Question: I just need answers for those that I did wrong. Help me with the journal entry and the other that i did wrong Recording and

I just need answers for those that I did wrong. Help me with the journal entry and the other that i did wrong

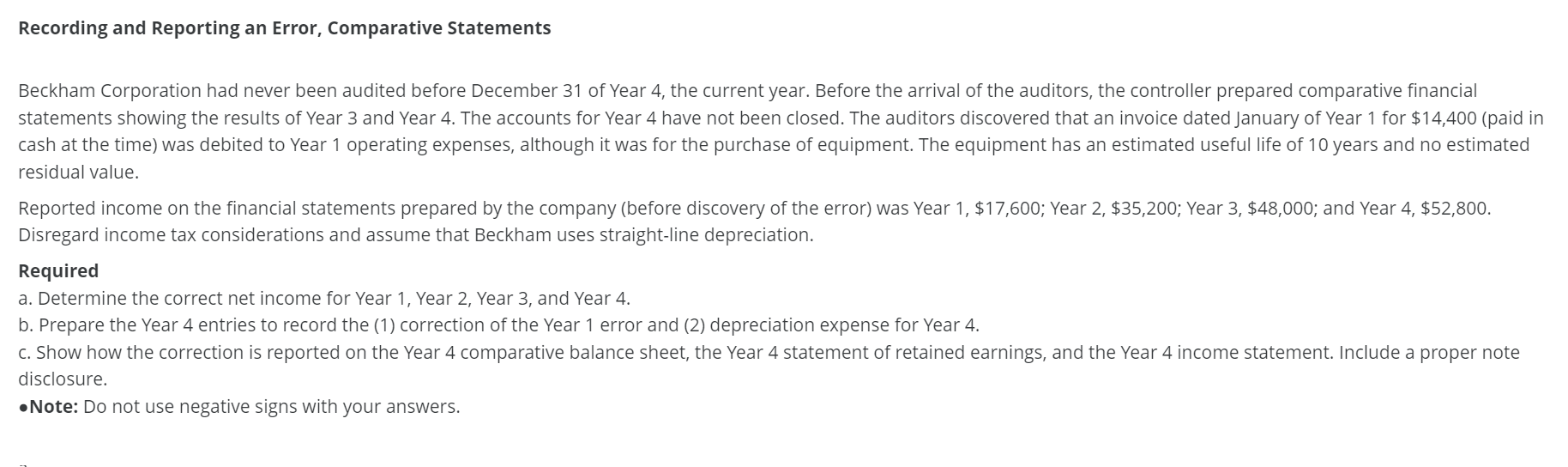

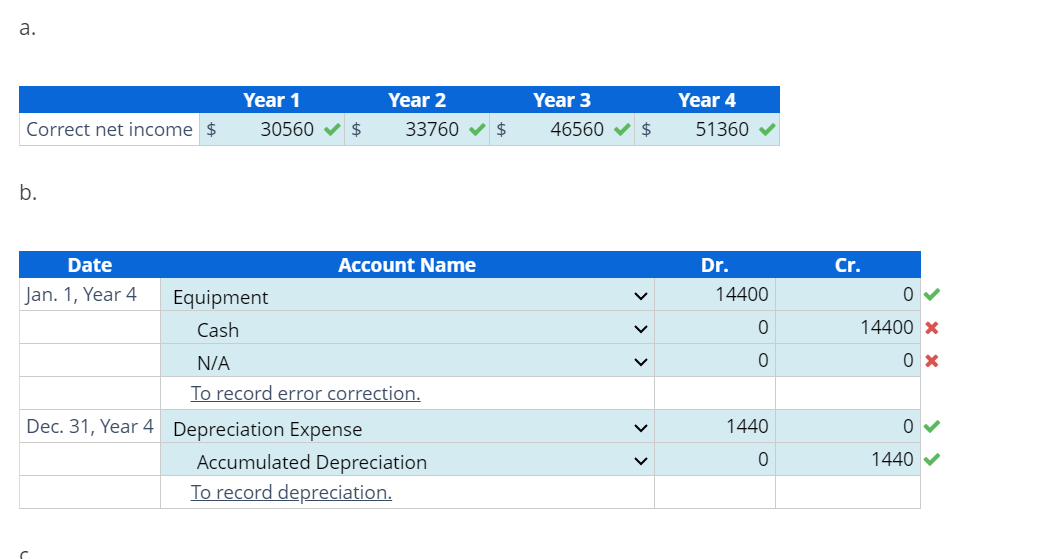

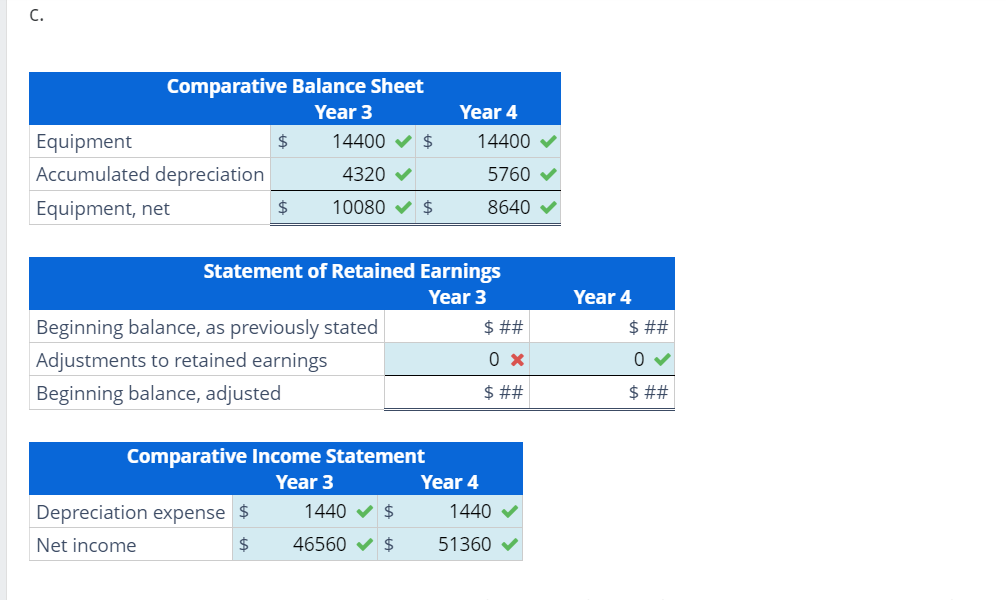

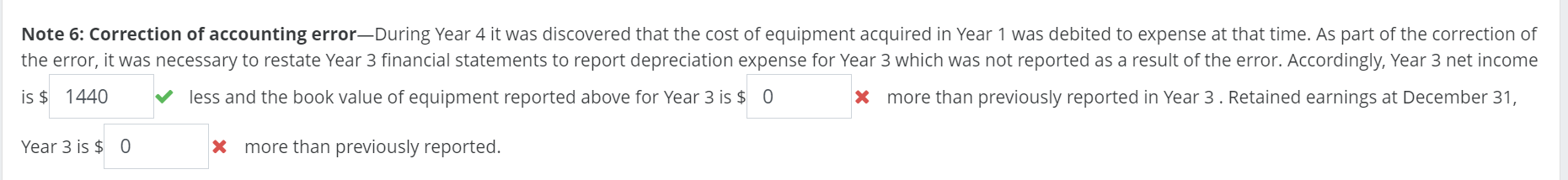

Recording and Reporting an Error, Comparative Statements Beckham Corporation had never been audited before December 31 of Year 4, the current year. Before the arrival of the auditors, the controller prepared comparative financial statements showing the results of Year 3 and Year 4 . The accounts for Year 4 have not been closed. The auditors discovered that an invoice dated January of Year 1 for $14,400 (paid in cash at the time) was debited to Year 1 operating expenses, although it was for the purchase of equipment. The equipment has an estimated useful life of 10 years and no estimated residual value. Reported income on the financial statements prepared by the company (before discovery of the error) was Year 1, \$17,600; Year 2, \$35,200; Year 3, \$48,000; and Year 4, \$52,800. Disregard income tax considerations and assume that Beckham uses straight-line depreciation. Required a. Determine the correct net income for Year 1, Year 2, Year 3, and Year 4. b. Prepare the Year 4 entries to record the (1) correction of the Year 1 error and (2) depreciation expense for Year 4. c. Show how the correction is reported on the Year 4 comparative balance sheet, the Year 4 statement of retained earnings, and the Year 4 income statement. Include a proper note disclosure. -Note: Do not use negative signs with your answers. a. b. C. \begin{tabular}{|l|r|r|} \hline \multicolumn{2}{|c}{ Statement of Retained Earnings } \\ Year 3 & Year 4 \\ \hline Beginning balance, as previously stated & $## & \$\#\# \\ \hline Adjustments to retained earnings & 0 & 0 \\ \hline Beginning balance, adjusted & $## & $## \\ \hline \end{tabular} \begin{tabular}{|l|rrr|} \hline \multicolumn{4}{|c|}{ Comparative Income Statement } \\ \multicolumn{1}{|c|}{} & Year 3 & Year 4 \\ \hline Depreciation expense & $ & 1440 & $1440 \\ \hline Net income & $ & 46560 & 51360 \\ \hline \end{tabular} Note 6: Correction of accounting error-During Year 4 it was discovered that the cost of equipment acquired in Year 1 was debited to expense at that time. As part of the correction of the error, it was necessary to restate Year 3 financial statements to report depreciation expense for Year 3 which was not reported as a result of the error. Accordingly, Year 3 net income is $ less and the book value of equipment reported above for Year 3 is \$ x more than previously reported in Year 3 . Retained earnings at December 31, Year 3 is $ x more than previously reported

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts