Question: i just dont understand question f please explain and answer that one only!! 1 Normal ABDUED AaBbcc AaBbcc AaBbcl AaBbcc No Spact. Heading 1 Heading

i just dont understand question f please explain and answer that one only!!

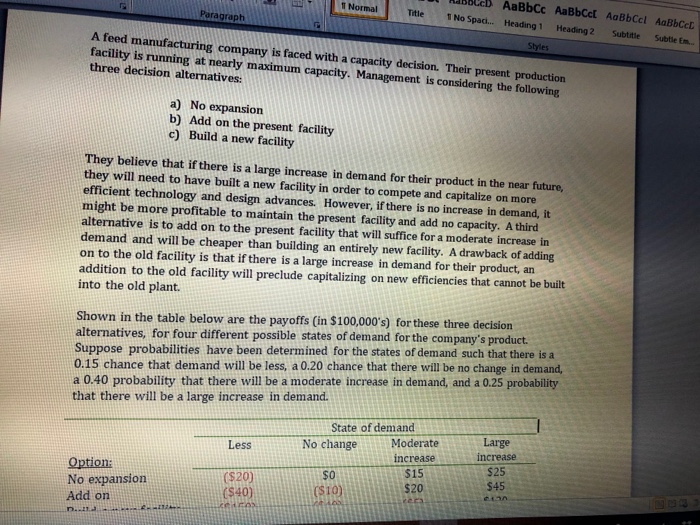

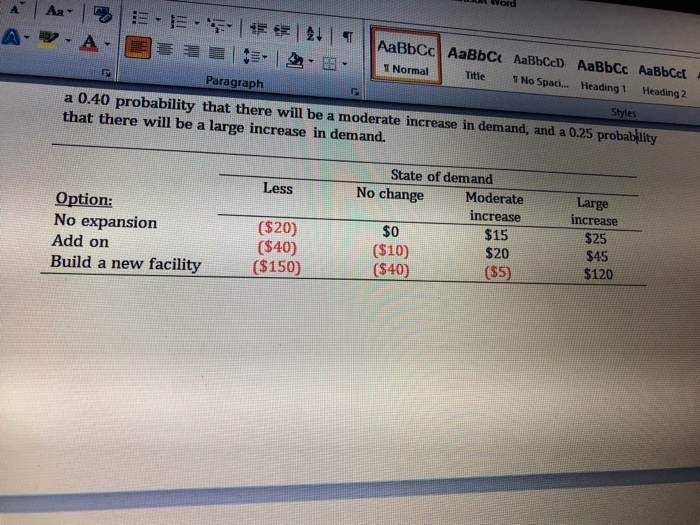

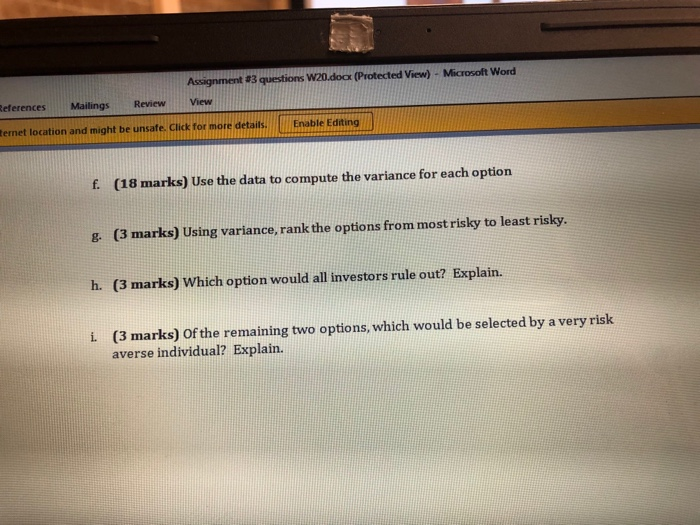

1 Normal ABDUED AaBbcc AaBbcc AaBbcl AaBbcc No Spact. Heading 1 Heading 2 Subtitle Subtle in Paragraph Title A feed manufacturing company is faced with a capacity decision. Their present production facility is running at nearly maximum capacity. Management is considering the following three decision alternatives: Styles a) No expansion b) Add on the present facility c) Build a new facility They believe that if there is a large increase in demand for their product in the near future, they will need to have built a new facility in order to compete and capitalize on more efficient technology and design advances. However, if there is no increase in demand, it might be more profitable to maintain the present facility and add no capacity. A third alternative is to add on to the present facility that will suffice for a moderate increase in demand and will be cheaper than building an entirely new facility. A drawback of adding on to the old facility is that if there is a large increase in demand for their product, an addition to the old facility will preclude capitalizing on new efficiencies that cannot be built into the old plant. Shown in the table below are the payoffs (in $100,000's) for these three decision alternatives, for four different possible states of demand for the company's product. Suppose probabilities have been determined for the states of demand such that there is a 0.15 chance that demand will be less, a 0.20 chance that there will be no change in demand, a 0.40 probability that there will be a moderate increase in demand, and a 0.25 probability that there will be a large increase in demand. Less Large Option: No expansion Add on State of demand No change Moderate increase $15 ($10) ($20) SO increase $25 $45 (540) $20 D.-11. Word A- - | | ! - - - | 24 . et -A- - 1 Normal Title T No Spac... Heading 1 Heading 2 Styles a 0.40 probability that there will be a moderate increase in demand, and a 0.25 probability that there will be a large increase in demand. Paragraph Less Option: No expansion Add on Build a new facility Large increase State of demand No change Moderate increase $15 ($10) $20 ($40) ($5) ($20) ($40) ($150) $25 $45 $120 View Assignment #3 questions W20.docx (Protected View) - Microsoft Word References Mailings Review ternet location and might be unsafe. Click for more details. Enable Editing f. (18 marks) Use the data to compute the variance for each option g. (3 marks) Using variance, rank the options from most risky to least risky. h. (3 marks) Which option would all investors rule out? Explain. i (3 marks) of the remaining two options, which would be selected by a very risk averse individual? ExplainStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock