Question: I just need the answer, I don't need the process ( ) 1. ( ) 2. ( ) 3. ( ) 4. A Japanese investor

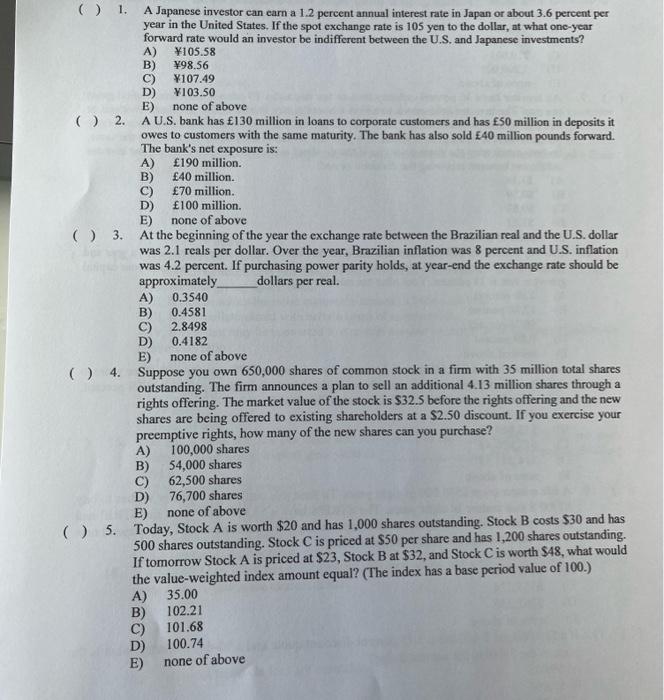

( ) 1. A Japanese investor can earn a 1.2 pereent annual interest rate in Japan or about 3.6 percent per year in the United States. If the spot exchange rate is 105 yen to the dollar, at what one-year forward rate would an investor be indifferent between the U.S. and Japanese investments? A) 105.58 B) 98.56 C) $107.49 D) 103.50 E) none of above ( ) A. A U.S. bank has 130 million in loans to corporate customers and has 50 million in deposits it owes to customers with the same maturity. The bank has also sold 40 million pounds forward. The bank's net exposure is: A) {190 million. B) f40 million. C) 70 million. D) 100 million. E) none of above 3. At the beginning of the year the exchange rate between the Brazilian real and the U.S. dollar was 2.1 reals per dollar. Over the year, Brazilian inflation was 8 percent and U.S. inflation was 4.2 percent. If purchasing power parity holds, at year-end the exchange rate should be approximately dollars per real. A) 0.3540 B) 0.4581 C) 2.8498 D) 0.4182 E) none of above 4. Suppose you own 650,000 shares of common stock in a firm with 35 million total shares outstanding. The firm announces a plan to sell an additional 4.13 million shares through a rights offering. The market value of the stock is $32.5 before the rights offering and the new shares are being offered to existing shareholders at a $2.50 discount. If you exercise your preemptive rights, how many of the new shares can you purchase? A) 100,000 shares B) 54,000 shares C) 62,500 shares D) 76,700 shares E) none of above 5. Today, Stock A is worth $20 and has 1,000 shares outstanding. Stock B costs $30 and has 500 shares outstanding. Stock C is priced at $50 per share and has 1,200 shares outstanding. If tomorrow Stock A is priced at $23,StockB at $32, and S tock C is worth $48, what would the value-weighted index amount equal? (The index has a base period value of 100.) A) 35.00 B) 102.21 C) 101.68 D) 100.74 E) none of above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts