sold to 2014 levels. This agreement was contingent upon making payments within 30 days. Yates predicted that with the new accounting employees, YCS would be able to reduce the accounts receivable age to 60 days. Although she believed that allowing customers longer payment periods gave YCS a competitive advantage, Yates wanted to follow YCS's contracted terms. To stay at the forefront in controls technology, Yates planned to increase spending on research and development to 5 per cent of sales, starting in 2018. Yates also planned to increase the company dividend payments to $500,000 in each of the next two years. The increase was necessary as part of an internal agreement between Yates and Wood. DECISION TIME McLoud considered the information Yates had provided with the loan request. Yates was a long-time customer of the bank and had built a successful business. Still, this was the largest loan approval request McLoud had handled since her promotion to business account manager, and she wanted to ensure she made the best decision. With only a few days left, McLoud began a final review of the documents. A tender was a written Invitation from a buyer to potential suppliers of a product or service to bid on a job by providing pricing, timelines, and other relevant Information. "Building and renovation costs depreciated over 15 years.EXHIBIT 1: YCS STATEMENTS OF EARNINGS, FOR THE YEARS ENDING JULY 31 2016 2015 2014 Net Sales $9.581,040 59,390,310 39 296,407 Cost of Sales 6,428,582 8,225,776 8.117,036 Gross Profit $3,155,367 $3.184,534 $3.179,371 Operating Expenses: Administrative 5965,580 5086,981 $063,544 Miscellaneous 241,300 225,367 241,707 Research & Development 256,300 272,319 278,802 Sales & Marketing 377,380 380,833 381.153 Rent 180,854 180,854 180,854 Depreciation 111,855 90,934 90.934 Total Operating Expenses $2.113,279 $2,095,288 $2.126,083 Operating Income $1,042,088 $1,080,246 $1.053,288 Other Income $12.105 $6,387 $6,885 Interest and Bank Charges 538,517 530,114 $40,811 Net Income before Taxes $1,015,766 $1,036,519 $1,018,362 Taxes 248.734 230.801 224.280 Net Income (Loss) 5767.033 $804 330 5795.102 Note: All amounts are In CAS. Source: Created by the case author using data from company files. EXHIBIT 2: YCS STATEMENTS OF RETAINED EARNINGS, FOR THE YEARS ENDING JULY 31 2016 2015 2014 Beginning Retained Earnings $3.346,085 52,881,812 $2.377.026 Add: Net Income 776,033 804,330 785,102 Less: Dividends 335,206 340,066 290,316 Ending Retained Earnings 53.777.812 53.348.085 $2 881.812 Note: All amounts are In CAS. Source: Created by the case author using data from company files.EXHIBIT 3: YCS BALANCE SHEET, AS AT JULY 31 2016 2015 2014 ASSETS Current Assets Cash $12.306 $15,772 533,205 Accounts Receivable 2,047.378 1,807,074 1,502,707 Inventory 1,563,464 1,552,180 1.424,515 Pre-paid Expenses 53,012 55,016 51,364 Total Current Assets $3,676.128 $3,320,042 $3,011,791 Fixed Assets Equipment and Leaseholds $2,487.382 $2.254,618 $1,986,479 Less: Accumulated Depreciation 1,083,325 971.470 871,536 Net Fixed Assets $1,404.057 $1,283,148 $1,114,043 Intangible Assets $54.075 $54.075 $54,075 TOTAL ASSETS $5.135 130 $4.850.035 54.181.678 LIABILITIES Current Liabilities Line of Credit ($50,000) 50 50 $0 Accounts Payable 808,001 861,454 543,916 Customer Deposits 88,807 85 444 86,711 Accrued Expenses Payable 76.575 77,303 75,480 Current portion of LTD 105,003 105,003 105,003 Total Current Liabilities $1.078.476 5920,204 5811,119 Long-Term Debt $253.742 $358,745 $483,748 Total Liabilities $1,332.218 $1,287,049 $1,274,867 EQUITY Capital, Brandon Wood $10,000 $10,000 $10,000 Capital, Katherine Yates 15.000 15.000 15,000 Retained Earnings 3.785.368 3.341.620 2.881.812 Total Shareholders' Equity $3.814.833 $3,371,085 $2,906,812 TOTAL LIABILITIES AND EQUITY $5.135 130 $4.850.034 54.181.678 Note: All amounts are In CAS; LTD - long-term debt; the line of credit and long-term loan were secured using company asGets Source: Created by the case author using data from company files.EXHIBIT 4: STATEMENT OF YSC CASH FLOWS, FOR THE YEARS ENDED JULY 31 (IN CA$) 2016 2015 OPERATIONS Net Earnings 767.063 S 804,330 Adjustment to Cash Basis: Depreciation 111,855 90.034 Accounts Receivable (349,402) (185.267) Inventory (11,284) (127.685) Pre-paid Expenses 2,004 (3.652] Accounts Payable 146,637 117,538 Customer Deposits 3,363 (1.267) Accrued Expenses Payable (728) 1,814 Net Cash Flow from Operations 860,508 895,774 FINANCING Line of Credit Long-Term Debt S (105,003) S (105 003) Dividends (335,2061 (340.086) Net Cash Flow from Financing Activities $ (440,209) S (445,069) INVESTING Fixed Assets & Leasehold Improvements S 232.7841 S (268 132) Net Cash Flow from Investing Activities (232.784) (268.130) Net Cash Flow (3,485) (17.434) Beginning Cash, August 1 15.771 33 205 Ending Cash, July 31 12,306 15,771 Note: All amounts are In CAS. Source: Created by the case author using data from company files.EXHIBIT 5: RATIO ANALYSIS 2016 2015 2014 Industry PROFITABILITY Vertical Analysis Sales 100.0% 100.0% 100.0% Cost of Sales 87.1% 68.3% 65.8% Gross Profit 32.9% 33.7% 34.2% 29.0% Operating Expenses: Administrative 10.1% 10.3% 10.4% Miscellaneous 2.5% 2.4% 2.6% Research & Development 2.7% 2.0% 3.0% Sales and Marketing 3.9% 3.0% 4.1% Rent 1.7% 1.7% 1.7% Depreciation 1.2% 1.1% 1.1% Total Operating Expenses 22.1% 22.3% 22.0% 20.6% Other Income 0.1% 0.1% 0.1% Interest and Bank Charges 0.4% 0.4% 0.4% Tax 2.0% 2.5% 2.4% Net Income 8.0% 8.8% 8.6% 6.6% Return on Equity 20.1% 23.9% 27 4% LIQUIDITY Current ratio 3.41:1 3.57:1 3.71:1 1.20:1 Acid test 1.91:1 1.84:1 1 80-1 D.87:1 Working capital (in CA$) $2,507.652 $2,301.738 $2.200.672 EFFICIENCY Age of Accounts Receivable in Days 78 68 59 65 Age of Accounts Payable in Days 48 38 32 Age of Inventory in Days 89 91 85 STABILITY Net Worth/Total Assets 74.3% 72.4% 60.5% Interest Coverage 27.4x 27.5x 26.0x GROWTH 2015-2016 2014-2015 Sales 20.4% 10.1% Net Income (4.6)% 1.2% Total Assets 10.2% 11.4% Equity 12.8% 11.4% Source: Created by the case author using data from company files