Question: i just need help with question D, E, and F. The Teenie Tiny Company is currently an un-levered firm with a beta of 1.3925. Since

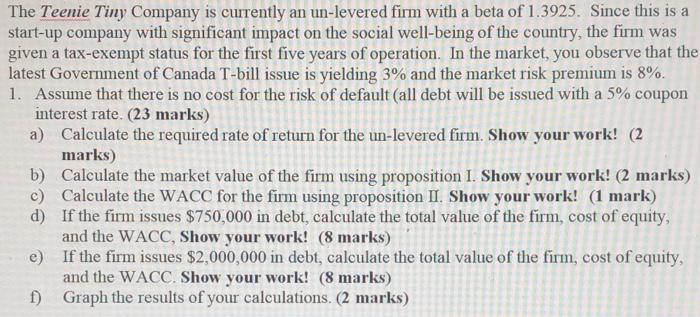

The Teenie Tiny Company is currently an un-levered firm with a beta of 1.3925. Since this is a start-up company with significant impact on the social well-being of the country, the firm was given a tax-exempt status for the first five years of operation. In the market, you observe that the latest Government of Canada T-bill issue is yielding 3% and the market risk premium is 8%. 1. Assume that there is no cost for the risk of default (all debt will be issued with a 5% coupon interest rate. (23 marks) a) Calculate the required rate of return for the un-levered firm. Show your work! (2 marks) b) Calculate the market value of the firm using proposition 1. Show your work! (2 marks) c) Calculate the WACC for the firm using proposition II. Show your work! (1 mark) d) If the firm issues $750,000 in debt, calculate the total value of the firm, cost of equity, and the WACC, Show your work! (8 marks) e) If the firm issues $2,000,000 in debt, calculate the total value of the firm, cost of equity, and the WACC. Show your work! (8 marks) 1) Graph the results of your calculations. (2 marks) The Teenie Tiny Company is currently an un-levered firm with a beta of 1.3925. Since this is a start-up company with significant impact on the social well-being of the country, the firm was given a tax-exempt status for the first five years of operation. In the market, you observe that the latest Government of Canada T-bill issue is yielding 3% and the market risk premium is 8%. 1. Assume that there is no cost for the risk of default (all debt will be issued with a 5% coupon interest rate. (23 marks) a) Calculate the required rate of return for the un-levered firm. Show your work! (2 marks) b) Calculate the market value of the firm using proposition 1. Show your work! (2 marks) c) Calculate the WACC for the firm using proposition II. Show your work! (1 mark) d) If the firm issues $750,000 in debt, calculate the total value of the firm, cost of equity, and the WACC, Show your work! (8 marks) e) If the firm issues $2,000,000 in debt, calculate the total value of the firm, cost of equity, and the WACC. Show your work! (8 marks) 1) Graph the results of your calculations. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts