Question: I just need the answer, I don't need the process ( ) 6. A firm is using cumulative voting and 4 director spots are up

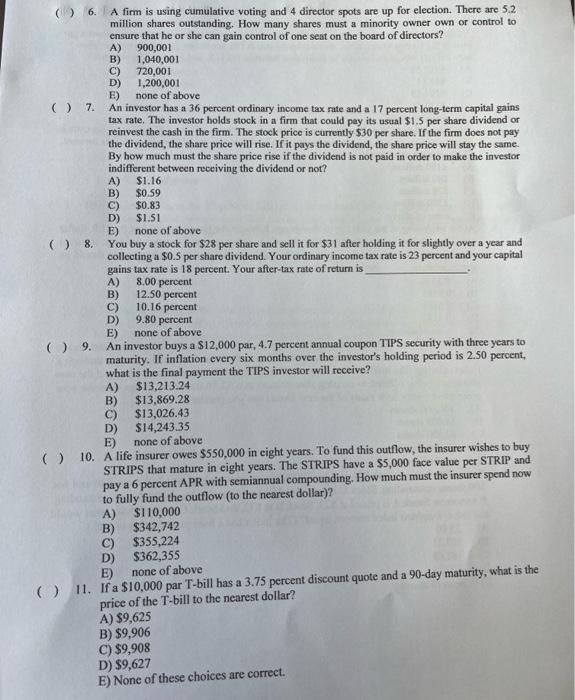

( ) 6. A firm is using cumulative voting and 4 director spots are up for election. There are 5.2 million shares outstanding. How many shares must a minority owner own or control to ensure that he or she can gain control of one seat on the board of directors? A) 900,001 B) 1,040,001 C) 720,001 D) 1,200,001 E) none of above ( ) 7. An investor has a 36 pereent ordinary income tax rate and a 17 percent long-term capital gains tax rate. The investor holds stock in a firm that could pay its usual $1.5 per share dividend or reinvest the cash in the firm. The stock price is currently $30 per share. If the firm does not pay the dividend, the share price will rise. If it pays the dividend, the share price will stay the same. By how much must the share price rise if the dividend is not paid in order to make the investor indifferent between receiving the dividend or not? A) $1.16 B) $0.59 C) $0.83 D) $1.51 E) none of above ( ) 8, You buy a stock for $28 per share and sell it for $31 after holding it for slightly over a year and collecting a $0.5 per share dividend. Your ordinary income tax rate is 23 percent and your capital gains tax rate is 18 percent. Your after-tax rate of return is A) 8.00 percent B) 12.50 percent C) 10.16 percent D) 9.80 percent E) none of above ( ) 9. An investor buys a $12,000 par, 4.7 percent annual coupon TTPS security with three years to maturity. If inflation every six months over the investor's holding period is 2.50 percent, what is the final payment the TIPS investor will receive? A) $13,213.24 B) $13,869,28 C) $13,026.43 D) $14,243.35 E) none of above ( 10. A life insurer owes $550,000 in eight years. To fund this outflow, the insurer wishes to buy STRIPS that mature in eight years. The STRIPS have a $5,000 face value per STRIP and pay a 6 percent APR with semiannual compounding. How much must the insurer spend now to fully fund the outflow (to the nearest dollar)? A) $110,000 B) $342,742 C) $355,224 D) $362,355 E) none of above 11. If a $10,000 par T-bill has a 3.75 percent discount quote and a 90 -day maturity, what is the price of the T-bill to the nearest dollar? A) $9,625 B) $9,906 C) $9,908 D) $9,627 E) None of these choices are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts