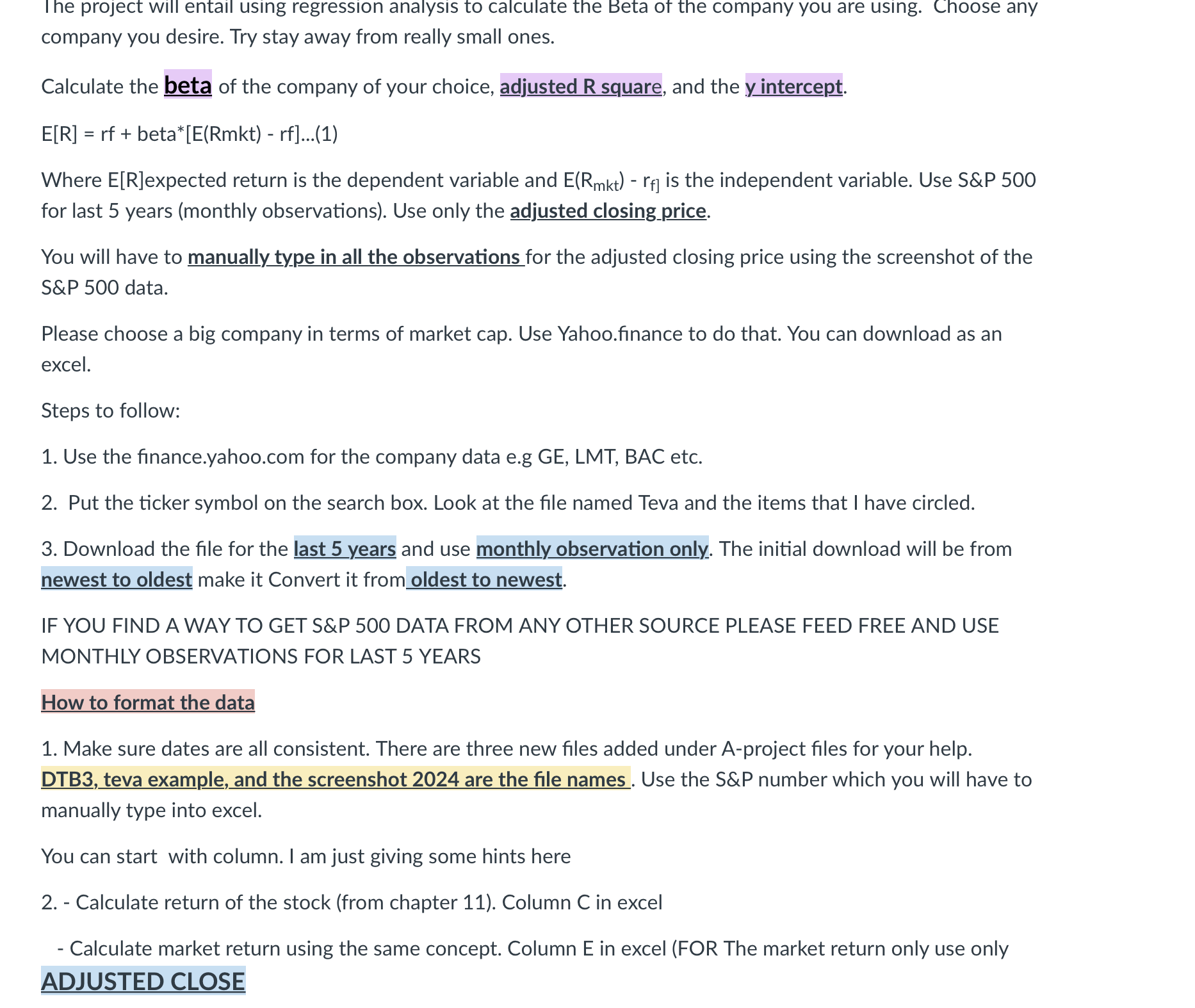

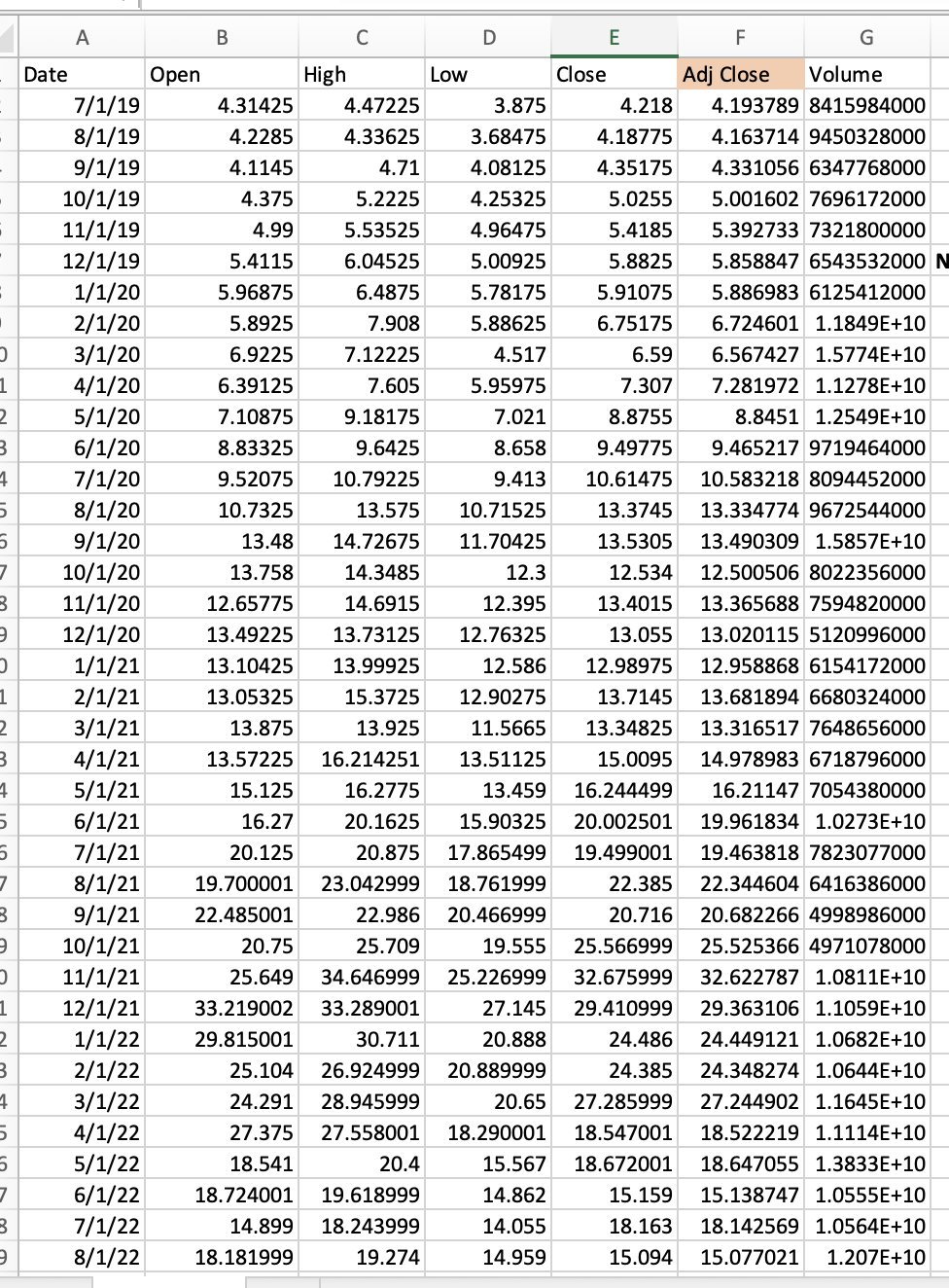

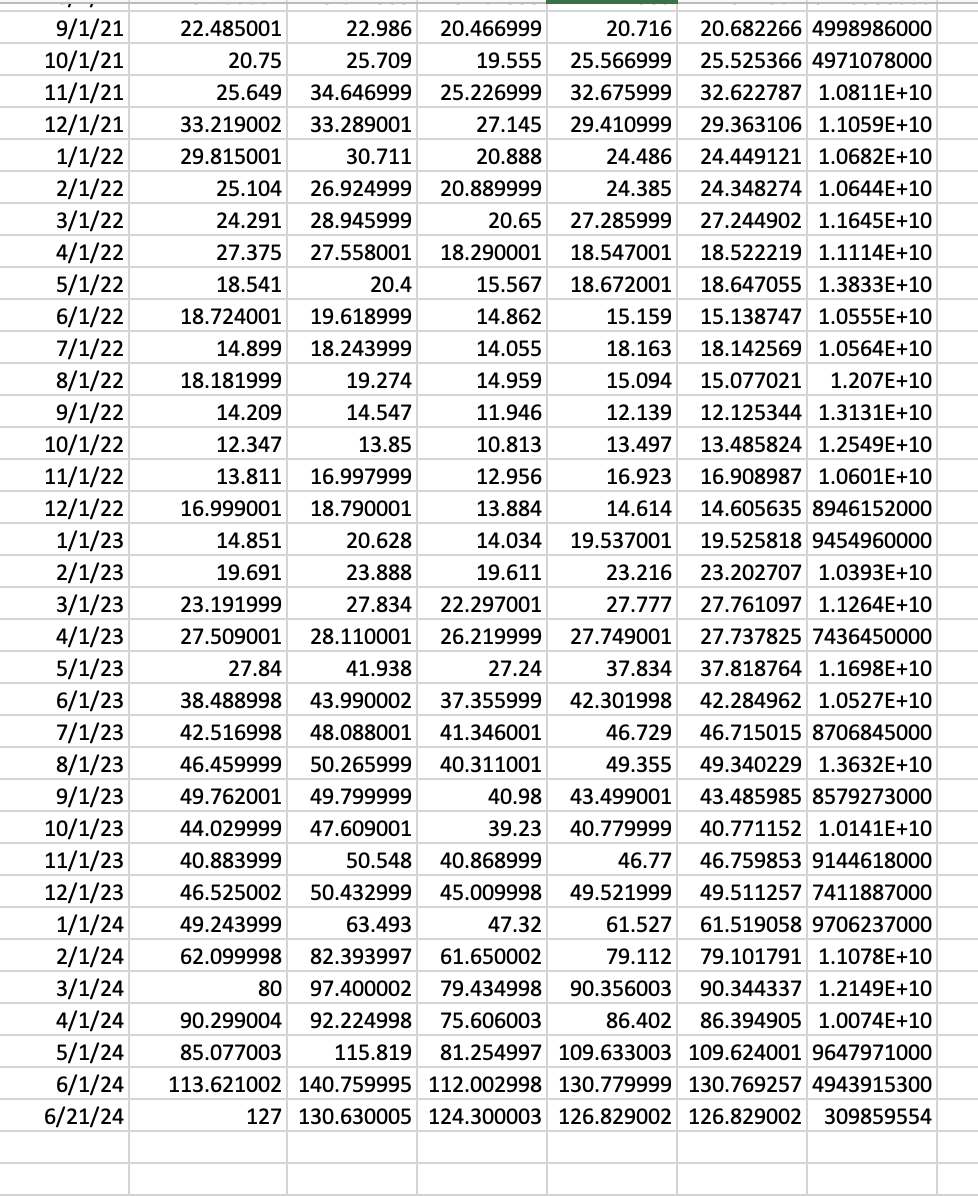

Question: I he project will entail using regression analysis to calculate the Beta of the company you are using. Choose any company you desire. Try stay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts