Question: I know it's not A so my next guess was D Does the IRR model make significantly different decisions than does the NPV model? Why

I know it's not A so my next guess was D

I know it's not A so my next guess was D

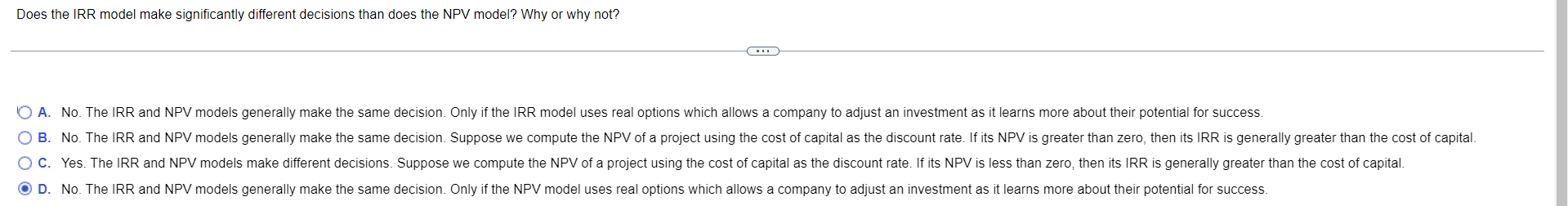

Does the IRR model make significantly different decisions than does the NPV model? Why or why not? A. No. The IRR and NPV models generally make the same decision. Only if the IRR model uses real options which allows a company to adjust an investment as it learns more about their potential for success.

B. No. The IRR and NPV models generally make the same decision. Suppose we compute the NPV of a project using the cost of capital as the discount rate. If its NPV is greater than zero, then its IRR is generally greater than the cost of capital.

C. Yes. The IRR and NPV models make different decisions. Suppose we compute the NPV of a project using the cost of capital as the discount rate. If its NPV is less than zero, then its IRR is generally greater than the cost of capital.

D. No. The IRR and NPV models generally make the same decision. Only if the NPV model uses real options which allows a company to adjust an investment as it learns more about their potential for success.

Does the IRR model make significantly different decisions than does the NPV model? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts