Question: I I already have the solution to this problem, but I don't fully understand the answer. For requirement 1, the answer according to my textbook

I

I

I already have the solution to this problem, but I don't fully understand the answer. For requirement 1, the answer according to my textbook is:

Common stock (2 million shares x $1 par) 2 Paid-in capitalexcess of par (2 million shares x $3*) 6 Retained earnings (difference) 2 Cash (2 million shares x $5 per share) 1

Why is the debit to Retained earnings and not to Paid-in capital -- Repurchase shares? How do I know which of those accounts (retained earnings vs. paid-in capital - repurchase shares) I need to use just by looking at the problem?

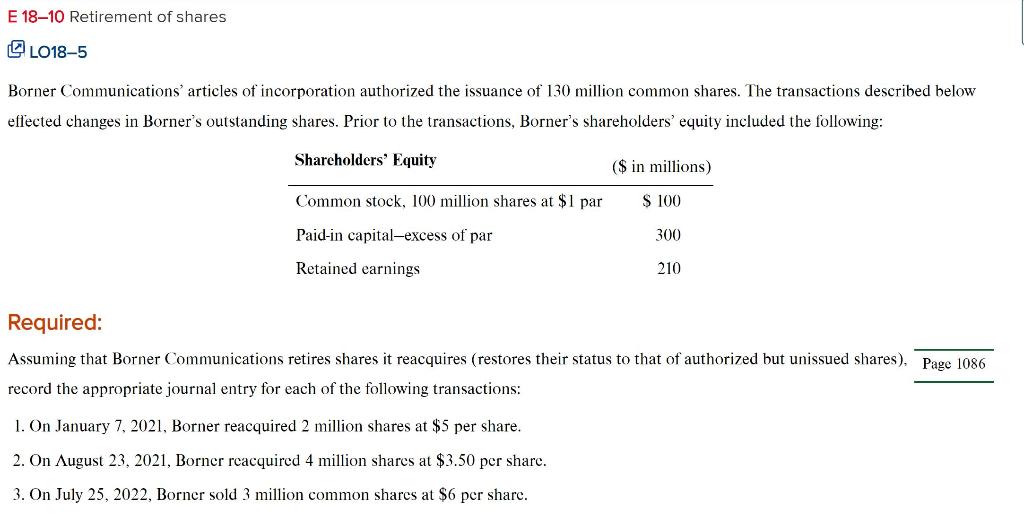

E 18-10 Retirement of shares LO18-5 Borner Communications' articles of incorporation authorized the issuance of 130 million common shares. The transactions described below effected changes in Borner's outstanding shares. Prior to the transactions, Borner's shareholders' equity included the following: Shareholders' Equity ($ in millions) Common stock, 100 million shares at $1 par $ 100 Paid-in capital-excess of par 300 Retained earnings 210 Required: Assuming that Borner Communications retires shares it reacquires (restores their status to that of authorized but unissued shares). Page 1086 record the appropriate journal entry for each of the following transactions: 1. On January 7, 2021, Borner reacquired 2 million shares at $5 per share. 2. On August 23, 2021, Borner reacquired 4 million shares at $3.50 per share. 3. On July 25, 2022, Borner sold 3 million common shares at $6 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts