Question: I highlighted the Requirement. Prepare a cashflow Module Code: LUBS229101 Additional information: . During the year ended 31 December 20X9, a piece of equipment which

I highlighted the Requirement. Prepare a cashflow

I highlighted the Requirement. Prepare a cashflow

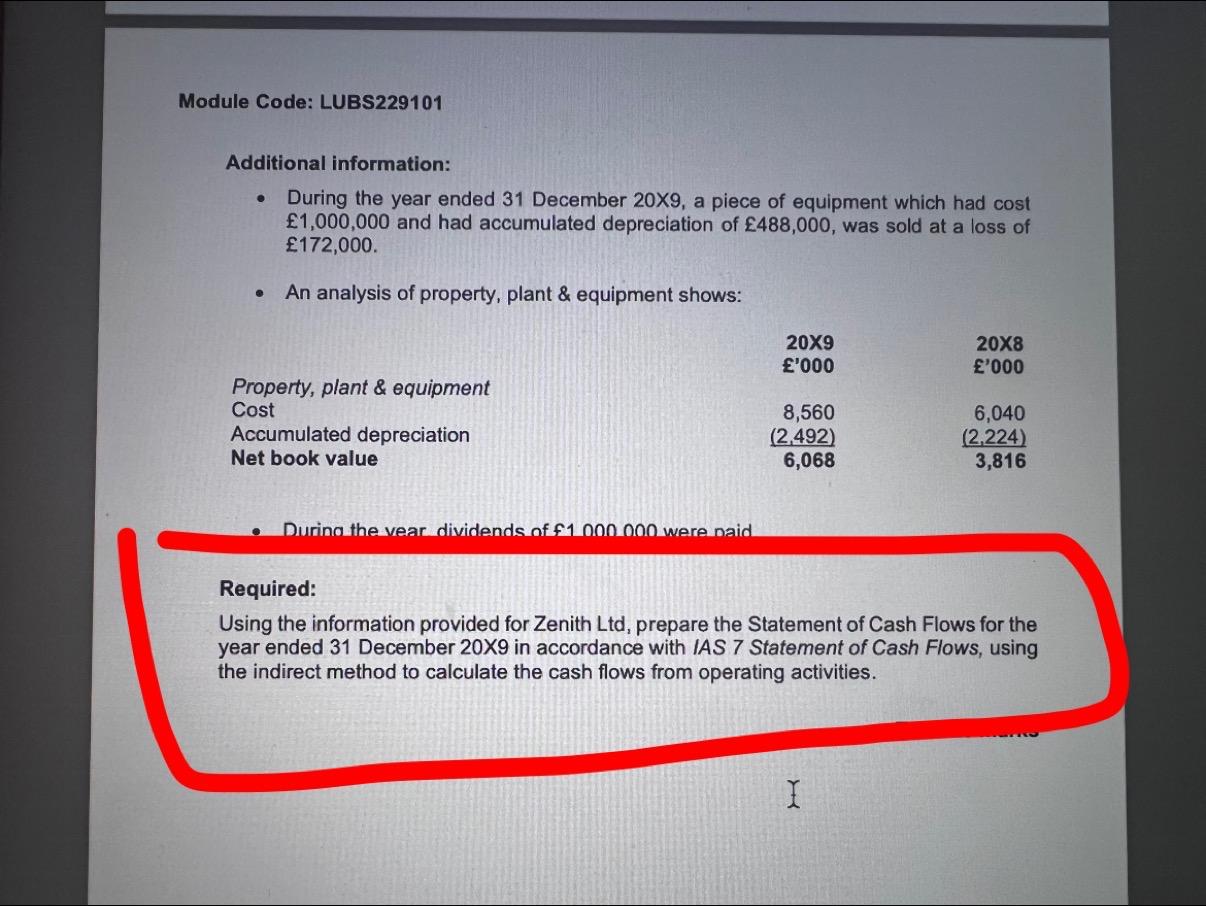

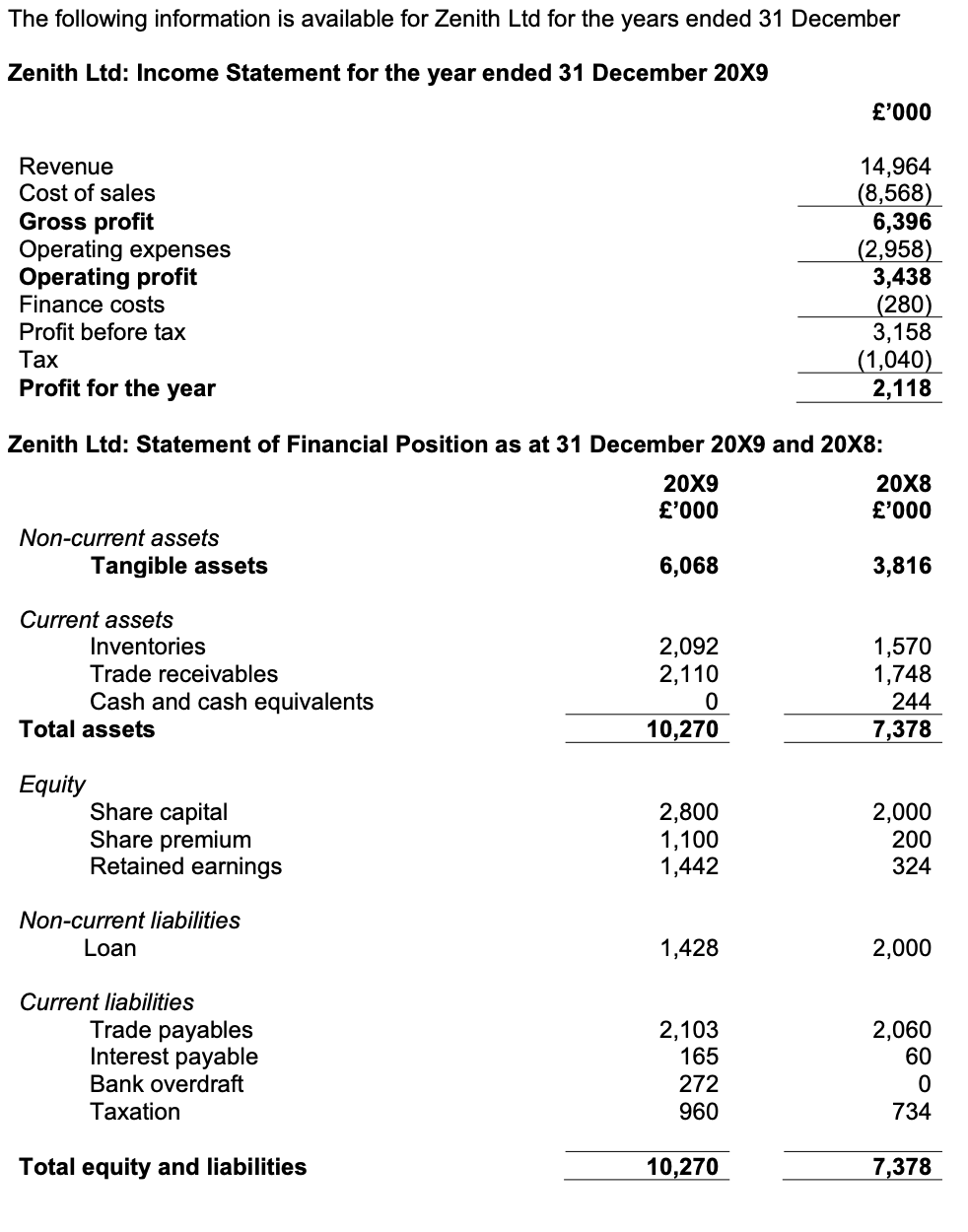

Module Code: LUBS229101 Additional information: . During the year ended 31 December 20X9, a piece of equipment which had cost 1,000,000 and had accumulated depreciation of 488,000, was sold at a loss of 172,000. An analysis of property, plant & equipment shows: 20X9 '000 20X8 '000 Property, plant & equipment Cost Accumulated depreciation Net book value 8,560 (2,492) 6,068 6,040 (2,224) 3,816 During the vean dividends of $1.000 000 were paid Required: Using the information provided for Zenith Ltd, prepare the Statement of Cash Flows for the year ended 31 December 20X9 in accordance with IAS 7 Statement of Cash Flows, using the indirect method to calculate the cash flows from operating activities. I The following information is available for Zenith Ltd for the years ended 31 December Zenith Ltd: Income Statement for the year ended 31 December 20X9 '000 Revenue Cost of sales Gross profit Operating expenses Operating profit Finance costs Profit before tax Tax Profit for the year 14,964 (8,568) 6,396 (2,958) 3,438 (280) 3,158 (1,040) 2,118 Zenith Ltd: Statement of Financial Position as at 31 December 20X9 and 20X8: 20x9 '000 20X8 '000 Non-current assets Tangible assets 6,068 3,816 Current assets Inventories Trade receivables Cash and cash equivalents Total assets 2,092 2,110 0 10,270 1,570 1,748 244 7,378 Equity Share capital Share premium Retained earnings 2,800 1,100 1,442 2,000 200 324 Non-current liabilities Loan 1,428 2,000 Current liabilities Trade payables Interest payable Bank overdraft Taxation 2,103 165 272 2,060 60 0 734 960 Total equity and liabilities 10,270 7,378

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts