Question: I I cI I cannot find long term debt and Equity. pls help! thank u Please use the following projections for Top-A1 Inc.: Total sales

I

I cI

I cI

I cannot find long term debt and Equity. pls help! thank u

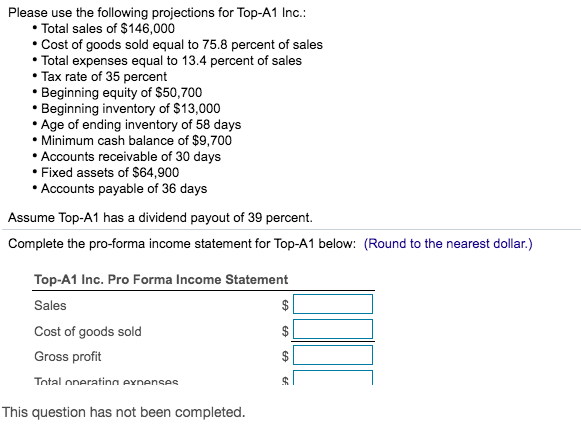

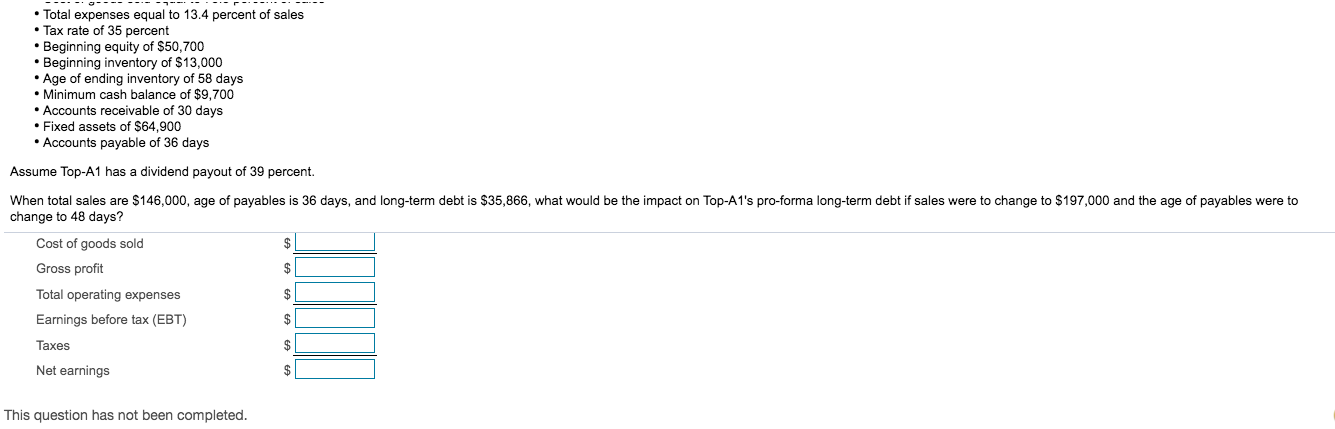

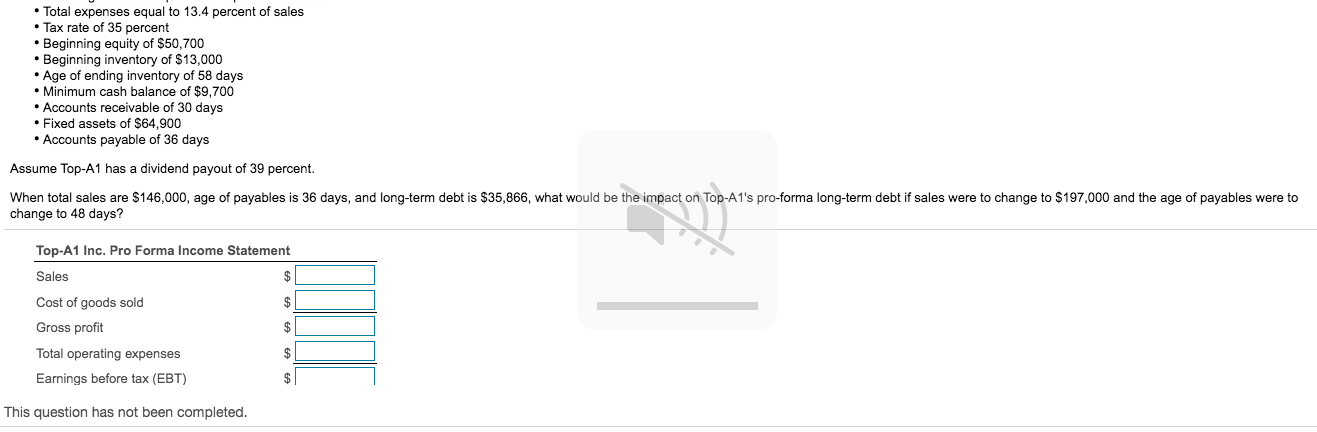

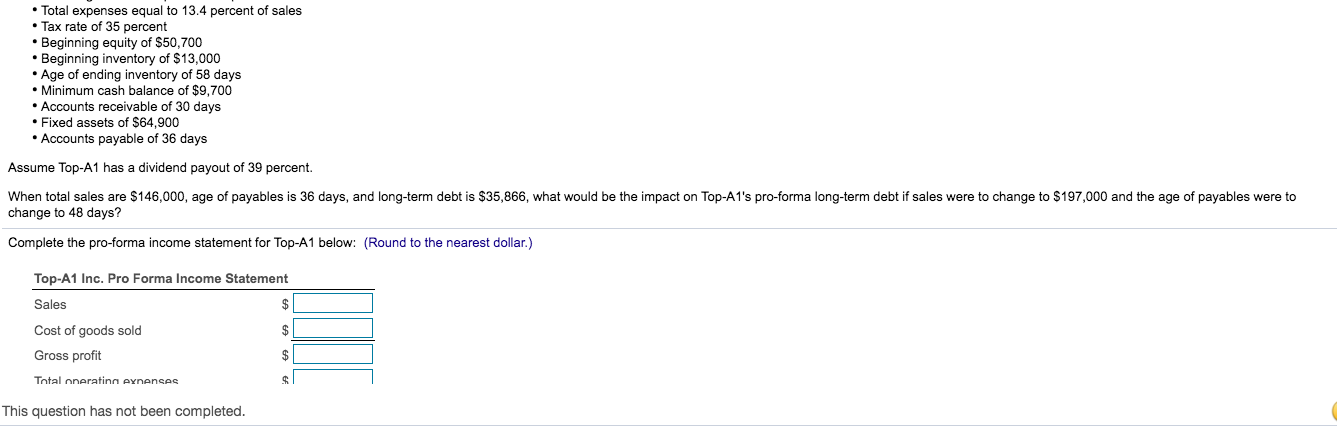

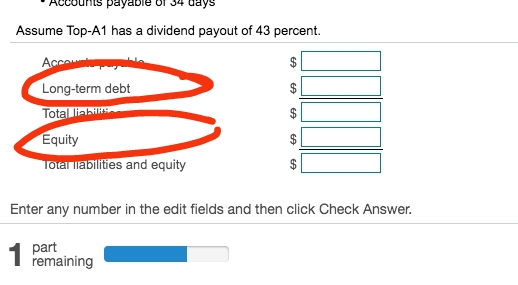

Please use the following projections for Top-A1 Inc.: Total sales of $146,000 Cost of goods sold equal to 75.8 percent of sales Total expenses equal to 13.4 percent of sales Tax rate of 35 percent Beginning equity of $50,700 Beginning inventory of $13,000 Age of ending inventory of 58 days Minimum cash balance of $9,700 Accounts receivable of 30 days Fixed assets of $64,900 Accounts payable of 36 days Assume Top-A1 has a dividend payout of 39 percent. Complete the pro-forma income statement for Top-A1 below: (Round to the nearest dollar.) $ Top-A1 Inc. Pro Forma Income Statement Sales $ Cost of goods sold Gross profit Total oneratinn eynenses This question has not been completed. $ $ Total expenses equal to 13.4 percent of sales Tax rate of 35 percent Beginning equity of $50,700 Beginning inventory of $13,000 Age of ending inventory of 58 days Minimum cash balance of $9,700 Accounts receivable of 30 days Fixed assets of $64,900 Accounts payable of 36 days Assume Top-A1 has a dividend payout of 39 percent. When total sales are $146,000, age of payables is 36 days, and long-term debt is $35,866, what would be the impact on Top-A1's pro-forma long-term debt if sales were to change to $197,000 and the age of payables were to change to 48 days? Cost of goods sold Gross profit $ Total operating expenses $ Earnings before tax (EBT) $ Taxes $ Net earnings $ This question has not been completed. Total expenses equal to 13.4 percent of sales Tax rate of 35 percent Beginning equity of $50,700 Beginning inventory of $13,000 Age of ending inventory of 58 days . Minimum cash balance of $9,700 Accounts receivable of 30 days . Fixed assets of $64,900 Accounts payable of 36 days Assume Top-A1 has a dividend payout of 39 percent. When total sales are $146,000, age of payables is 36 days, and long-term debt is $35,866, what would be the impact on Top-A1's pro-forma long-term debt if sales were to change to $197,000 and the age of payables were to change to 48 days? Top-A1 Inc. Pro Forma Income Statement Sales $ Cost of goods sold Gross profit Total operating expenses Earnings before tax (EBT) TII $ $ $ This question has not been completed. Total expenses equal to 13.4 percent of sales Tax rate of 35 percent Beginning equity of $50,700 Beginning inventory of $13,000 Age of ending inventory of 58 days Minimum cash balance of $9,700 Accounts receivable of 30 days Fixed assets of $64,900 Accounts payable of 36 days Assume Top-A1 has a dividend payout of 39 percent. When total sales are $146,000, age of payables is 36 days, and long-term debt is $35,866, what would be the impact on Top-A1's pro-forma long-term debt if sales were to change to $197,000 and the age of payables were to change to 48 days? Complete the pro-forma income statement for Top-A1 below: (Round to the nearest dollar.) Top-A1 Inc. Pro Forma Income Statement Sales Cost of goods sold Gross profit GA $ Total Oneratin aynensee $ This question has not been completed. payable days Assume Top-A1 has a dividend payout of 43 percent. ACCA $ Long-term debt Totalli Equity Total abilities and equity CA $ Enter any number in the edit fields and then click Check Answer. 1 part remaining Please use the following projections for Top-A1 Inc.: Total sales of $146,000 Cost of goods sold equal to 75.8 percent of sales Total expenses equal to 13.4 percent of sales Tax rate of 35 percent Beginning equity of $50,700 Beginning inventory of $13,000 Age of ending inventory of 58 days Minimum cash balance of $9,700 Accounts receivable of 30 days Fixed assets of $64,900 Accounts payable of 36 days Assume Top-A1 has a dividend payout of 39 percent. Complete the pro-forma income statement for Top-A1 below: (Round to the nearest dollar.) $ Top-A1 Inc. Pro Forma Income Statement Sales $ Cost of goods sold Gross profit Total oneratinn eynenses This question has not been completed. $ $ Total expenses equal to 13.4 percent of sales Tax rate of 35 percent Beginning equity of $50,700 Beginning inventory of $13,000 Age of ending inventory of 58 days Minimum cash balance of $9,700 Accounts receivable of 30 days Fixed assets of $64,900 Accounts payable of 36 days Assume Top-A1 has a dividend payout of 39 percent. When total sales are $146,000, age of payables is 36 days, and long-term debt is $35,866, what would be the impact on Top-A1's pro-forma long-term debt if sales were to change to $197,000 and the age of payables were to change to 48 days? Cost of goods sold Gross profit $ Total operating expenses $ Earnings before tax (EBT) $ Taxes $ Net earnings $ This question has not been completed. Total expenses equal to 13.4 percent of sales Tax rate of 35 percent Beginning equity of $50,700 Beginning inventory of $13,000 Age of ending inventory of 58 days . Minimum cash balance of $9,700 Accounts receivable of 30 days . Fixed assets of $64,900 Accounts payable of 36 days Assume Top-A1 has a dividend payout of 39 percent. When total sales are $146,000, age of payables is 36 days, and long-term debt is $35,866, what would be the impact on Top-A1's pro-forma long-term debt if sales were to change to $197,000 and the age of payables were to change to 48 days? Top-A1 Inc. Pro Forma Income Statement Sales $ Cost of goods sold Gross profit Total operating expenses Earnings before tax (EBT) TII $ $ $ This question has not been completed. Total expenses equal to 13.4 percent of sales Tax rate of 35 percent Beginning equity of $50,700 Beginning inventory of $13,000 Age of ending inventory of 58 days Minimum cash balance of $9,700 Accounts receivable of 30 days Fixed assets of $64,900 Accounts payable of 36 days Assume Top-A1 has a dividend payout of 39 percent. When total sales are $146,000, age of payables is 36 days, and long-term debt is $35,866, what would be the impact on Top-A1's pro-forma long-term debt if sales were to change to $197,000 and the age of payables were to change to 48 days? Complete the pro-forma income statement for Top-A1 below: (Round to the nearest dollar.) Top-A1 Inc. Pro Forma Income Statement Sales Cost of goods sold Gross profit GA $ Total Oneratin aynensee $ This question has not been completed. payable days Assume Top-A1 has a dividend payout of 43 percent. ACCA $ Long-term debt Totalli Equity Total abilities and equity CA $ Enter any number in the edit fields and then click Check Answer. 1 part remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts