Question: I just need part C on first question I need parts b and c on the last one Free cash flow valuation You are evaluating

I just need part C on first question

I need parts b and c on the last one

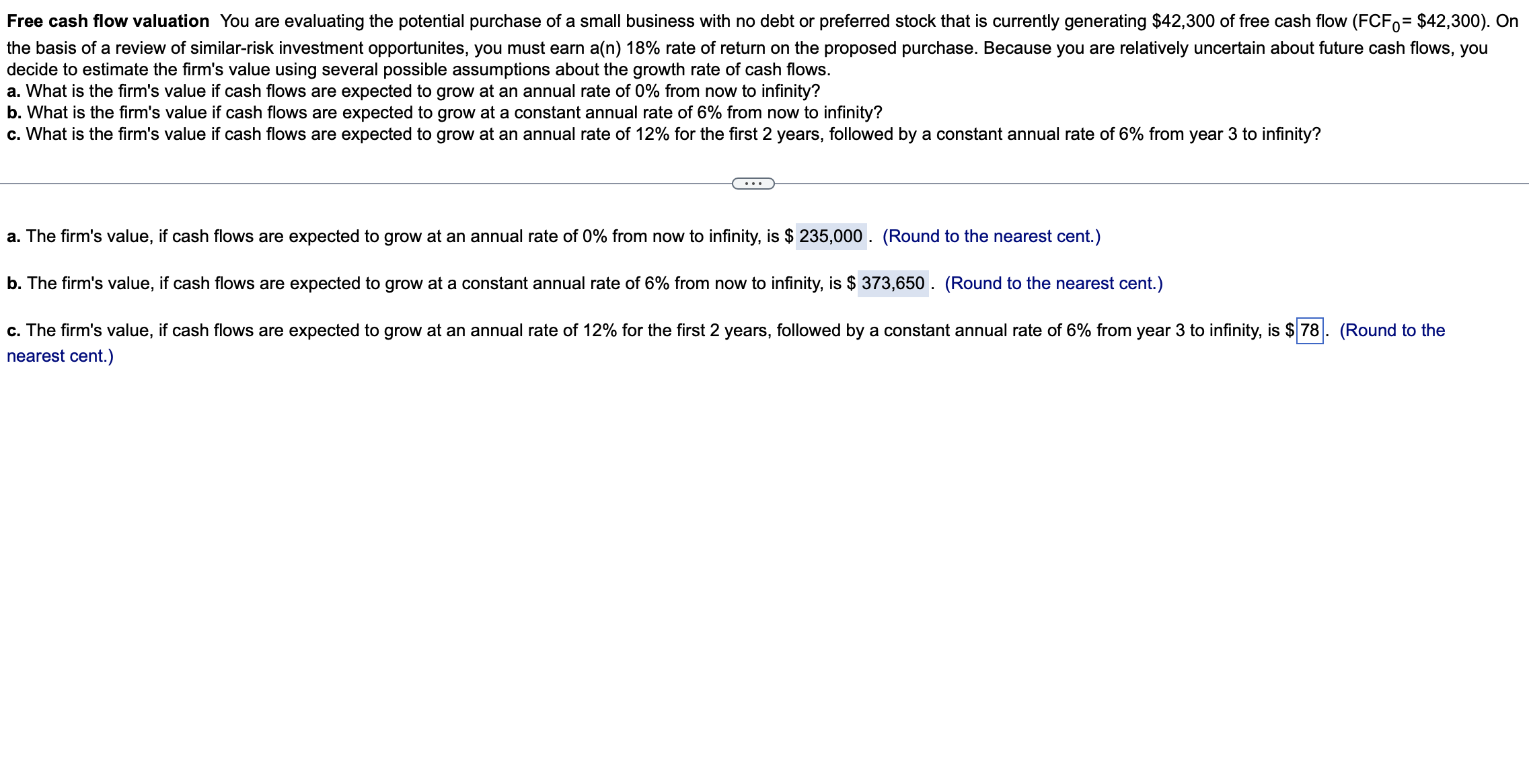

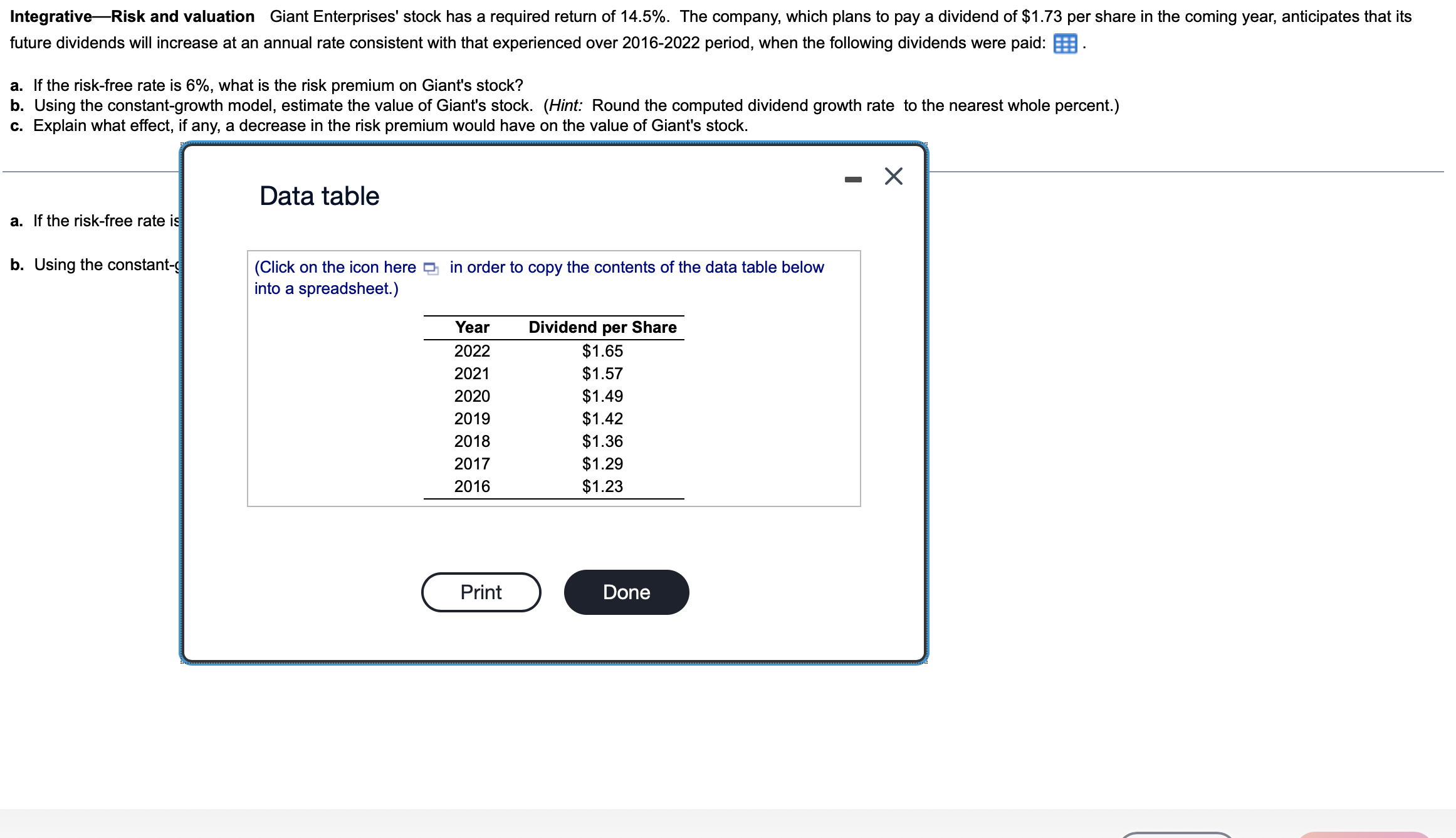

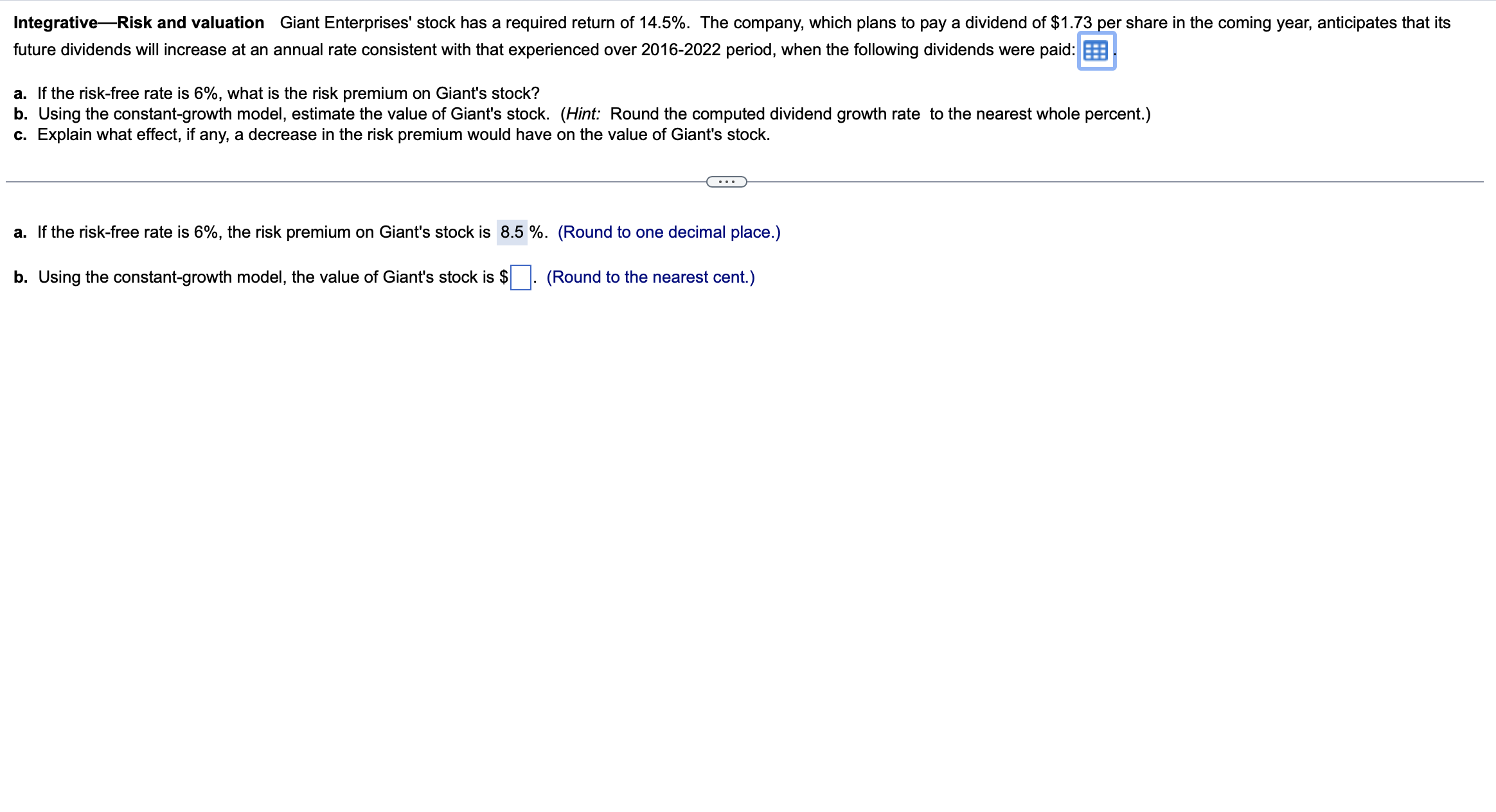

Free cash flow valuation You are evaluating the potential purchase of a small business with no debt or preferred stock that is currently generating $42,300 of free cash flow (FCF =$42,300 ). On the basis of a review of similar-risk investment opportunites, you must earn a(n) 18% rate of return on the proposed purchase. Because you are relatively uncertain about future cash flows, you decide to estimate the firm's value using several possible assumptions about the growth rate of cash flows. a. What is the firm's value if cash flows are expected to grow at an annual rate of 0% from now to infinity? b. What is the firm's value if cash flows are expected to grow at a constant annual rate of 6% from now to infinity? c. What is the firm's value if cash flows are expected to grow at an annual rate of 12% for the first 2 years, followed by a constant annual rate of 6% from year 3 to infinity? a. The firm's value, if cash flows are expected to grow at an annual rate of 0% from now to infinity, is $ b. The firm's value, if cash flows are expected to grow at a constant annual rate of 6% from now to infinity, is $ (Round to the nearest cent.) (Round to the nearest cent.) c. The firm's value, if cash flows are expected to grow at an annual rate of 12% for the first 2 years, followed by a constant annual rate of 6% from year 3 to infinity, is $78. (Round to the nearest cent.) Integrative-Risk and valuation Giant Enterprises' stock has a required return of 14.5%. The company, which plans to pay a dividend of $1.73 per share in the coming year, anticipates that its future dividends will increase at an annual rate consistent with that experienced over 2016-2022 period, when the following dividends were paid: a. If the risk-free rate is 6%, what is the risk premium on Giant's stock? b. Using the constant-growth model, estimate the value of Giant's stock. (Hint: Round the computed dividend growth rate to the nearest whole percent.) c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock. Data table a. If the risk-free rate is b. Using the constant- - (Click on the icon here into a spreadsheet.) in order to copy the contents of the data table below Integrative-Risk and valuation Giant Enterprises' stock has a required return of 14.5%. The company, which plans to pay a dividend of $1.73 per share in the coming year, anticipates that its future dividends will increase at an annual rate consistent with that experienced over 2016-2022 period, when the following dividends were paid: a. If the risk-free rate is 6%, what is the risk premium on Giant's stock? b. Using the constant-growth model, estimate the value of Giant's stock. (Hint: Round the computed dividend growth rate to the nearest whole percent.) c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock. a. If the risk-free rate is 6%, the risk premium on Giant's stock is 8.5%. (Round to one decimal place.) b. Using the constant-growth model, the value of Giant's stock is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts