Question: I know its only supposed to be one question but please this is the last question I can ask this pay period You have just

I know its only supposed to be one question but please this is the last question I can ask this pay period

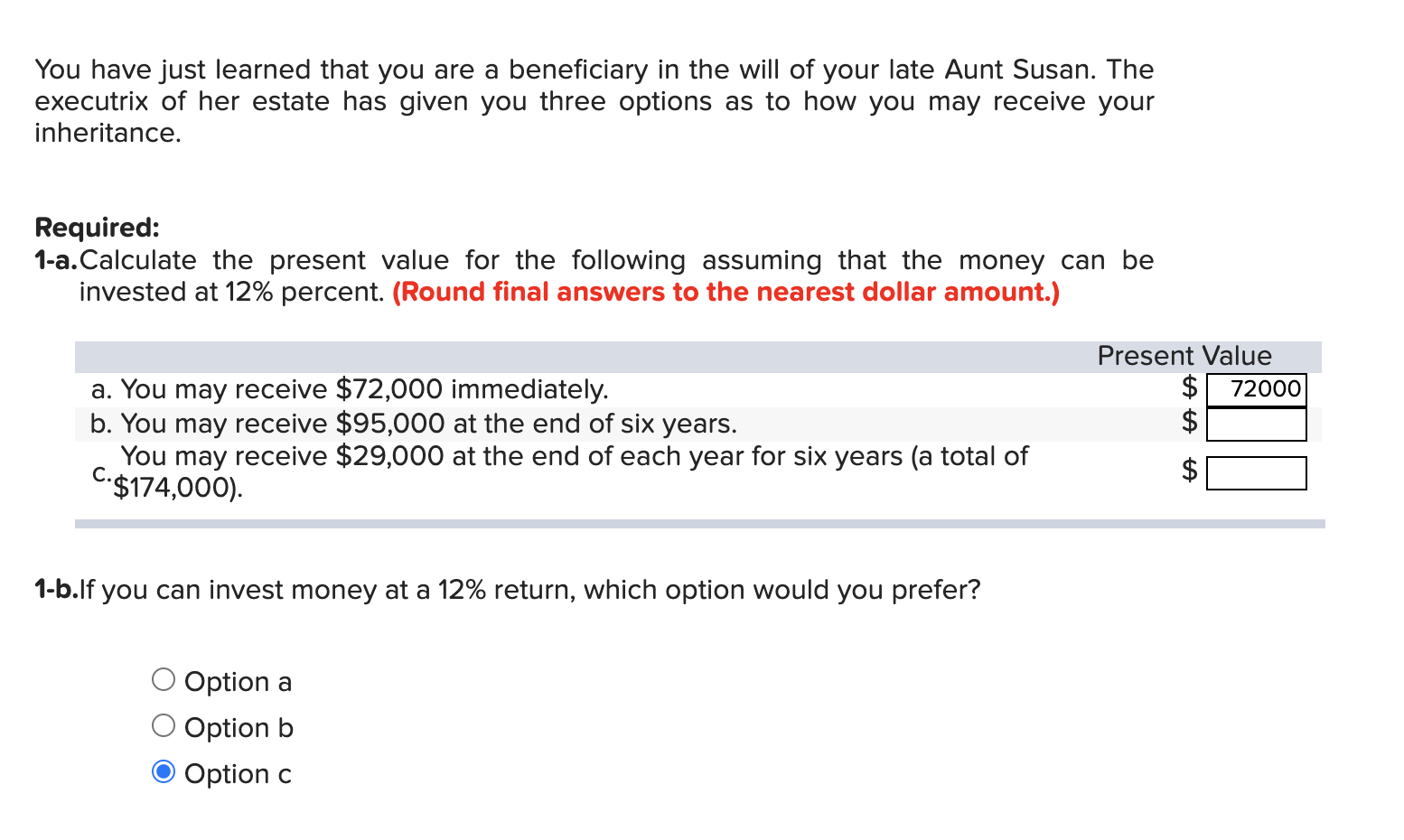

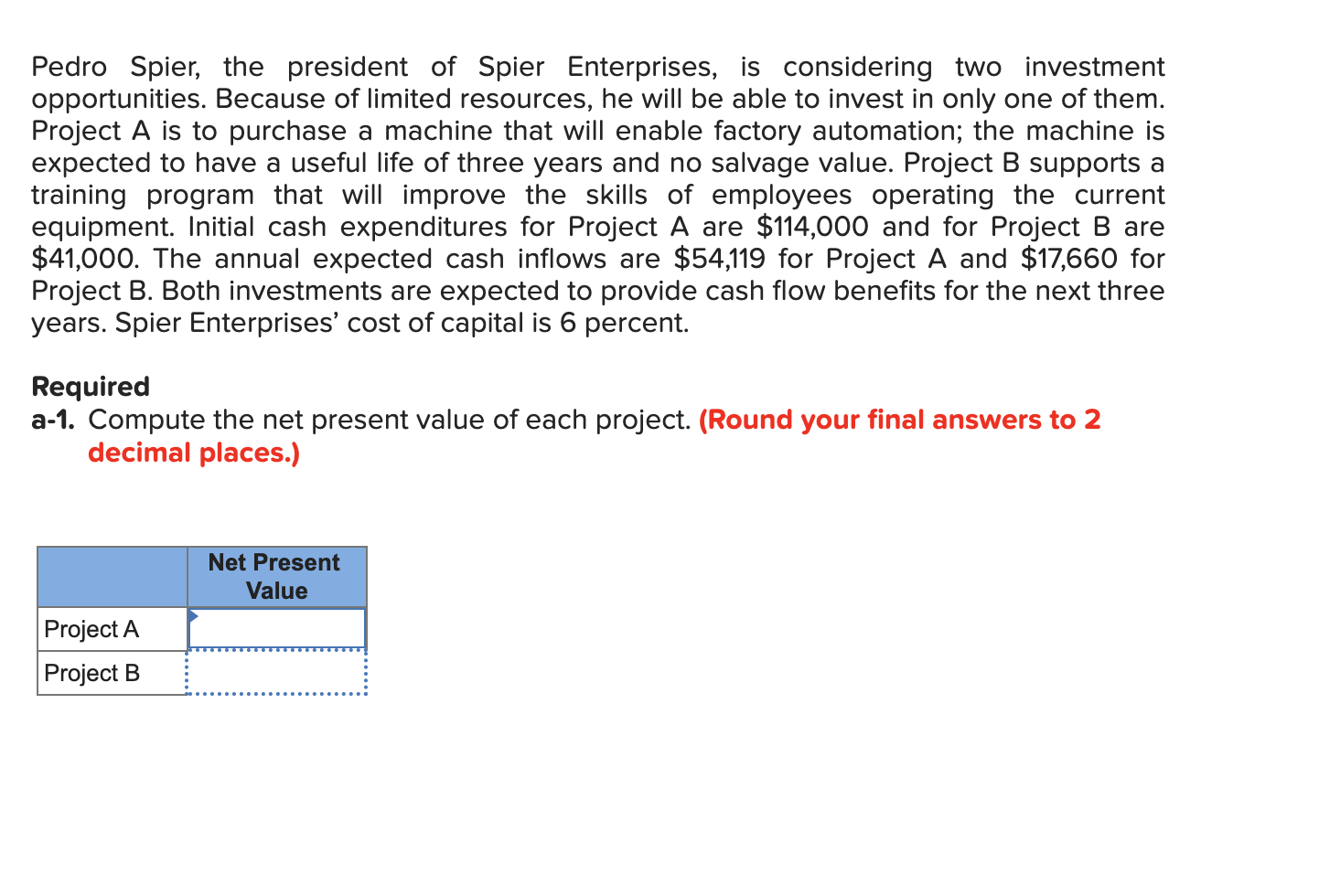

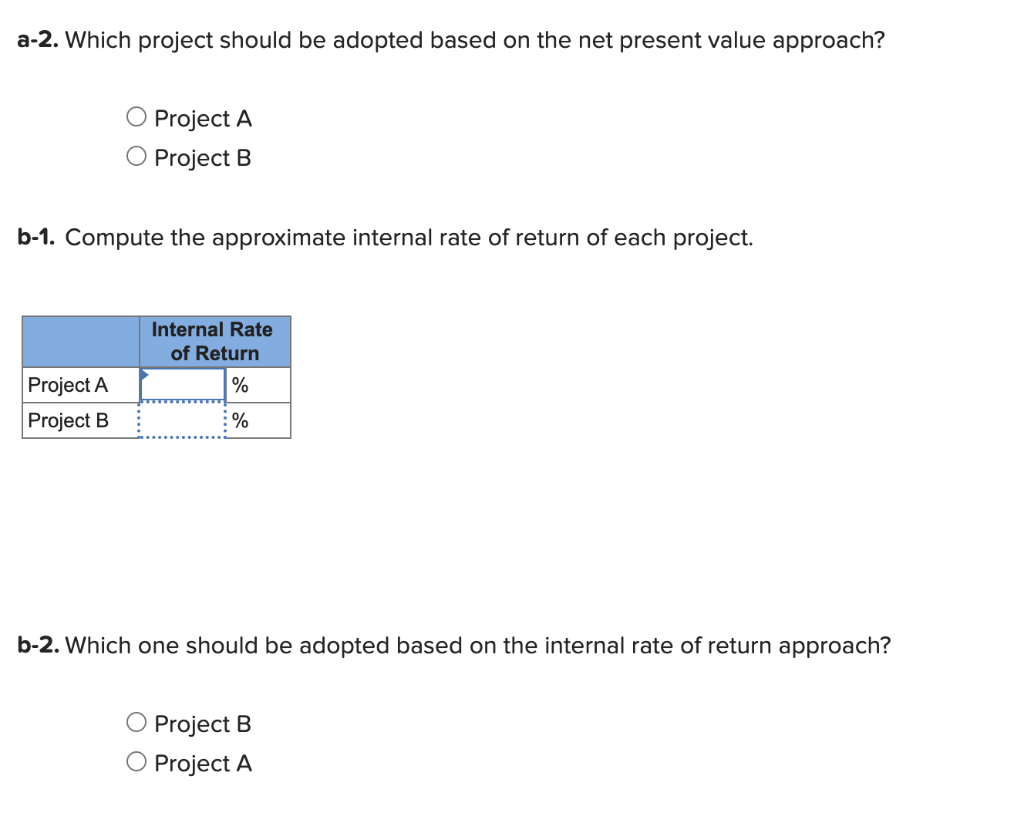

You have just learned that you are a beneficiary in the will of your late Aunt Susan. The executrix of her estate has given you three options as to how you may receive your inheritance. Required: 1-a.Calculate the present value for the following assuming that the money can be invested at 12% percent. (Round final answers to the nearest dollar amount.) Present Value $ 72000 a. You may receive $72,000 immediately. b. You may receive $95,000 at the end of six years. You may receive $29,000 at the end of each year for six years (a total of C-$174,000). A A A 1-b.If you can invest money at a 12% return, which option would you prefer? Option a Option b O Option c Pedro Spier, the president of Spier Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of three years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are $114,000 and for Project B are $41,000. The annual expected cash inflows are $54,119 for Project A and $17,660 for Project B. Both investments are expected to provide cash flow benefits for the next three years. Spier Enterprises' cost of capital is 6 percent. Required a-1. Compute the net present value of each project. (Round your final answers to 2 decimal places.) Net Present Value Project A Project B a-2. Which project should be adopted based on the net present value approach? O Project A Project B b-1. Compute the approximate internal rate of return of each project. Internal Rate of Return % Project A Project B % b-2. Which one should be adopted based on the internal rate of return approach? O Project B O Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts