Question: This is an old test we took and I would just like some clarification on what the answers were and why. (Also to eliminate comfusion

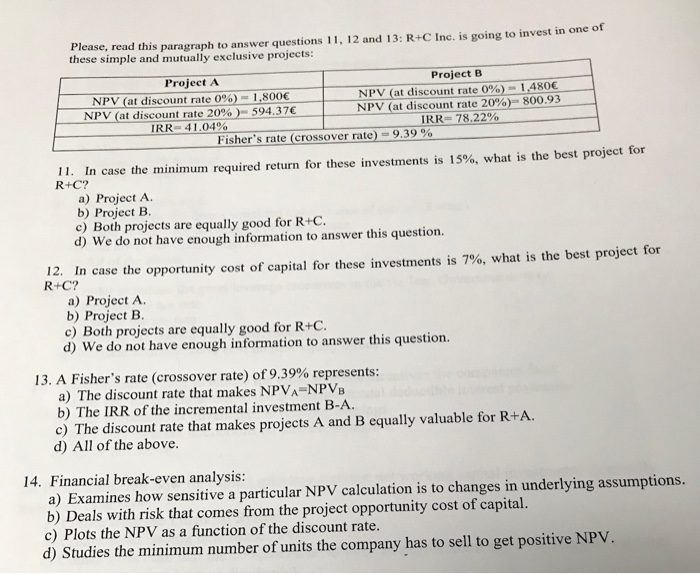

Please, read this paragraph to answer questions 11, 12 and 13: R+C Inc. is going these simple and mutually exclusive projects: to invest in one of Project B Project A NPV (at discount rate 0 %) NPV (at discount rate 20% ) - 594.37 NPV (at discount rate 0% )- 1,480E NPV (at discount rate 20%)- 800.93 IRR 78.22% -1,800 IRR-41.04% Fisher's rate (crossover rate) 9.39 % 11. In case the minimum required return for these investments is 15 % , what is the best project for R+C? a) Project A b) Project B c) Both projects are equally good for R+C d) We do not have enough information to answer this question 12. In case the opportunity cost of capital for these investments is 7 %, what is the best project for R+C? a) Project A b) Project B c) Both projects are equally good for R+C d) We do not have enough information to answer this question. 13. A Fisher's rate (crossover rate) of 9.39% represents: a) The discount rate that makes NPVA=NPVB b) The IRR of the incremental investment B-A c) The discount rate that makes projects A and B equally valuable for R+A d) All of the above. 14. Financial break-even analysis: a) Examines how sensitive a particular NPV calculation is to changes in underlying assumptions b) Deals with risk that comes from the project opportunity cost of capital. c) Plots the NPV as a function of the discount rate. d) Studies the minimum number of units the company has to sell to get positive NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts