Question: Please answer all 3 parts - b), c), and d) I missed the additional Information The question has been updated (d) Prepare the consolidated financial

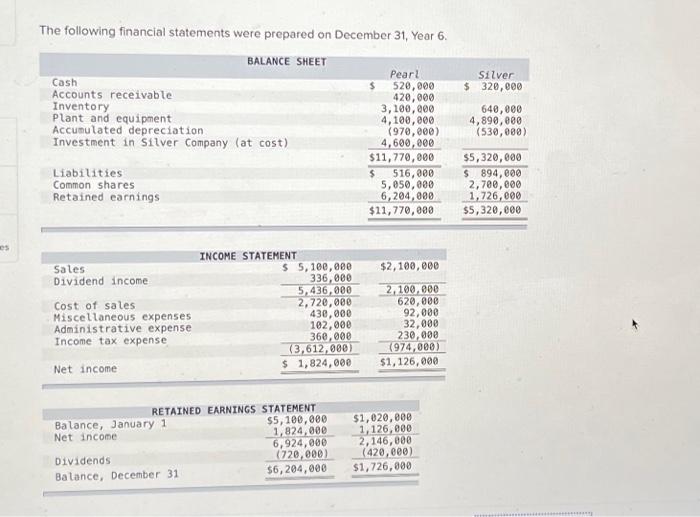

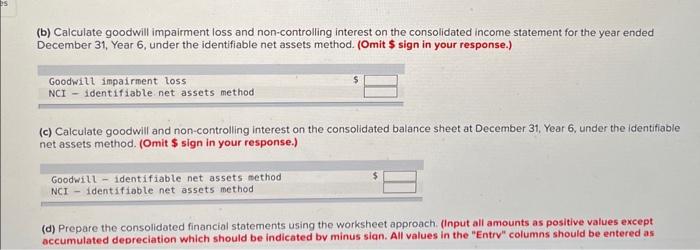

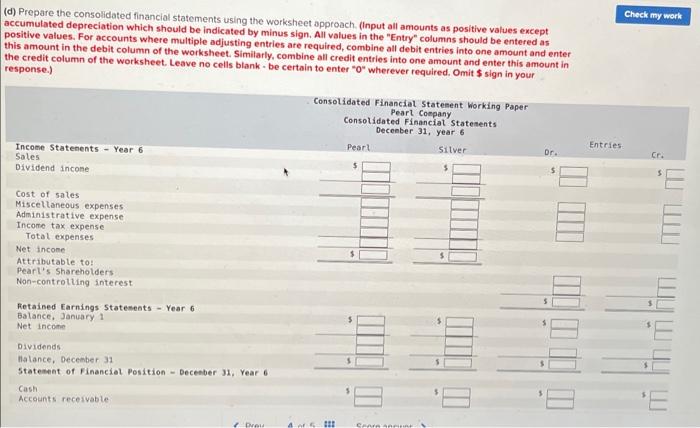

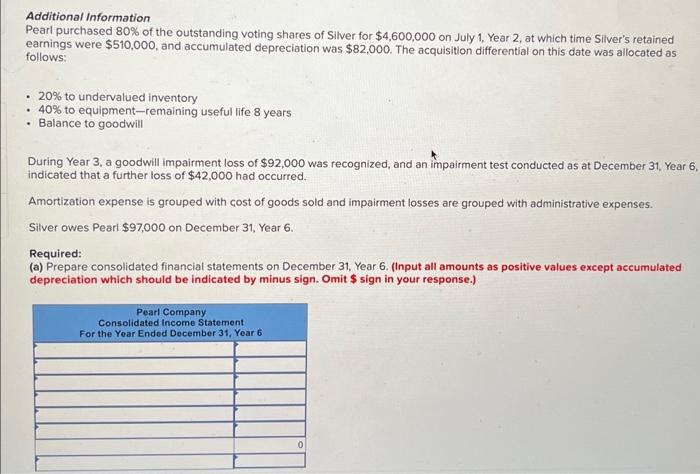

(d) Prepare the consolidated financial statements using the worksheet approach. (Input all amounts as positive values except accumulated depreciation which should be indicated by minus sign. All values in the "Entry" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Leave no cells blank - be certain to enter " 0 " wherever required. Omit $ sign in your response.) (b) Calculate goodwill impairment loss and non-controlling interest on the consolidated income statement for the year ended December 31, Year 6 , under the identifiable net assets method. (Omit \$ sign in your response.) (c) Calculate goodwill and non-controlling interest on the consolidated balance sheet at December 31, Year 6 , under the identifiable net assets method. (Omit \$ sign in your response.) (d) Prepare the consolidated financial statements using the worksheet approach. (Input all amounts as positive values except accumulated depreciation which should be indicated by minus sian. All values in the "Entrv" columns should be entered as The following financial statements were prepared on December 31 , Year 6 . (d) Prepare the consolidated financial statements using the worksheet approach. (Input all amounts as positive values except accumulated depreciation which should be indicated by minus sign. All values in the "Entry" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Leave no cells blank - be certain to enter " 0 " wherever required. Omit $ sign in your response.) (b) Calculate goodwill impairment loss and non-controlling interest on the consolidated income statement for the year ended December 31, Year 6 , under the identifiable net assets method. (Omit \$ sign in your response.) (c) Calculate goodwill and non-controlling interest on the consolidated balance sheet at December 31, Year 6 , under the identifiable net assets method. (Omit \$ sign in your response.) (d) Prepare the consolidated financial statements using the worksheet approach. (Input all amounts as positive values except accumulated depreciation which should be indicated by minus sian. All values in the "Entrv" columns should be entered as The following financial statements were prepared on December 31 , Year 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts