Question: I just need question 2 abd 3 in an hour Federal Tax 1 Spring 2018 In Class Homework Problems Chapter 1 USE THE 2017 TAX

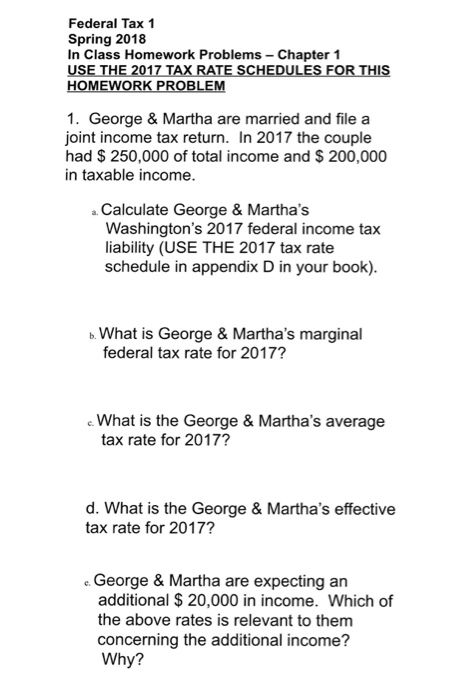

Federal Tax 1 Spring 2018 In Class Homework Problems Chapter 1 USE THE 2017 TAX RATE SCHEDULES FOR THIS HOMEWORK PROBLEM 1. George & Martha are married and file a joint income tax return. In 2017 the couple had $ 250,000 of total income and S 200,000 in taxable income. aCalculate George & Martha's Washington's 2017 federal income tax liability (USE THE 2017 tax rate schedule in appendix D in your book) What is George & Martha's marginal federal tax rate for 2017? What is the George & Martha's average tax rate for 2017? d. What is the George & Martha's effective tax rate for 2017? George & Martha are expecting an additional $ 20,000 in income. Which of the above rates is relevant to them concerning the additional income? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts