Question: I just need question number 7 which is: Prepare entry *C (asterisk C) to convert parent's beginning retained earnings to full accrual basis also I

I just need question number 7 which is: Prepare entry *C (asterisk C) to convert parent's beginning retained earnings to full accrual basis

I just need question number 7 which is: Prepare entry *C (asterisk C) to convert parent's beginning retained earnings to full accrual basis

also I tried this answer $ 84500 but it is wrong too (103000 -(13000+7500))=84500

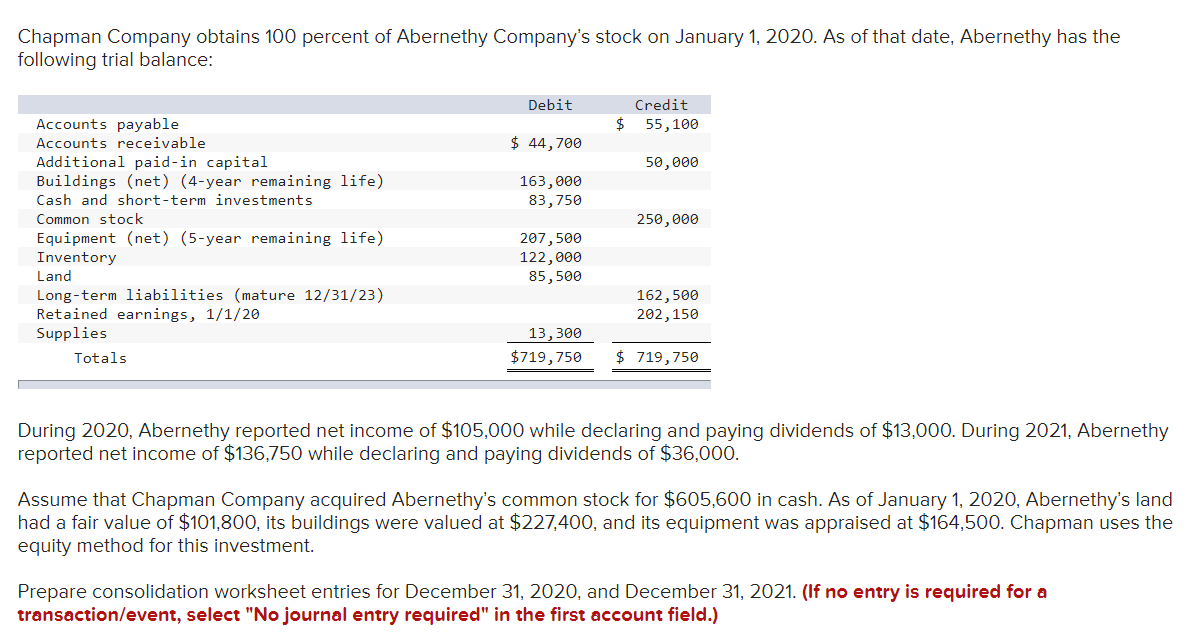

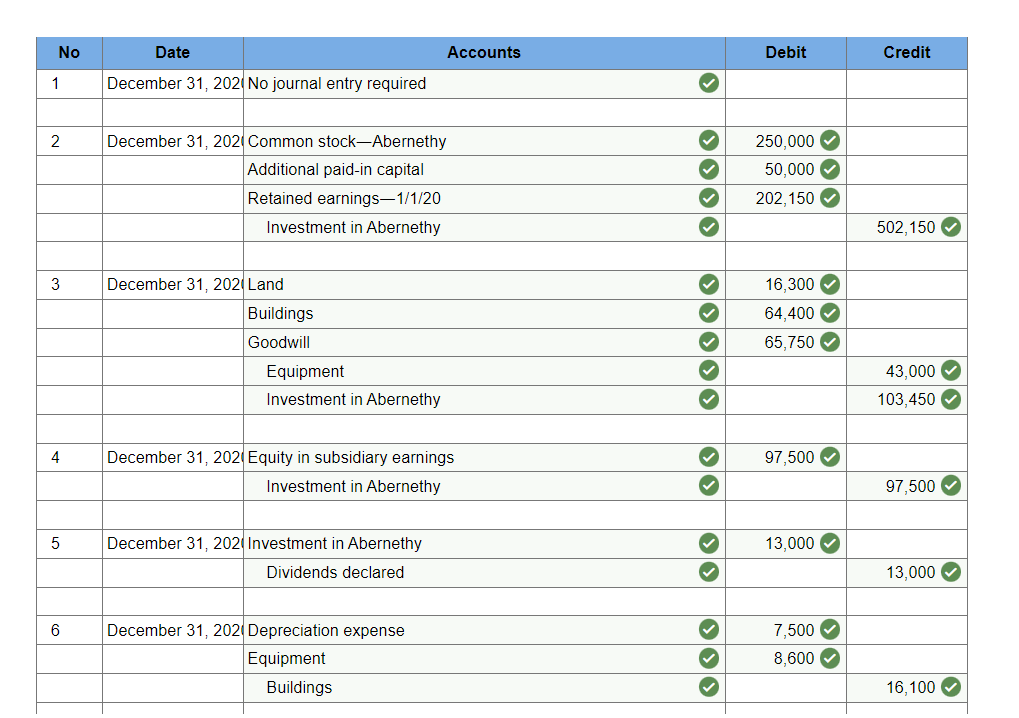

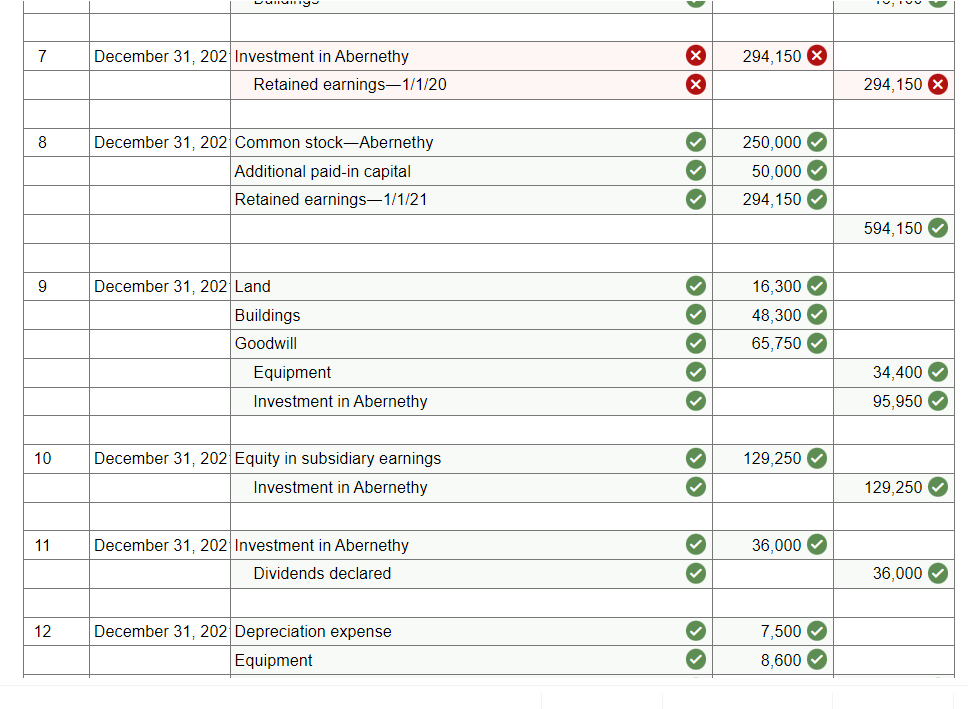

Chapman Company obtains 100 percent of Abernethy Company's stock on January 1,2020 . As of that date, Abernethy has the following trial balance: During 2020 , Abernethy reported net income of $105,000 while declaring and paying dividends of $13,000. During 2021 , Abernethy reported net income of $136,750 while declaring and paying dividends of $36,000. Assume that Chapman Company acquired Abernethy's common stock for $605,600 in cash. As of January 1, 2020, Abernethy's land had a fair value of $101,800, its buildings were valued at $227,400, and its equipment was appraised at $164,500. Chapman uses the equity method for this investment. Prepare consolidation worksheet entries for December 31, 2020, and December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts