Question: i just need question 4 & 5 Freddy and Frieda Finance are looking to buy a house. They can comfortably afford a monthly payment of

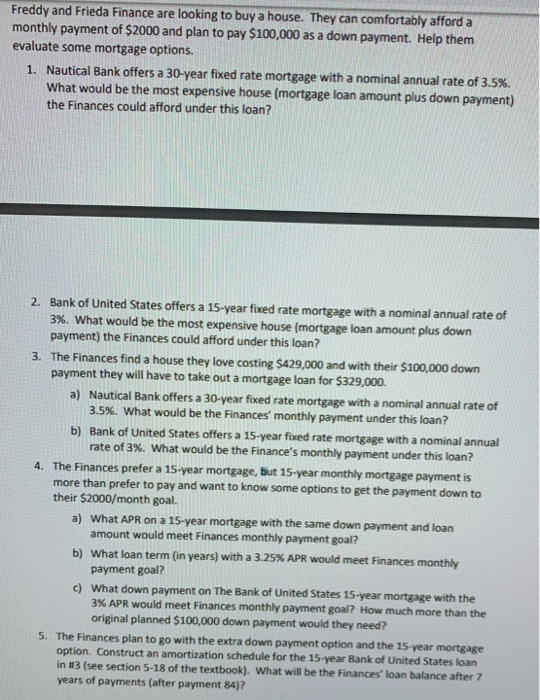

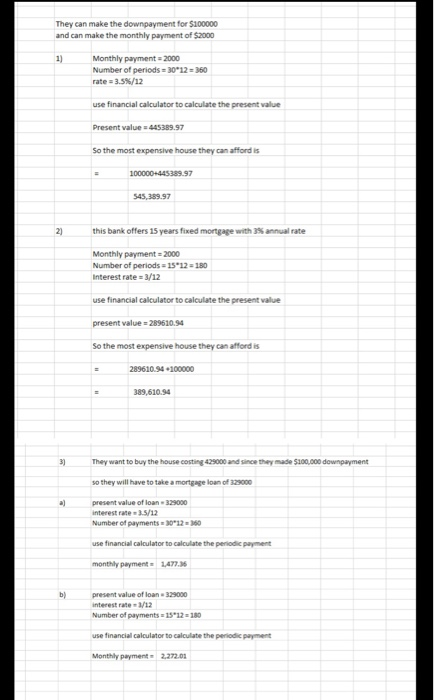

Freddy and Frieda Finance are looking to buy a house. They can comfortably afford a monthly payment of $2000 and plan to pay $100,000 as a down payment. Help them evaluate some mortgage options. 1. Nautical Bank offers a 30-year fixed rate mortgage with a nominal annual rate of 3.5%. What would be the most expensive house (mortgage loan amount plus down payment) the Finances could afford under this loan? 2. Bank of United States offers a 15-year fixed rate mortgage with a nominal annual rate of 3%. What would be the most expensive house (mortgage loan amount plus down payment) the Finances could afford under this loan? 3. The Finances find a house they love costing $429,000 and with their $100.000 down payment they will have to take out a mortgage loan for $329,000 a) Nautical Bank offers a 30-year fixed rate mortgage with a nominal annual rate of 3.5%. What would be the Finances monthly payment under this loan? b) Bank of United States offers a 15-year foxed rate mortgage with a nominal annual rate of 3%. What would be the Finance's monthly payment under this loan? 4. The Finances prefer a 15-year mortgage, but 15-year monthly mortgage payment is more than prefer to pay and want to know some options to get the payment down to their $2000/month goal. a) What APR on a 15-year mortgage with the same down payment and loan amount would meet Finances monthly payment goal? b) What loan term (in years) with a 3.25% APR would meet Finances monthly payment goal? c) What down payment on The Bank of United States 15-year mortgage with the 3% APR would meet Finances monthly payment goal? How much more than the original planned $100,000 down payment would they need? 5. The Finances plan to go with the extra down payment option and the 15-year mortgage option. Construct an amortization schedule for the 15-year Bank of United States loan in 83 (see section 5-18 of the textbook). What will be the Finances' loan balance after 7 years of payments (after payment 84)? They can make the downpayment for $100000 and can make the monthly payment of $2000 Monthly payment - 2000 Number of periods = 3012 = 360 rate = 3.5%/12 use financial calculator to calculate the present value Present value = 445389.97 So the most expensive house they can afford is 100000+445389.97 545,389.97 this bank offers 15 years fixed mortgage with 3% annual rate Monthly payment = 2000 Number of periods 1512 = 180 Interest rate = 3/12 use financial calculator to calculate the present value present value 289610.94 So the most expensive house they can afford is 289610.54 100000 389,610.94 They want to buy the house costing 429000 and since they made $100.000 downpayment so they will have to take a mortgage loan of 329000 present value of loan 329000 interest rate 35/12 Number of payments 3012150 use financial calculator to calculate the periodic payment monthly payment 1.477.36 present value of loan.329000 interest rate=1/12 Number of payments 1512180 use financial calculator to calculate the periodic payment Monthly payment 2.272.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts