Question: I just need this to be revised. Not sure if the percentages are correct and if they should be written in negative. In 2016, Natural

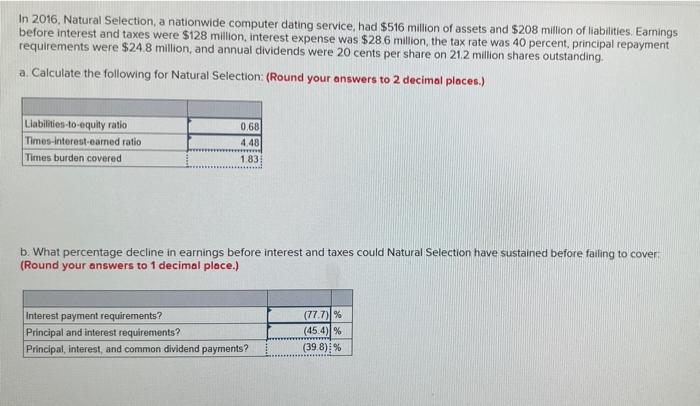

In 2016, Natural Selection, a nationwide computer dating service, had $516 million of assets and $208 million of liabilities. Earnings before interest and taxes were $128 million, interest expense was $286 million, the tax rate was 40 percent. principal repayment requirements were $24.8 million, and annual dividends were 20 cents per share on 212 million shares outstanding a Calculate the following for Natural Selection: (Round your answers to 2 decimal places.) Liabilities to-equity ratio Times-interest-camed ratio Times burden covered 0.68 4.48 1.83 b. What percentage decline in earnings before interest and taxes could Natural Selection have sustained before failing to cover (Round your answers to 1 decimal place.) Interest payment requirements? Principal and interest requirements? Principal, Interest, and common dividend payments? (777) % (45.4) % (39.8) %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts