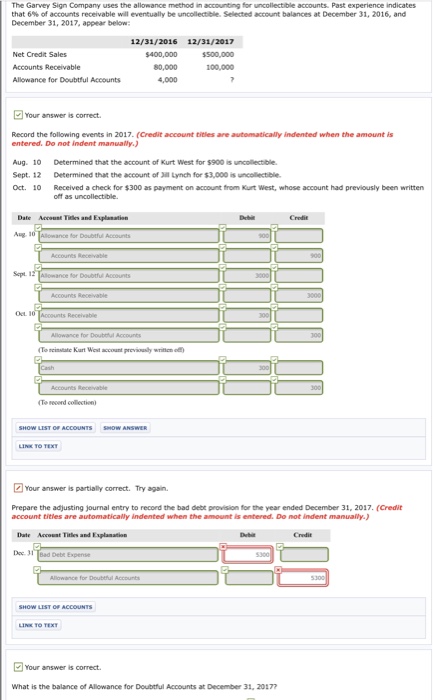

Question: I just need help with the adjusting journal entry. If it helps, the balance of Allowance for Doubtful Accounts at December 31, 2017 is 6000.

The Garvey Sign Company uses the allowance method in accounting for uncollectible accounts. Past experience indicates that 6% of accounts receivable will eventually be uncolletee. Selected account balances at December 31, 2016, and December 31, 2017, appear below 12/31/2016 12/31/2017 $400,000 80,000 4,000 100,000 Accounts Receivable Allowance for Doubtful Accounts Your answer is correct. Record the following events in 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually Aug. 10 Determined that the account of Kurt West for $900 is uncolectible Sept. 12 Determined that the account of il Lynch for $3,000 is uncollectible Oct. 10 Received a check for $300 as payment on account from Kurt West, whose account had previously been written Date Account Tiles and Euplanation Sept To reiniate Kart West account previouily writcnl To reoerd collection) Your answer is partially correct. Try again. Prepare the adjusting journal entry to record the bad debt provision for the year ended December 31, 2017.(Credit account tities are automatically indented when the amount is entered. Do not indent manually.) Date Aecoust Titlies and Explanation What is the balance of Allowance for Doubtful Accounts at December 31 20177

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts