Question: I just need help with the word problem sections but heres all the info i have so far. Check my work In the tables that

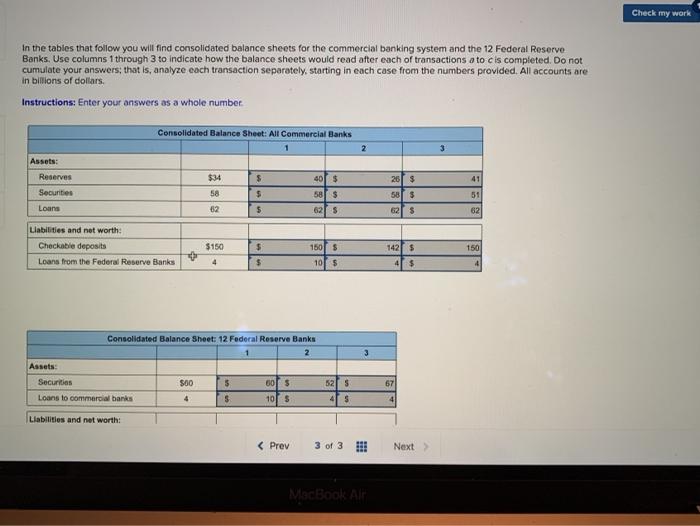

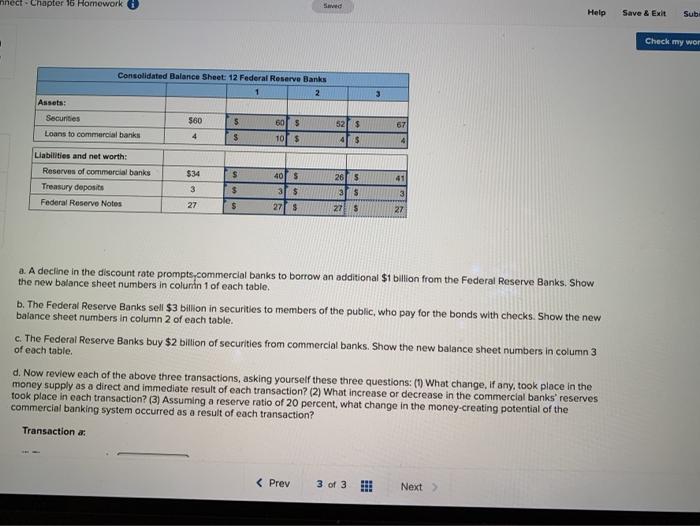

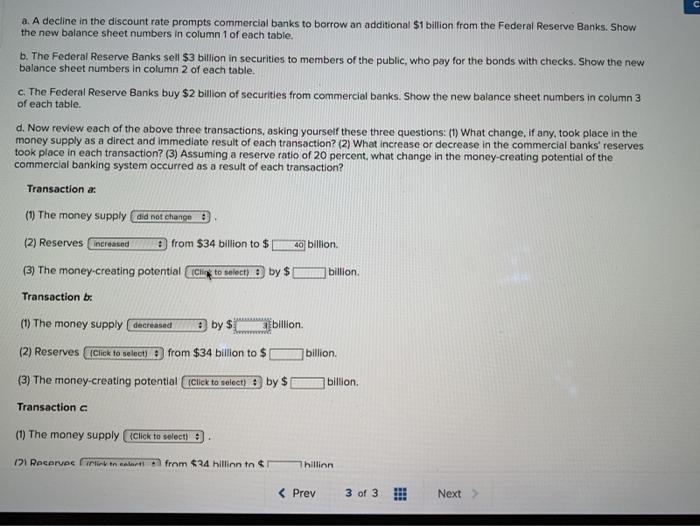

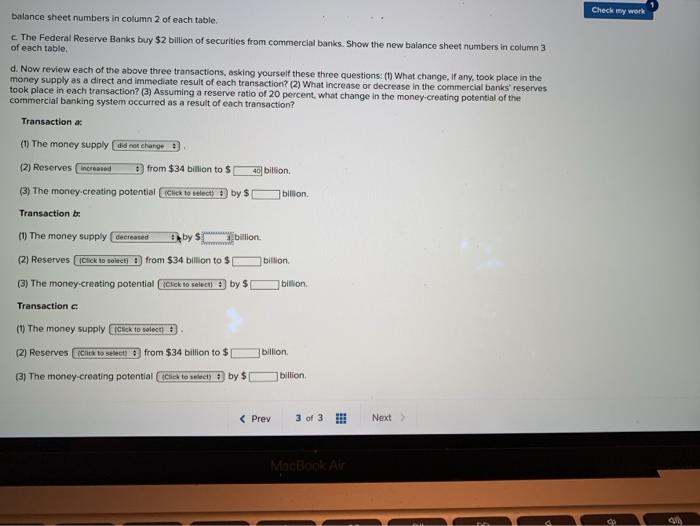

Check my work In the tables that follow you will find consolidated balance sheets for the commercial banking system and the 12 Federal Reserve Banks. Use columns 1 through 3 to indicate how the balance sheets would read after each of transactions a to cis completed. Do not cumulate your answers, that is, analyze each transaction separately, starting in each case from the numbers provided. All accounts are in billions of dollars. Instructions: Enter your answers as a whole number Consolidated Balance Sheet: All Commercial Banks 2 Assets: $34 40 $ Reserves Securities Loans $ $ 26 $ 58 $ 58 51 58 $ 62 S 52 5 $ 621 Llabilities and net worth: $150 150 Checkable deposits Loans from the Federal Reserve Banks $ $ 150 $ 10 $ 142 $ 4 $ Consolidated Balance Sheet: 12 Federal Reserve Banks 2 Assets Securities 500 $ 00 $ Loans to commercial banks 4 5 10 $ 67 52 s 45 4 Liabilities and net worth: U a. A decline in the discount rate prompts commercial banks to borrow an additional S1 billion from the Federal Reserve Banks. Show the new balance sheet numbers in column 1 of each table. b. The Federal Reserve Banks sell $3 billion in securities to members of the public, who pay for the bonds with checks. Show the new balance sheet numbers in column 2 of each table. C. The Federal Reserve Banks buy $2 billion of securities from commercial banks. Show the new balance sheet numbers in column 3 of each table. d. Now review each of the above three transactions, asking yourself these three questions: (1) What change, if any, took place in the money supply as a direct and immediate result of each transaction? (2) What increase or decrease in the commercial banks' reserves took place in each transaction? (3) Assuming a reserve ratio of 20 percent, what change in the money-creating potential of the commercial banking system occurred as a result of each transaction? Transaction a (1) The money supply did not change 3 (2) Reserves increased from $34 billion to $ 40 billion. (3) The money creating potential Click to select) by $ billion Transaction b: (1) The money supply decreased by $ billion (2) Reserves Click to select from $34 billion to $ billion. (3) The money creating potential Click to select) by $ billion. Transaction (1) The money supply click to select). 121 Recerves link in salaril from $24 hillinn tn billion 1 Check my work balance sheet numbers in column 2 of each table. The Federal Reserve Banks buy $2 billion of securities from commercial banks. Show the new balance sheet numbers in column 3 of each table. d. Now review each of the above three transactions, asking yourself these three questions: () What change, If any, took place in the money supply as a direct and immediate result of each transaction? (2) What increase or decrease in the commercial banks' reserves took place in each transaction? (3) Assuming a reserve ratio of 20 percent, what change in the money creating potential of the commercial banking system occurred as a result of each transaction? Transaction as (1) The money supply did not change 3 (2) Reserves increased from $34 billion to $ 40 billion (3) The money creating potential Click to select) by $ billion Transaction b: (1) The money supply decreased by billion. (2) Reserves Click to select from $34 billion to $ billion billion (3) The money-creating potential Click to selven) by $ Transactions (1) The money supply click to selecte 2) Reserves cellek to select from $34 billion to $ (3) The money-creating potential Cliek te siect by $ billion billion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts