Question: I keep getting different answers so please be careful when answering. Thank you so much! 2. Weir Service Company purchased a copier on January 1,

I keep getting different answers so please be careful when answering. Thank you so much!

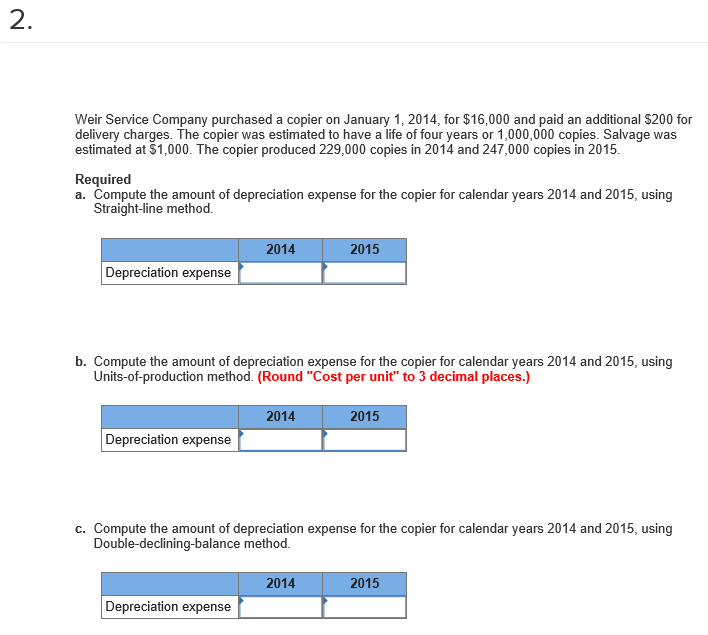

2. Weir Service Company purchased a copier on January 1, 2014, for $16,000 and paid an additional $200 for delivery charges. The copier was estimated to have a life of four years or 1,000,000 copies. Salvage was estimated at $1,000. The copier produced 229,000 copies in 2014 and 247,000 copies in 2015 Required a. Compute the amount of depreciation expense for the copier for calendar years 2014 and 2015, using Straight-line method. 2014 2015 Depreciation expense b. Compute the amount of depreciation expense for the copier for calendar years 2014 and 2015, using Units-of-production method. (Round "Cost per unit" to 3 decimal places.) 2014 2015 Depreciation expense c. Compute the amount of depreciation expense for the copier for calendar years 2014 and 2015, using Double-declining-balance method. 2014 2015 Depreciation expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts