Question: I just need clarification on the calculations with the solution. thank you What is the most you would pay for this annuity right now? Personal

I just need clarification on the calculations with the solution. thank you

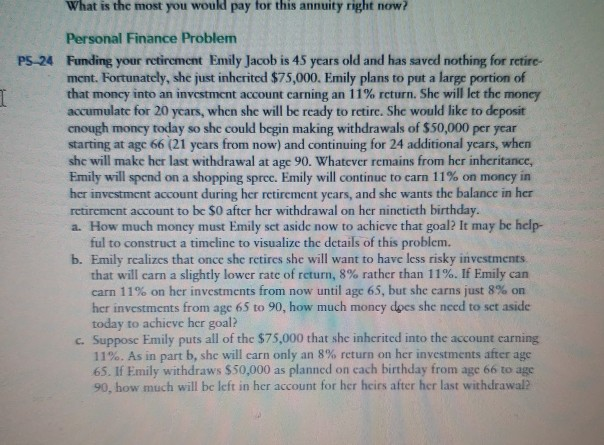

What is the most you would pay for this annuity right now? Personal Finance Problem Funding your retirement Emily Jacob is 45 years old and has saved nothing for retire- ment. Fortunatcly, she just inherited $75,000. Emily plans to put a large portion of that money into an investment account carring an 1 1 % return. She will Ict the money accumulate for 20 ycars, when she will be ready to rctire. She would like to deposit cnough moncy today so she could begin making withdrawals of $50,000 per year starting at age 66 (21 ycars from now) and continuing for 24 additional years, when she will make her last withdrawal at age 90. Whatever remains from her inheritance, Emily will spend on a shopping spree. Emily will continuc to carn 11% on money in her investment account during her retirement ycars, and she wants the balance in her retirement account to be $0 after her withdrawal on her nincticth birthday. a. How much moncy must Emily set aside now to achieve that goal? It may be help- PS-24 ful to construct a timcline to visualize the details of this problem. b. Emily rcalizes that once she retires she will want to have less risky investments that will earn a slightly lower rate of rcturn, 8% rather than 1 1%. If Emily can carn 11% on her investments from now until age 65, but she earns just 8% on her investments from age 65 to 90, how much money does she need to sct aside today to achieve her goal? c. Suppose Emily puts all of the $75,000 that she inherited into the account earning 11%. As in part b, she will carn only an 8% return on hcr investments after age 65. If Emily withdraws $50,000 as planned on cach birthday from age 66 to age 90, how much will be left in her account for her heirs after her last withdrawal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts